EUR/USD: Attack On 1.22? Another Dose Of Good News Needed After The FDA Nod, ECB Boost

Euro/dollar’s consolidation may be coming to an end – and 1.22 is in sight, yet there are still some clouds to clear. After two injections of hope, additional developments are awaited.

The euro received a boost from the European Central Bank on Thursday. The Frankfurt-based institution announced a €500 billion expansion of its Pandemic Emergency Purchase Program (PEPP) as expected, but surprised by extending the program through March 2022. Investors cheered the move, which lowers governments’ borrowing costs. In parallel, the EU finalized the multi-year budget after a compromise with Poland and Hungary.

Christine Lagarde, President of the ECB, said that the bank is monitoring the exchange rate, but did not offer starker language meant to push the euro lower. Her lack of urgency on the topic also allowed the common currency to rise.

Another shot in the arm came from the US Food and Drugs Administration, which recommended approving the Pfizer/BioNTech coronavirus vaccine. The American regulator is considered the global “gold standard” and should accelerate injections worldwide.

On the other hand, immunization could not come sooner – COVID-19 is raging on both sides of the Atlantic. Germany is set to tighten restrictions ahead of Christmas as daily deaths and cases hit new highs. and France abandoned plans to lift the nationwide lockdown as infections stopped falling.

The US recorded another day of over 3,000 deaths and yet another record in hospitalizations, above 107,000. The virus is taking a growing toll on the economy – US jobless claims jumped to 853,000 from near 700,000 in the previous week.

Despite the dual developments, Senate Majority Leader Mitch McConnel remains reluctant to give his blessing to new stimulus worth around $900 billion. Proposals from a bipartisan group of senators and the Treasury seem stuck in the mud. The safe-haven US dollar may gain further ground if the progress made earlier this week fully stalls.

Another set of talks is also deep in a quagmire – the EU and the UK are preparing for a no-deal Brexit, and that is weighing on the euro. The bloc announced a contingency plan in case deliberations hit the Sunday deadline without a breakthrough. UK Prime Minister Boris Johnson said there is a “strong possibility” of leaving on “Australian terms” – a code for no accord.

Euro/dollar is set to move to the tune of talks in Brussels and Washington and also to watch US data. The University of Michigan’s Consumer Sentiment Index is set to edge down from 76.9 to 76.5 points in December.

Overall, while the FDA and the ECB are moving forward, there are still several clouds in play.

EUR/USD Technical Analysis

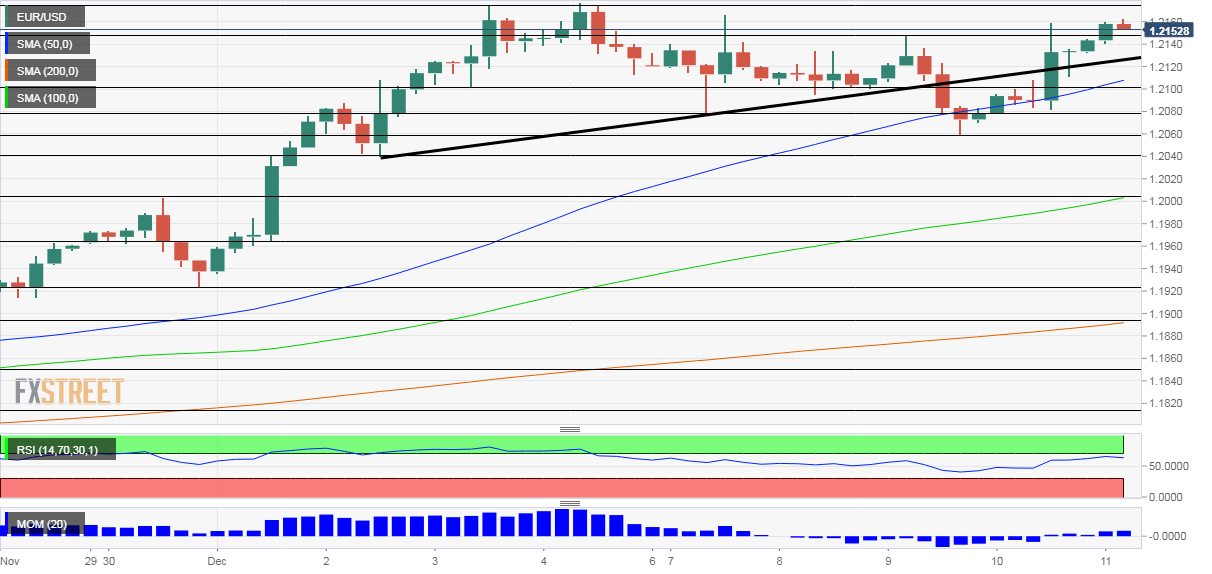

(Click on image to enlarge)

Euro/dollar recaptured the broken uptrend support line on Thursday and is benefiting from upside momentum on the four-hour chart. It is also trading above the 50, 100 and 200 Simple Moving Averages. Moreover, the Relative Strength Index is below 70, outside overbought conditions – contrary to the previous swing to the highs.

Resistance awaits at 1.2177, the 2020 peak, followed by 1.22 and 1.2250, lines that played a role back in 2018.

Below the 1.2150 battlelines, support awaits at 1.21, which was a cushion last week. It is followed by 1.2080, 1.2060, and 1.2040, which provided support during December.

Disclaimer: Foreign exchange (Forex) trading carries a high level of risk and may not be suitable for all investors. The risk grows as the leverage is higher. Investment objectives, risk ...

more