EUR/USD: Fall Coming? Failure To Advance On Several Positive Developments Points Down

- EUR/USD has been rising in response to warming Sino-American relations.

- An upgrade of German GDP, US consumer confidence, and expectations for a dovish Fed are in play.

- Tuesday’s four-hour chart is showing the pair is capped by two significant moving averages.

Weakness exposed – that is becoming the conclusion of EUR/USD’s failure to materially capitalize on a plethora of upbeat developments. The world’s most popular currency pair is trading around 1.18, little changed from Monday morning’s quote.

The most significant positive development has come from the Sino-American front. US Trade Representative Robert Lighthizer and Chinese Vice Premier Liu He held a phone call and both concluded they made progress and that there is more to come.

Heightened rhetoric between the world’s largest economies has been under the radar, but investors are content as long as the Phase One accord remains intact. Moreover, President Donald Trump refrained from bashing Beijing on the first night of the Republican convention. Keeping the topic off the agenda also helps improve the market mood and weigh on the safe-haven dollar.

Another positive development is Germany’s upward revision of its Gross Domestic Product figures for the second quarter. According to the final read, the continent’s largest economy squeezed by 9.7% and not 10.1% originally reported.

The change may seem minor, but revisions are rare in this indicator. The German IFO Business Climate is set to show stability in August after a bounce in July.

Jerome Powell, Chairman of the Federal Reserve, is set to deliver a highly anticipated speech on Thursday, at the virtual Jackson Hole Symposium. According to reports, he may open the door to allowing inflation to catch up – overheat in one year to compensate for slow price rises beforehand. That shift implies keeping interest rates lower for longer and thus weighing on the dollar. Nevertheless, EUR/USD’s gains are limited.

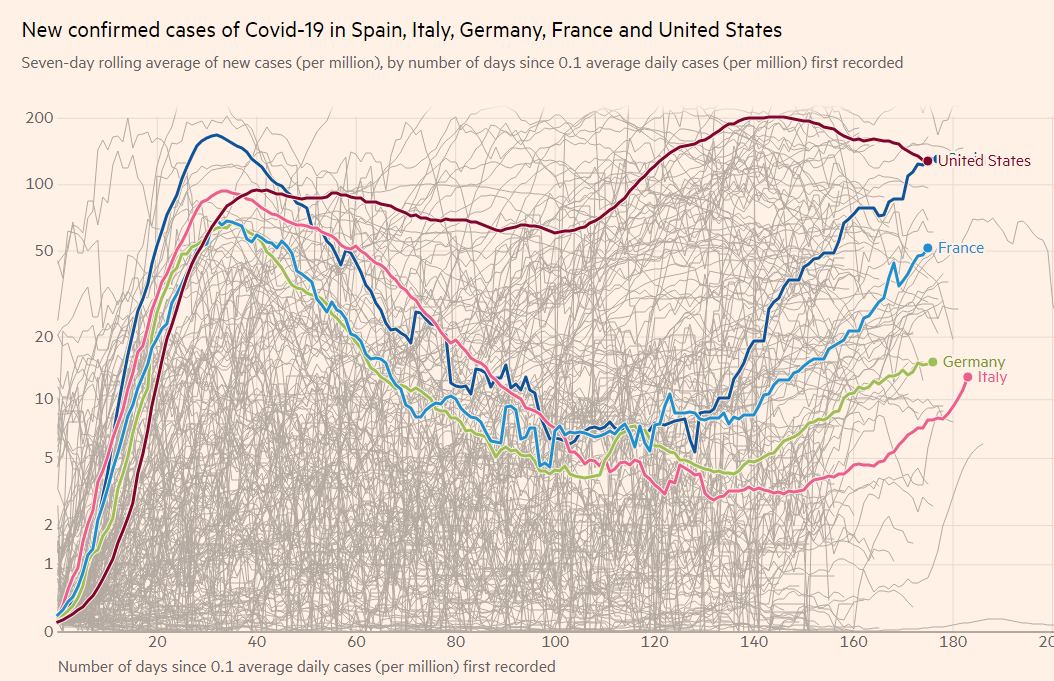

What is weighing on the euro? Rising coronavirus cases in the old continent remain of concern, as doubts about returning to school creep in.

(Click on image to enlarge)

Source: FT

Later in the day, the US Conference Board’s Consumer Confidence measure is of interest. It is set to edge up in August.

Will EUR/USD unchain itself and move higher? The accumulation of positive news– outweighing the negatives – may eventually trigger a rally, yet the current hesitation implies that any adverse development could send it down.

EUR/USD Technical Analysis

(Click on image to enlarge)

Euro/dollar is capped below the 50 and 100 Simple Moving Averages after failing to rise above them. While momentum is waning, it remains to the downside. All in all, bears are in the lead.

Some support awaits at 1.1805, a cushion from last week. The next line is 1.1750, a support line from Friday, followed by 1.17, a double bottom from earlier in the month which is about to converge with the 200 SMA.

Resistance is at 1.1850, the weekly high, and also where the 50 SMA hits the price. Further above, 1.1915 was the initial peak in August, and it is followed by 1.1965, last week’s high point.

Disclaimer: Foreign exchange (Forex) trading carries a high level of risk and may not be suitable for all investors. The risk grows as the leverage is higher. Investment objectives, risk ...

more