EUR/USD Forecast: Buyers Dominating Above 1.1600 Ahead Of US Data

The EUR/USD forecast is neutral to bearish despite today’s upside attempt. The recent optimism in the market keeps Euro supported, but the USD strength can’t be questioned.

On Tuesday, the EUR/USD pair managed to overcome initial weakness and hit session highs in the 1.1610/15 area.

As risk appetite remains unclear and US yields increase, the EUR / USD bounces off weekly lows around 1.1590, which looks to reverse earlier pessimism.

Despite the poor performance of the German 10-year bond, which hit -0.12% on Tuesday, US yields are regaining traction at the lower end of the curve, flirting with the 1.64% area.

It has managed to maintain its daily gains against the Euro despite losing ground against competitors such as the pound sterling, the yen, and the Australian dollar.

The empty list in the euro area on Tuesday should draw attention to the participation of Enrià in the afternoon panel discussion in Europe. Following the release of the FHFA index and the S&P/Case-Shiller index, and the October Conference Board Consumer Confidence Index, the US calendar looks pretty interesting.

As of Oct 19th, bullish growth on EUR/USD is still capped at around 1.1670. Thus, the weakening chatter still dominates the market in spite of improved risk sentiment in recent sessions. Prices are expected to continue focusing on the dollar for the time being, however.

Nevertheless, the idea that heightened inflation may last longer, in conjunction with a weakening of economic fundamentals in the region, appears to have shaken investor optimism and bullish expectations.

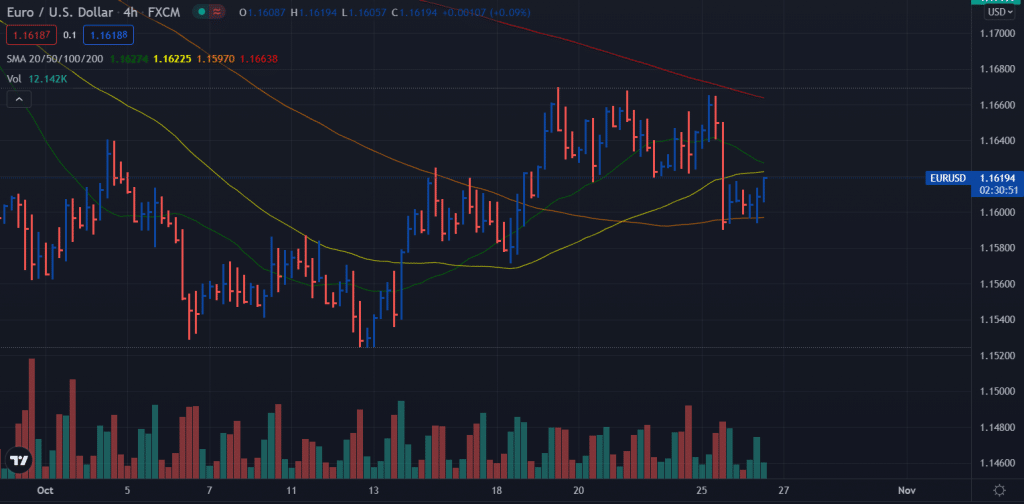

EUR/USD Technical Forecast: Locked Between 100, 200 SMAs

(Click on image to enlarge)

The EUR/USD price broke below the key levels yesterday. The down bar was widespread with huge volume. Right now, the upside attempt remains barred by the 20-period and 50-period SMAs on the 4-hour chart. However, the price found some support around the 100-period SMA and has continued to rise since then. Overall, the price is ranging while the volume is showing no clue at the moment. In simple words, the price is locked between 100-period and 200-period SMAs and will look for a decisive breakout on either side.

Disclaimer: Foreign exchange (Forex) trading carries a high level of risk and may not be suitable for all investors. The risk grows as the leverage is higher. Investment objectives, risk ...

more