EUR/USD: Only A Dead Cat Bounce? COVID, Election Uncertainty And Data Push Lower

Clinging on by the fingernails – that seems to be the case for EUR/USD, which is clawing onto 1.18. However, it is not going anywhere fast. Monday’s market decline boosted the safe-haven dollar and the recovery is meager – a classic “dead cat bounce” pattern.

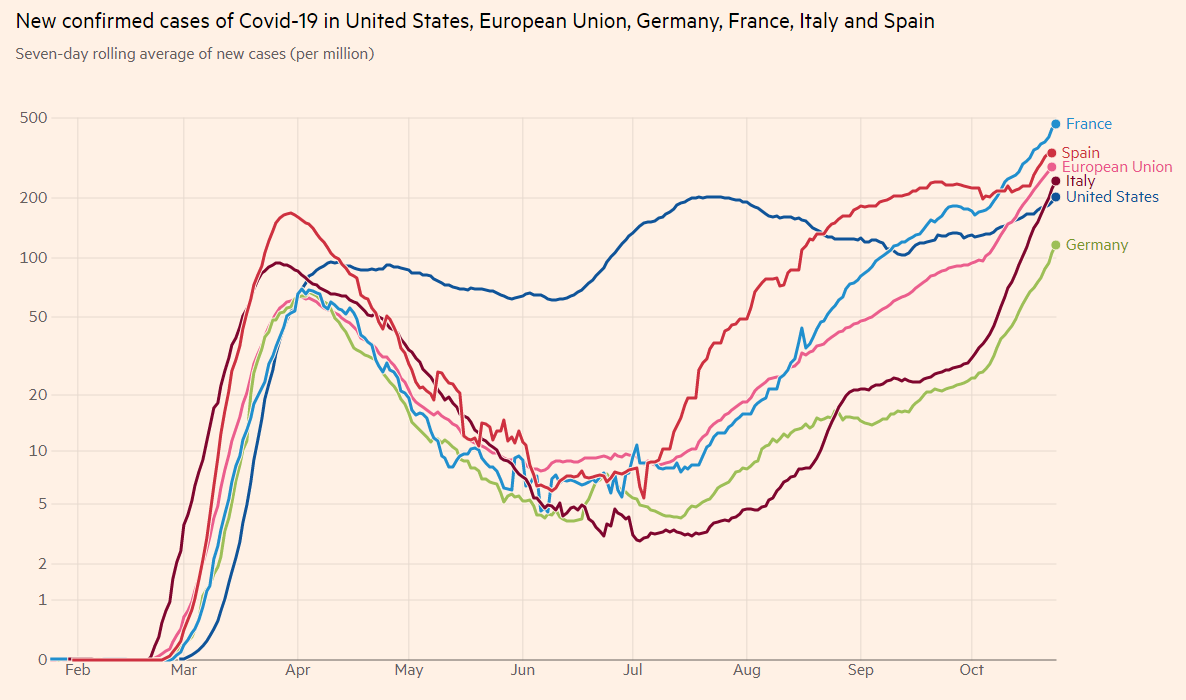

The lack of a meaningful pickup is due to the same reasons that pushed the pair lower – and have only worsened since. First and foremost, COVID-19 cases continue spreading rapidly across the old continent despite action taken by governments – and a massive shuttering is getting closer.

German Chancellor Angela Merkel told the nation that “difficult months are coming” and her government is reportedly preparing a “lockdown light.” France, which slapped long nighttime curfews in Paris and other cities, is contemplating expanding extending it, moving it closer to a full stop of the economy.

Caes in Germany, France, Italy, Spain, the EU, and the US:

Source: FT

The European Central Bank convenes on Thursday amid the raging second wave and consequent measures. The consensus is for no imminent action from the ECB, but President Christine Lagarde and her colleagues may opt to hint at the action in December. An increase in bond-buying is one of the options on the table.

