EUR/USD Forecast: Dovish ECB, Fed’s Hawks To Cap Bulls Above 1.16

The EUR/USD forecast is temporarily bullish as the price managed to surge beyond the 1.1600 mark after struggling around the mid-1.1500 area. However, the fundamental stance does not remain in favor of the Euro bulls.

Fundamental Forecast

Klaas Knot – the Dutch Governor – followed a clear dominance of dovish remarks by ECB policymakers and lived up to his reputation as a hawk by speaking out against an accommodative stance towards inflation that he believes will persist for longer than expected.

It is unclear whether the Governing Council’s more dovish front will move anytime soon, so markets remain skeptical. As a result, EUR/USD remains almost exclusively influenced by dollar dynamics, and the lack of any idiosyncratic catalysts for the euro probably limits the pair’s upside.

While the dollar has given up some of its recent gains this week, we are reluctant to take this as a sign that the bullish sentiment on the greenback is abating. Instead, the modest correction appears more likely to be due to the profit-taking on long dollar positions as markets now fully place a price on the first hike in September/November 2022, as well as the start of the Fed tapering program by the end of the year.

According to CFTC data, dollar positioning versus G10 currencies reached 13.9% of open interest for the week ending 5 October (the highest level since November 2019), so some long-term price pressure could be expected.

This softness will not last, as we discussed above. EUR/USD is likely to follow the same path seen in early October, therefore stalling around the next key levels.

EUR/USD Price Technical Forecast: Positive Outlook To Continue

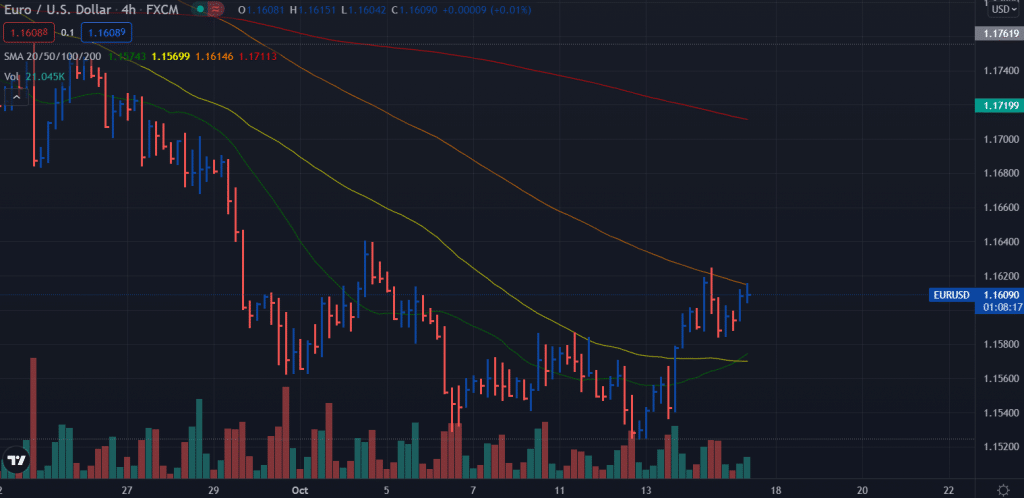

(Click on image to enlarge)

The EUR/USD price surges above the 1.1600 mark. The price remains well bid above the 20-period and 5-period SMAs on the 4-hour chart. The volume data shows some healthy signs of recovery. Moreover, the average daily range is 55% which is a healthy sign that the market will keep progressing. The upside target is 200-period SMA around 1.1675, coinciding with a horizontal level. The next hurdle could be the 1.1700 mark. On the flip side, any fall below the 1.1600 mark may gather more selling and aim to test the weekly yearly lows around 1.1530.

Disclaimer: Foreign exchange (Forex) trading carries a high level of risk and may not be suitable for all investors. The risk grows as the leverage is higher. Investment objectives, risk ...

more