Equity Markets Shrug Off Dow Losing Streak

The Dow Jones Industrial Average ended an eight-day losing streak with a nice gain on Tuesday. Although this was its longest losing streak in six years, the overall decline was only 1.9%—hardly enough to make a dent. The sector, factor, and global ETFs treated it as a non-event and remained steady. The only change of any significance is Eurozone’s rise to the top, replacing China.

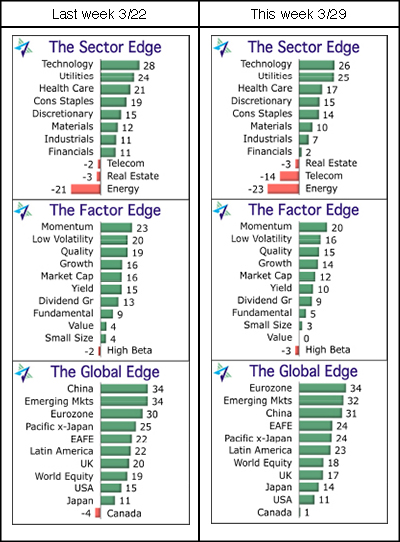

Sectors: Technology, Utilities, and Health Care remain the top three sector categories. Health Care displayed great stability in the face of uncertainty created by the congressional activities on the health care bill. Consumer Discretionary moved ahead of Consumer Staples but not by much. Financials continued to lose momentum and now has little left to lose. Unless it gets a nice bounce in the upcoming week, Financials is poised to become the fourth sector in the red. Vanguard Telecommunications (VOX) was the worst performer among our Sector Benchmark ETFs this past week. Yesterday, the House joined the Senate in voting to overturn an Obama-era internet privacy rule, an action believed to be favorable for telecommunications broadband providers. However, any positive response was muted, and Telecom slipped a spot lower in the rankings. Energy is on the bottom, where it has been eight of the past nine weeks.

Factors: You have to look closely to see any change among the Factor Benchmark ETFs. However, there near the bottom, you can see that Small Size and Value swapped places. Beyond that, all differences were confined to small reductions in momentum scores. Speaking of Momentum, it is the top-ranked factor for the third week in a row. While Momentum and Low Volatility may sound like they have little in common, Low Volatility is in the second-place spot again today. Value’s drop to 10th place coincided with the loss of its last sliver of momentum. It’s not that Value has entered a downtrend, although one might develop in the next few weeks. Instead, Value is just treading water and going nowhere. It is currently trading near the same levels it was in early December and all of January. High Beta is on the bottom for a second week and is the only factor in the red.

Global: The Global Benchmark ETFs have a new leader, and it is the iShares MSCI Eurozone ETF (EZU). Its steady uptrend of the past four months has paid off, allowing it to make a full transition from its last-place ranking in late November to the top today. China held the top spot for the past two weeks and is in third today, just below Emerging Markets. EAFE moved ahead of Pacific ex-Japan, although they appear to be in a tie for fourth place. Earlier today, the U.K. hand-delivered a letter to the European Union stating its intent to leave the bloc. This triggers Article 50 of the Lisbon Treaty and starts the two-year clock for the parties to negotiate the terms of the Brexit and obtain approval from the bloc. Meanwhile, the U.S. continues to fall behind its foreign counterparts, slipping below Japan to land in 10th place. Canada remains on the bottom, which places all of North America at the bottom of the heap.

The following Edge Charts are market momentum snapshots. They provide a quick and easy way to help you visually get a handle on the overall state of the market. With these charts, you can assess both the relative strength and absolute strength (momentum) of more than 30 global equity market segments. Please refer to the Edge Chart User’s Guide for further explanation.

Disclosure: more