Infections and deaths are on the rise in the US as well, but the reaction in currencies is different – the safe-haven dollar benefits from concerns.

Another factor weighing on sentiment is Congress’ failure to approve a multi-trillion fiscal stimulus package ahead of the elections. Lawmakers have officially been sent home until after the vote, just after confirming Amy Coney Barret to the Supreme Court. The new conservative justice could prove critical in case the nation’s highest court is asked to intervene in case of a conflict in one state or more.

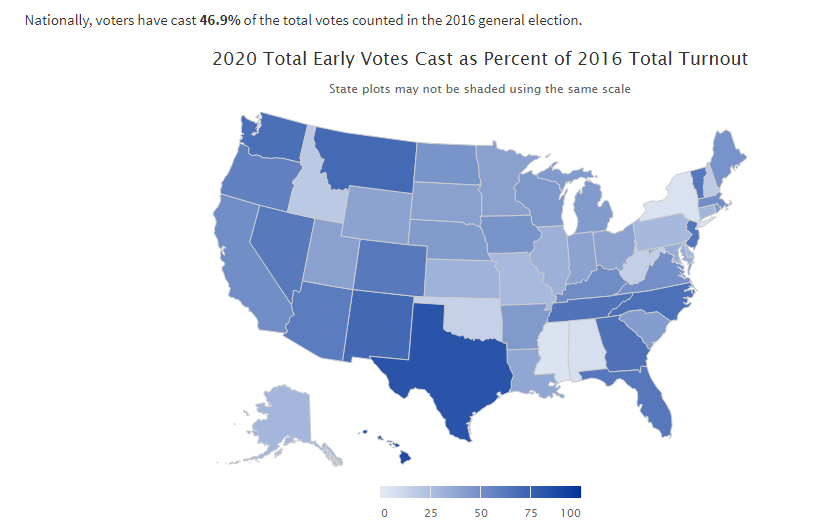

Uncertainty about the elections also adds to pressure. With one week to go, national and state polls continue showing a considerable lead for Democratic candidate Joe Biden over President Donald Trump. Investors currently prefer a “blue wave” scenario – in which Dems also win the Senate. In that case, the newly elected officials would pass provide massive fiscal relief. Markets seem to shrug off concerns about business-unfriendly policies down the road.

Doubts stem from Trump’s stunning victory in 2016, yet there are considerable differences, including higher margins, more robust polling, and also immense early voting. No fewer than 64 million Americans have cast their votes, nearly 47% of the total vote count in 2016. If the president provides an “October surprise” it could be too late o have an impact.

Source: US Elections Project

FiveThirtyEight’s model is pointing to an 87% chance that Biden wins the White House and around 70% for a full “blue wave.” Additional opinion polls will likely be published during the day and could have an impact. The most critical states are Florida and Pennsylvania.

Two significant US data points await traders. Durable Goods Orders for September are set to show another advance. The data feeds into Thursday’s Gross Domestic Product statistics for the third quarter. However, the lapse of government support in late July may have weighed on investment.

The second figure to watch is the Conference Board’s Consumer Confidence gauge for October. Economists expect an increase, yet rising coronavirus cases and concerns about the elections may have pushed it lower.

Downbeat US data could trigger haven flows to the greenback.

All in all, the recent bounce seems unjustified and could lead to falls.

EUR/USD Technical Analysis

(Click on image to enlarge)

Euro/dollar has broken below the uptrend support line that has been accompanying it since last week but is so far holding above the 50 Simple Moving Average on the four-hour chart, as well as the 100 and 200 SMAs.

Critical support awaits at 1.1785, which was a low point late last week. It is followed by 1.1760, the low point where the uptrend support line was formed, and then by 1.1720.

Resistance awaits at the daily high at 1.1835, followed by 1.1865 and 1.1880.

Disclaimer: Foreign exchange (Forex) trading carries a high level of risk and may not be suitable for all investors. The risk grows as the leverage is higher. Investment objectives, risk ...

more