Europe Enters Earnings Recession

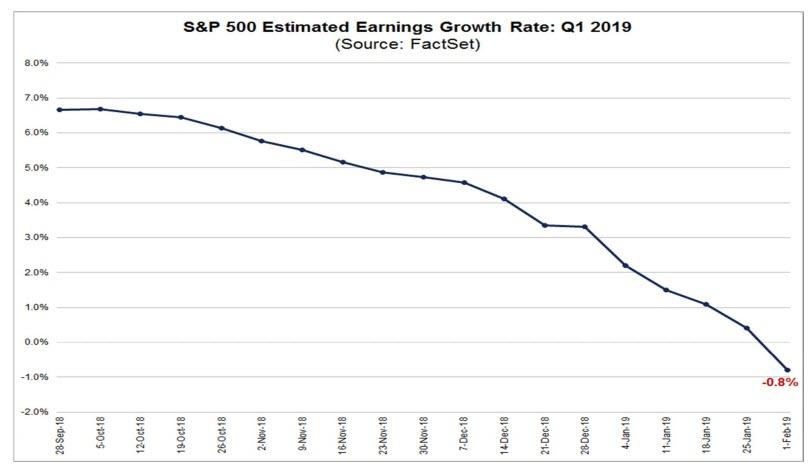

Whereas Morgan Stanley will likely end up being proven right in its call for a US earnings recession in the first quarter, especially as Q1 consensus earnings continue to plunge, and are now well in the red, from being over 3% at the start of the year...

(Click on image to enlarge)

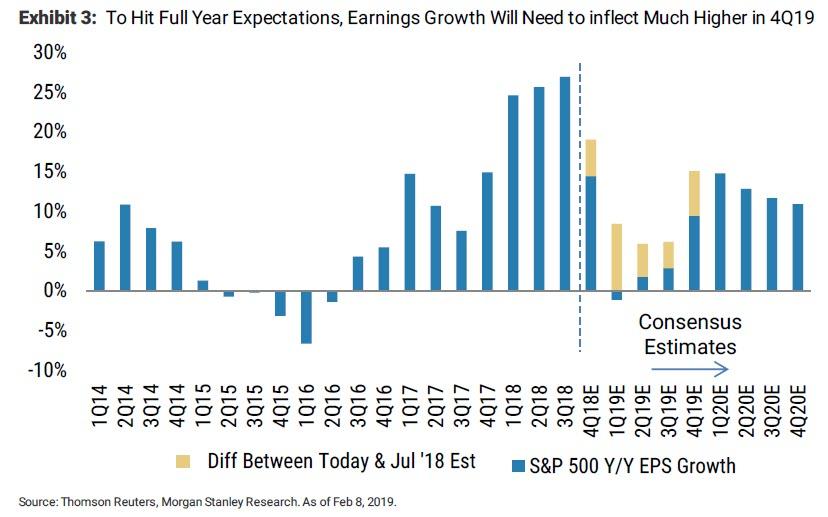

... and the only question is whether earning growth will then rebound back into the positive or continue to slide as MS' strategist Michael Wilson believes...

(Click on image to enlarge)

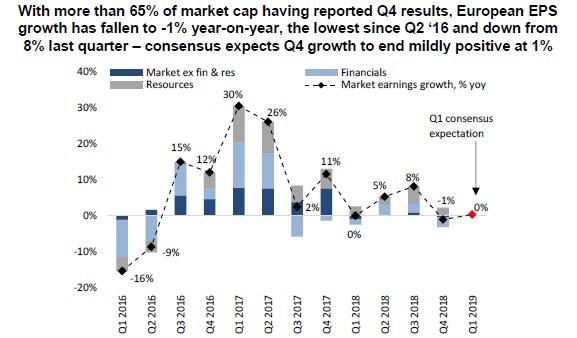

... Europe is already there.

