EUR/USD Breaks Out Of Descending Channel Ahead Of Fed Rate Decision

EUR/USD trades to a fresh monthly high (1.2117) following the limited reaction to the European Central Bank (ECB) meeting, and the exchange rate may attempt to test the February high (1.2243) as long as the Federal Open Market Committee (FOMC) stays on track to “increase our holdings of Treasury securities by at least $80 billion per month and of agency mortgage-backed securities by at least $40 billion per month.”

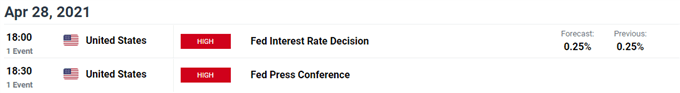

It seems as though the FOMC is in no rush to scale back its emergency measures as the central bank warns of a “transitory rise in inflation above 2 percent,” and the committee may continue to strike a dovish forward guidance as most Fed officials see the benchmark interest rate sitting near zero through 2023.

In turn, more of the same from Chairman Jerome Powell and Co. may do little to derail the recent appreciation in EUR/USD as the central bank remains in no rush to scale back its emergency measures, and it remains to be seen if the FOMC will alter the forward guidance at its next quarterly meeting in June as Fed officials are slated to update the Summary of Economic Projections (SEP).

Until then, EUR/USD may attempt to test the February high (1.2243) as it breaks out of the downward trend carried over from the start of the year, and the appreciation in the exchange rate may continue to coincide with the renewed tilt in retail sentiment as the crowding behavior from 2020 resurfaces.

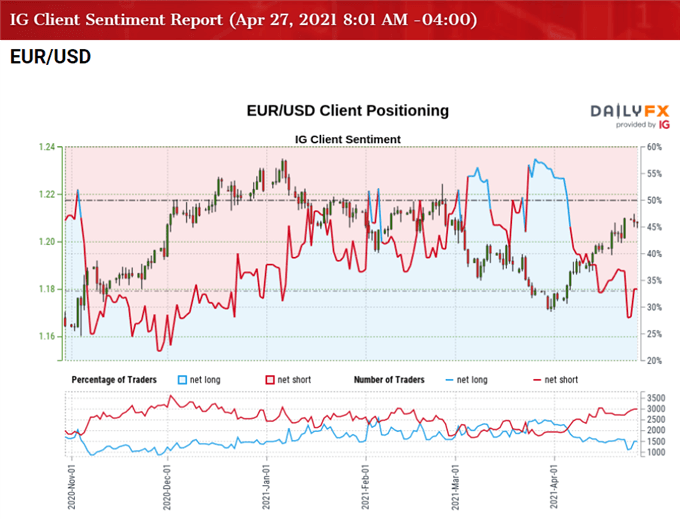

The IG Client Sentiment Report shows 34.68% of traders are currently net-long EUR/USD, with the ratio of traders short to long standing at 1.88 to 1.

The number of traders net-long is 12.00% higher than yesterday and 6.53% higher from last week, while the number of traders net-short is 1.36% lower than yesterday and 9.62% higher from last week. The rise in net-long position comes as EUR/USD clears the March high (1.2113), while the rise in net-short interest has fueled the tilt in retail sentiment as 35.00% of traders were net-long the pair last week.

With that said, the FOMC rate decision may do little to derail the recent advance in EUR/USD as the crowding behavior from 2020 resurfaces, and the exchange rate may attempt to test the February high (1.2243) as it breaks out of the descending channel from the start of the year.

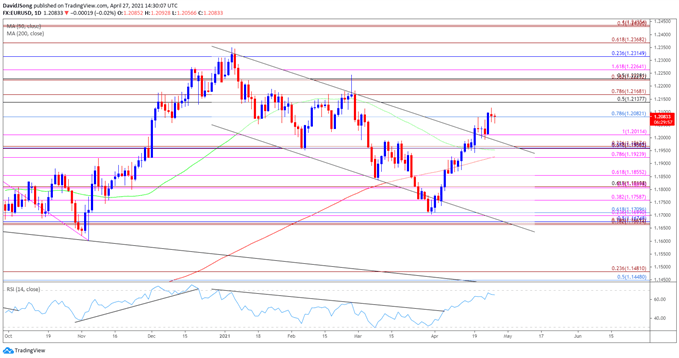

EUR/USD RATE DAILY CHART

Source: Trading View

- Keep in mind, EUR/USD established a descending channel following the failed attempt to test the April 2018 high (1.2414), but the decline from the January high (1.2350) may turn out to be a correction in the broader trend rather than a change in market behavior as the exchange rate trades back above the 50-Day SMA (1.1953) to break out of the bearish trend.

- The Relative Strength Index (RSI) showed a similar dynamic as the oscillator reversed ahead of oversold territory to break out of a downward trend, with a move above 70 in the indicator likely to be accompanied by a further appreciation in EUR/USD like the behavior seen in December.

- The close above 1.2080 (78.6% retracement) along with the break above the March high (1.2113) brings the 1.2140 (50% retracement) to 1.2170 (78.6% expansion), with the next area of interest coming in around 1.2220 (38.2% expansion) to 1.2260 (161.8% expansion), which largely lines up with the February high (1.2243).

Disclosure: See the full disclosure for DailyFX here.