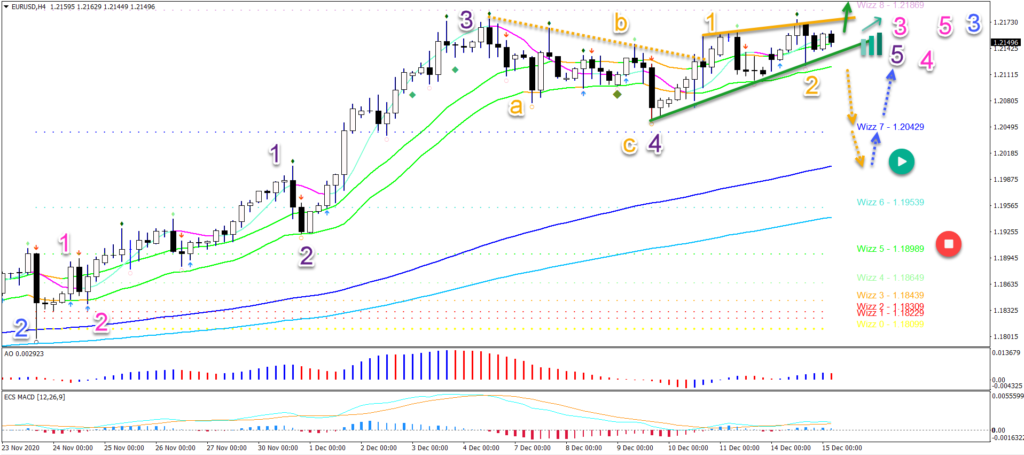

EUR/USD Prepares For Bullish Breakout Towards 1.2250

The EUR/USD remains above the 21 ema support zone. This indicates that an uptrend is likely to continue above the Wizz 8 resistance zone.

This article reviews the bullish targets – as well the bearish wave outlook if price action breaks below the 21 ema zone.

Price Charts and Technical Analysis

(Click on image to enlarge)

The EUR/USD seems to have completed a shallow wave 4 (purple) retracement. The current momentum and pullback pattern is probably a wave 1-2 (orange).

A bullish breakout (green arrow) above the resistance (orange) confirms the uptrend continuation. The main targets are located at 1.2250, 1.2350 and even 1.25.

The uptrend could see multiple higher highs before finishing. The wave patterns suggest that price could be in a wave 3 (pink) of wave 3 (blue).

A break below the 21 ema zone (orange arrows) means that price action is probably building a deeper wave 4. Price action could fall towards the 144 ema zone and expect a bounce there (blue arrows).

On the 1 hour chart, price action is looking for a bullish breakout above the resistance (orange) to confirm the uptrend.

A break below the bottom of wave 1 invalidates (red circle) the current wave 1-2 (grey) outlook. A deeper retracement is expected but the uptrend remains intact.

(Click on image to enlarge)

Disclaimer: The opinions in this article are for informational and educational purposes only and should not be construed as a recommendation to buy or sell the stocks mentioned or to solicit ...

more