EUR/USD: Euro Set To Fall Amid Ongoing Fed Effect, Europe’s Growing Coronavirus Crisis

Change of course or just a correction? That is the question for EUR/USD traders and the answer leans to the latter. The world’s most popular currency pair has been recovering as the dollar pares some of its gains related to the last decision by the Federal Reserve before the elections.

The Fed signaled no rate rises through 2023 – but also no imminent action despite rising uncertainty about the outlook. Markets dropped and the safe-haven dollar found fresh demand. Federal Reserve Chairman Jerome Powell also indicated that policymakers would be wise to act – adding fiscal stimulus.

Indeed, it seems that Republicans and Democrats seem to be making some progress toward agreeing on a new relief package. Nevertheless, there is still no white smoke above Capitol Hill, potentially as politicians have little incentive to compromise ahead of the elections. Failure to boost the economy could trigger further flows into the greenback.

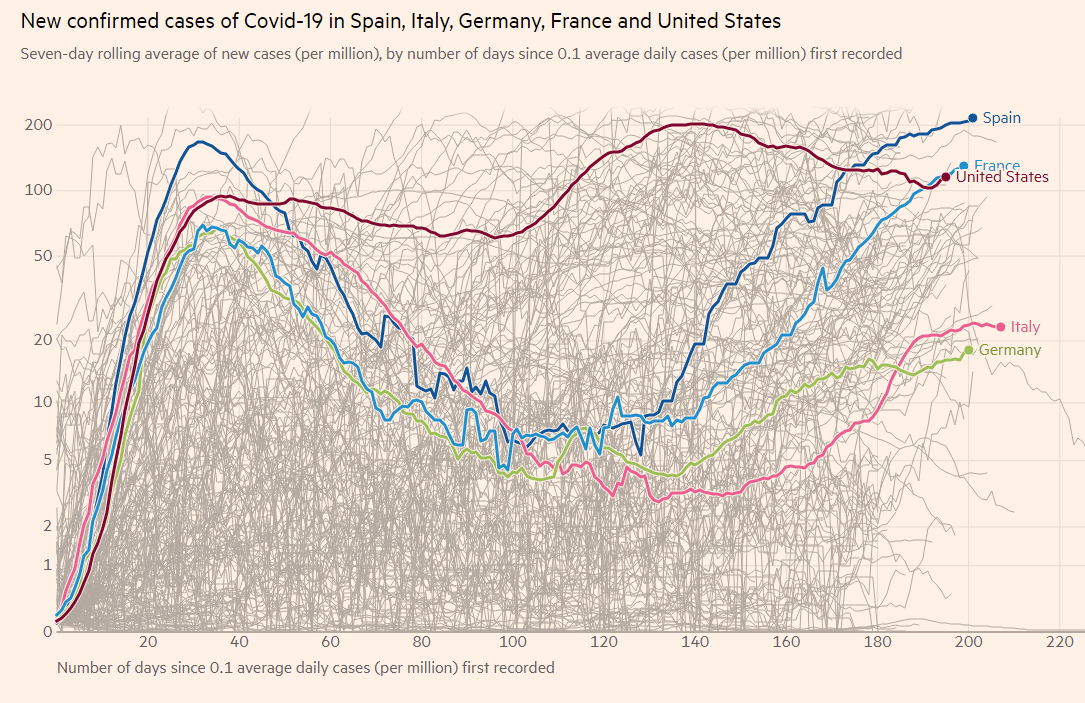

At this point, the dollar is retreating more on a counter-trend rather than fresh flows related to new hopes. Looking at the old continent, there are is a good reason to expect the euro to fall. Coronavirus cases continue rising rapidly in Spain, France, and even Germany and Austria – countries that initially coped well with coronavirus.

Israel, which initially depressed the disease, begins its second lockdown – the first country in the world to do so. Several European nations cannot rule that any longer. Pressure on hospitals is Madrid is growing and may trigger severe local restrictions. Other cities and countries are looking with worry at the Spanish capital.

(Click on image to enlarge)

Source: FT

Later on Friday, investors will be looking at the University of Michigan’s preliminary Consumer Sentiemnt Index for September. A minor advance is expected yet the disappointing retail sales figures for August imply that consumers may be struggling. The withdrawal of emergency government support is limiting the recovery in consumption.

EUR/USD Technical Analysis

(Click on image to enlarge)

Euro/dollar continues suffering from downside momentum on the four-hour chart, but it has overcome the 50, 100, and 200 Simple Moving Averages. With the Relative Strength Index hovering around 50, the picture is well balanced.

Some resistance awaits at the daily high of 1.1860, followed by the swing high of 1.1920. The next lines to watch are 1.1965 and 1.2010.

Support is at 1.1930, where the 50 SMA hits the price. It is followed by 1.1785, a swing low from early September, and then by 1.1760 and 1.1730, recent lows.

Disclaimer: Foreign exchange (Forex) trading carries a high level of risk and may not be suitable for all investors. The risk grows as the leverage is higher. Investment objectives, risk ...

more