EUR/USD: Gloom, Doom, And Double Top Point Lower As Coronavirus Rages In The US

- EUR/USD has been on the back foot amid an increase in US coronavirus cases.

- A big bulk of American economic figures, the ECB minutes, and other factors are eyed.

- Thursday’s four-hour chart is painting a mixed picture.

Houston, we have a problem – Intensive Care Units (ICUs) may run out of capacity in America’s fourth-largest city on Thursday as COVID-19 rages through Texas. The lone-star state is not alone, as the disease is rising in some 26 states, with the worst-hit ones being in the south.

President Donald Trump and his administration say that a higher testing capacity is behind the surge in cases – yet the increase in hospitalizations, the higher hit rate in tests, and Phoneix’s struggle to probe enough patients show that the issue is severe.

New York, New Jersey, and Connecticut want people coming from several southern states to quarantine for 14 days when arriving in the north. COVID-19 deaths – which were on a steady path of decline – are also moving in the wrong direction.

The worrying reports are weighing on the market mood and pushing the safe-haven dollar higher. Further gloom comes from the International Monetary Fund, which downgraded its forecasts – and now sees a decline of 4.9% in global growth this year. Moreover, it also laid out a scenario in which there is 0% growth in 2021 – an L-shaped non-recovery.

A trio of reports for the US economy is due out on Thursday. Investors will likely shrug off any revision of first-quarter Gross Domestic Product – projected to remain at a contraction of 5%. The most significant release is Durable Goods Orders for May – forecast to show a bounce after the downfall in April.

See US Durable Goods Orders May Preview: Retail trumps the lockdown blues

Weekly jobless claims for the week ending June 19 – and perhaps more importantly, continuing applications for the week ending June 12 – are eyed. The latter figure’s time frame is for the week when the Non-Farm Payrolls surveys are taken.

See US Initial Jobless Claims: The pandemic still controls risk perception

Sino-American relations remain tense after the Pentagon listed 20 companies aiding supporting the Chinese military, opening the door to new sanctions. Earlier this week, White House adviser Peter Navarro said the trade deal is over – triggering a sell-off – before walking back his comments. Further details are set to move markets.

Trade relations between the US and the EU are also sensitive after Washington threatened to slap $3.1 billion on Brussels. The bloc said such levies would be “very damaging.”

The European Central Bank’s meeting minutes are set to shed light on the level of concerns among policymakers when they opted to bump up the bond-buying scheme. The document will also likely claim that the €600 billion boost was “proportional” – aiming to appease the German constitutional court.

New coronavirus cases and deaths remain low in Europe, but various outbreaks in Germany and Spain could impede plans to reopen the skies to normal flights and to salvaging the tourism season.

Apart from US data and coronavirus statistics from southern states, markets may pay more heed to the presidential elections. Democrat Joe Biden is ahead against President Donald Trump by some 9-10%. A clean sweep by the opposition party would weigh on stocks amid regulation fears.

All in all, euro/dollar traders have a lot on their plates – and most news is negative. (FXE) (UUP)

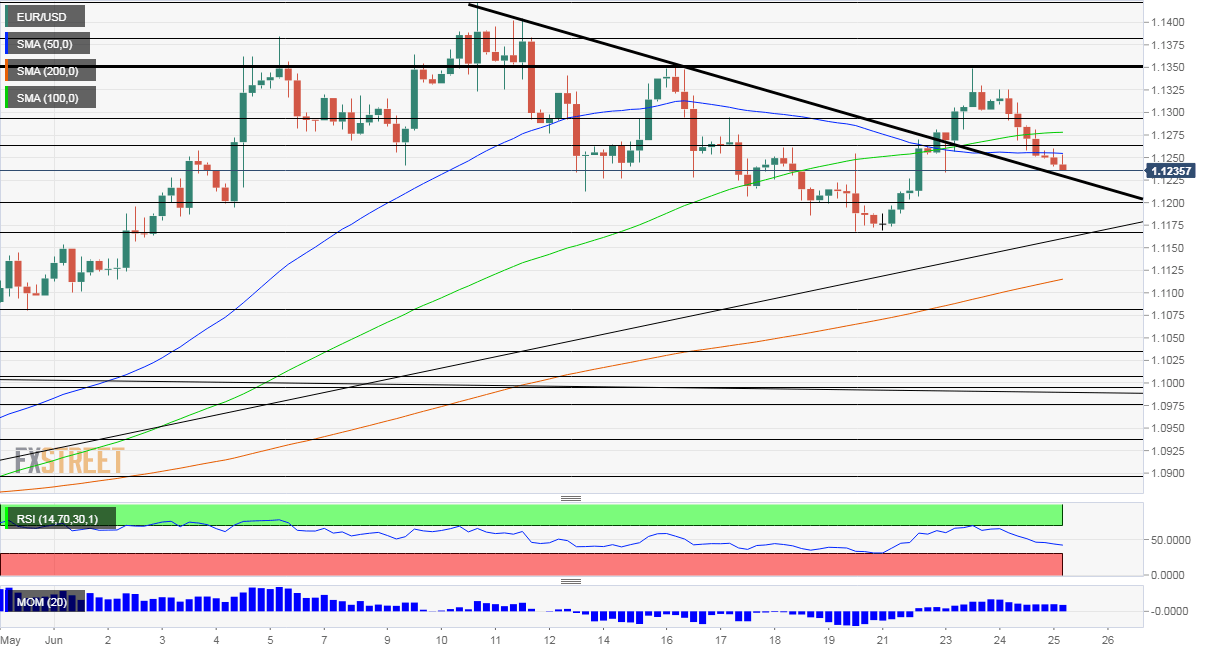

EUR/USD Technical Analysis

The world’s most popular currency pair has been sliding back down alongside the downtrend support line – that previously served as resistance. On its way down it has dipped below the 50 and 200 Simple Moving Average on the four-hour chart. While momentum remains to the upside, EUR/USD failed to break above 1.1350, creating a double-top.

Overall, bears are in the lead.

Support awaits at the round 1.12 level, which worked as support last week. It is followed by 1.1170, the previous week’s low. Further down, the next noteworthy cushion is only at 1.1075, levels seen in early June.

Resistance awaits at 1.1260, a temporary cap last week. It is followed by 1.1290, another swing high, and then by the mighty 1.1350.

Disclaimer: Foreign exchange (Forex) trading carries a high level of risk and may not be suitable for all investors. The risk grows as the leverage is higher. Investment objectives, risk ...

more