EUR/USD Looks Ready To Smash The 2020 Highs Amid Vaccine And Stimulus Hopes

The first breakout is often only a fakeout, and as warned – EUR/USD’s initial attack on 1.20 has failed. Monday’s choppy price action can be attributed to end-of-month flows. Equities had an outstanding month and the safe-haven dollar struggled – prompting some money managers to a last-minute scramble to readjust their portfolios.

That foggy price action is over now, and fundamentals still favor an upswing in the world’s most popular currency pair. The main driver is hope for a COVID-19 vaccine. US-based Moderna completed its Phase 3 immunization trial and confirmed a high efficacy rate of 94%. The firm announced it is asking for emergency approval to begin vaccinating against coronavirus from the US Food and Drugs Administration (FDA).

British authorities may grant the Pfizer/BioNTech inoculation the green light in the next few days, potentially registering the Western World’s first approved vaccine. Novavax also reported progress and while the AstraZeneca/University of Oxford project is suffering some difficulties, there are several additional efforts in various testing phases.

Monetary stimulus is another upside driver. Christine Lagarde, President of the European Central Bank, speaks again on Tuesday and will likely reiterate her pledge to expand the bond-buying scheme. The euro previously responded positively to the printing of euros – seeing it as enabling governments to boost the economies.

On the other side of the pond, dollar-printing had the opposite effect on the underlying currency – with markets seeing it as a devaluation from the dollar. Jerome Powell, Chairman of the Federal Reserve, is set to testify on Capitol Hill and urge lawmakers to provide fiscal stimulus. In prepared remarks,

Powell expressed concern about the next few months before a vaccine becomes available. The Fed Chair kept his cards close to his chest by refraining from hinting about the bank’s next moves. When he speaks later on Tuesday, elected officials will likely ask about buying more bonds. Any openness could boost stocks and weigh on the dollar.

While the monetary setup may be favorable to euro/dollar gains, the current economic data may limit the gains. Preliminary eurozone inflation figures are set to that the Core Consumer Price Index is only marginally above 0%, stoking fear of deflation. Final Purchasing Managers’ Indexes fro the manufacturing sector may also serve as a reminder about Europe’s current struggles with the covid winter wave.

In the US, Powell’s testimony comes just when the ISM Manufacturing PMI is due out. While economists expect a drop in November, estimates stand at figures pointing to robust growth.

On the political scene, President-elect Joe Biden officially nominated former Fed Chair Janet Yellen as Treasury Secretary. Markets had already cheered her reported candidacy last week. Outgoing President Donald Trump suffered another blow to his attempts at overturning the elections, as Arizona certified Biden’s victory in the Grand Canyon State. All in all, politics provides another tailwind for markets and a headwind for the dollar.

Can EUR/USD hit new highs? Data may hamstring gains, but the broader picture is positive.

EUR/USD Technical Analysis

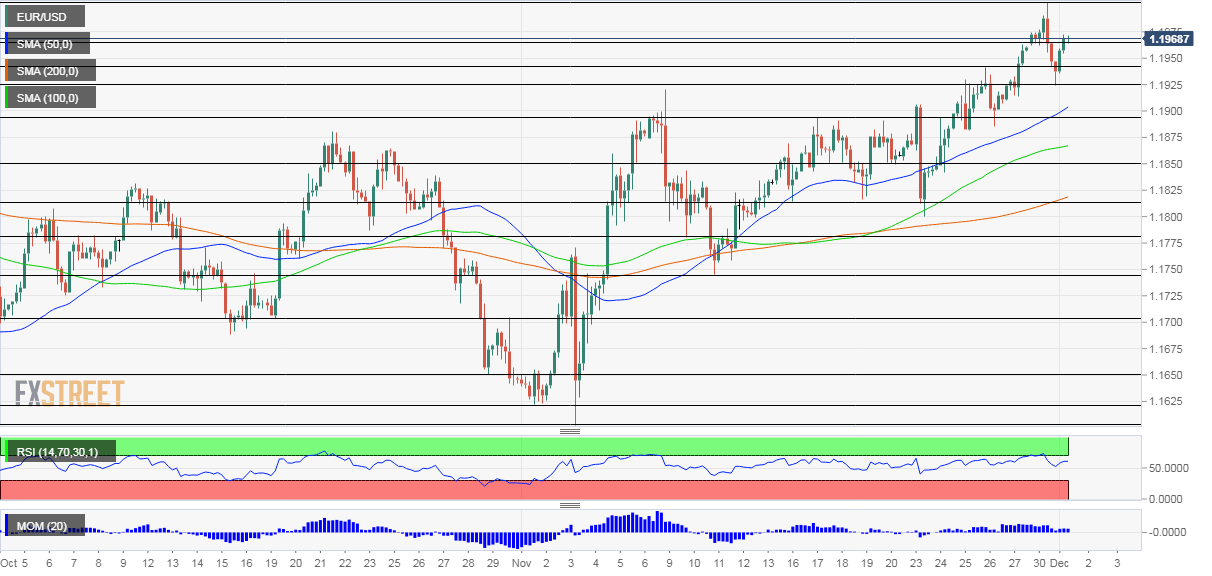

(Click on image to enlarge)

Euro/dollar is benefiting from upside momentum on the four-hour chart and trades above the 50, 100 and 200 Simple Moving Averages. The Relative Strength Index is back below 70, outside overbought conditions. Overall, bulls are in control.

Some resistance awaits at the daily high of 1.1973, followed by the round 1.20 level. Close by, the 2020 peak of 1.2010 is the next line to watch. A break higher opens the door to 1.2050, last seen in 2018.

Support awaits at 1.1940, a temporary cap last week, and then by 1.1925, the weekly low. Next, 1.1895 and 1.1850 await EUR/USD.

Disclaimer: Foreign exchange (Forex) trading carries a high level of risk and may not be suitable for all investors. The risk grows as the leverage is higher. Investment objectives, risk ...

more