As Deutsche Bank writes overnight, with more than 65% of market cap having reported results, historical Q4 European EPS growth stands at -1% year-on-year, the lowest since Q2 2016 and down from 8% for the full Q3 earnings season.

(Click on image to enlarge)

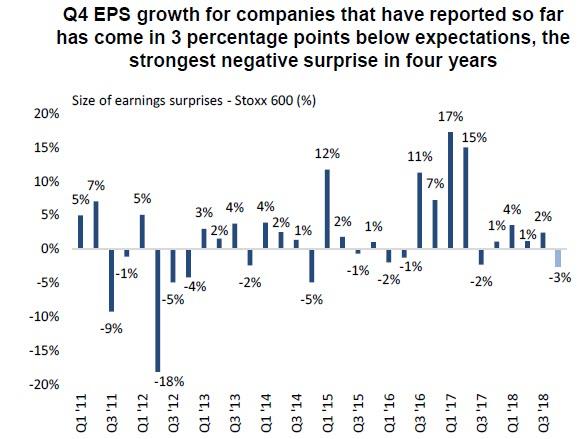

Worse, this is a material 3% disappointment relative to consensus expectations for the companies that have reported so far and the largest negative surprise in four years.

(Click on image to enlarge)

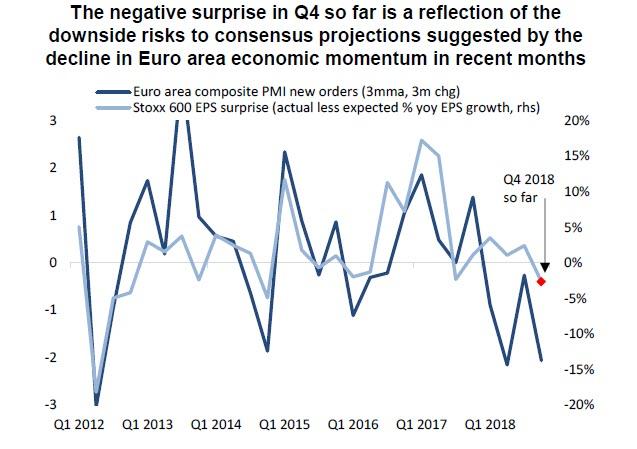

This negative surprise is a reflection of the downside risks to consensus projections implied by the deterioration in Euro area growth momentum in Q4.

(Click on image to enlarge)

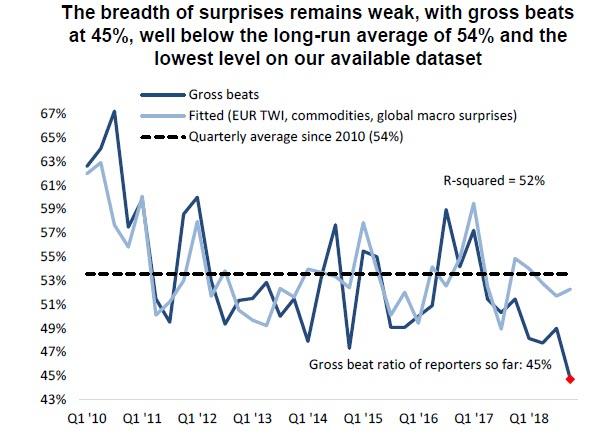

The breadth of surprises, at 45%, is at the lowest level since at least 2010 and is below the long-run average of 54%.

(Click on image to enlarge)

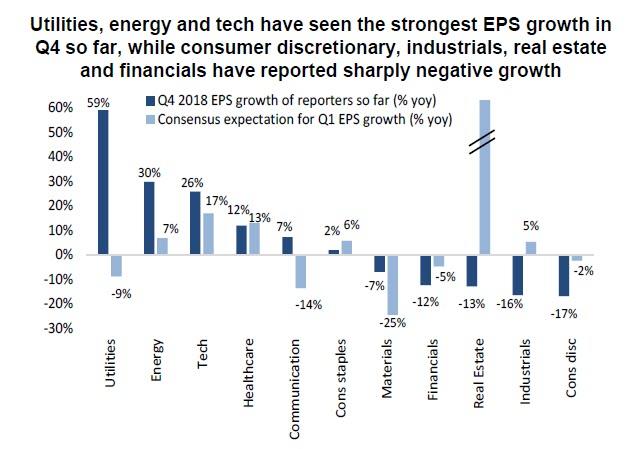

Looking at the composition, financials, industrials and consumer discretionary were all major drags on earnings, while among the companies that have reported so far, utilities, energy and tech have seen strongly positive EPS growth. Strength in utilities’ earnings bears out DB analysts' view of a turn in the sector’s earnings cycle. Meanwhile, consumer discretionary, industrials, real estate, and financials have all seen sharply negative growth.

(Click on image to enlarge)

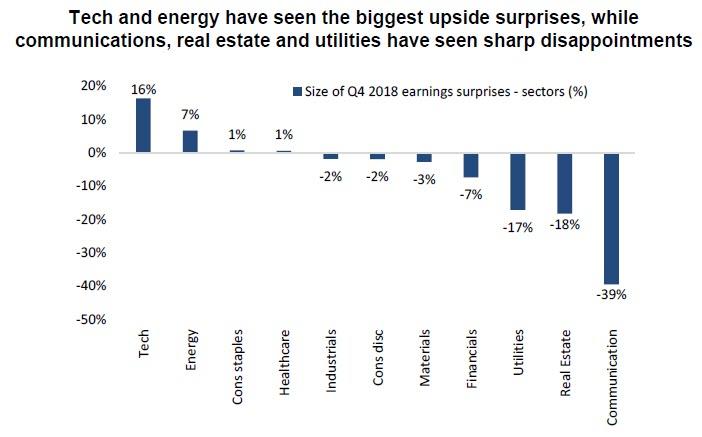

Energy, healthcare, and tech are the biggest positive contributors to market-level Q4 EPS growth so far this season, while financials, industrials and consumer discretionary are all major drags. Tech and energy have seen the biggest upside surprises to earnings, while communication services, real estate, and utilities have seen major disappointments.

(Click on image to enlarge)

Despite being glaringly wrong so far, consensus expects EPS growth for the full Q4 earnings season to end up mildly positive, at 1%, although in light of the current tracking error, that would appear virtually impossible.

Looking ahead, expectations for Q1 EPS growth have been marked down from 6% just before the start of reporting to just above 0% currently. And like in Q4, the disappointment will likely be far greater and the final number will likely be deep in the red.

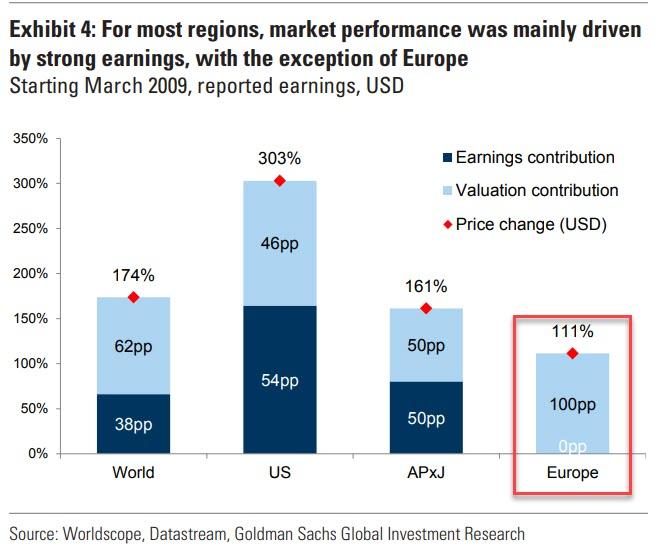

This means that as we noted last weekend, European earnings growth over the past decade remains missing and as the following Goldman chart showed, the only price change in European stocks since 2009 has been entirely due to multiple expansion.

(Click on image to enlarge)