Equity Markets Respond To COVID-19

The response by economic sectors to coronavirus has been uniquely different from previous market shocks. The U.S. equity market has been one of the best performers on a relative basis since the beginning of the year. Historically, certain sectors of the market have performed better during specific types of market environments. However, the unusual global impact of the coronavirus, along with the various containment measures being implemented, has led to each economic sector being affected differently.

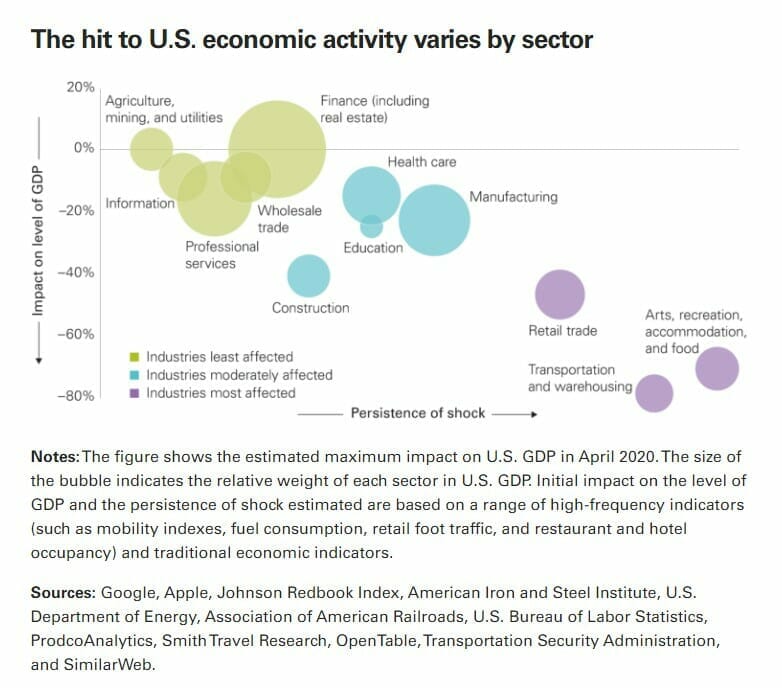

- Sectors that are highly reliant on face-to-face interactions, such as retail trade, hospitality and transport, have experienced a large shock to activity.

- Sectors that can operate relatively well with social distancing in place, such as construction and manufacturing, are less affected.

(Click on image to enlarge)

While various factors drive sector performance, it’s possible that better-performing sectors were the result of market participants believing that these businesses (technology companies, above all) can quickly adapt to new economic conditions without major disruptions to the supply chain.

Cyclical sectors, such as financials and real estate, sustained losses in 2020 because of their sensitivity to these unusual market and macroeconomic conditions. The energy sector, which normally suffers in periods of economic downturns as a result of lower energy demand, has taken an extra hit from the oil-price drop, caused by geopolitical reasons, driving down most oil companies’ expected cash flows.

Sector tilts driving equity rally

The U.S. equity market has been one of the best performers on a relative basis since the beginning of the year. Sector tilts have been a significant reason for the rally in equities over the past few months with outperformance coming from primarily technology and health care stocks. In fact, these two sectors comprise over 40% of the broad U.S. market.

Behavioral changes resulting from various state’s shutdowns, along with consumer reticence, will continue to act as a drag on other sectors that usually see a boost from a market rally. By looking at the shift in sector weights within the S&P 500 Index, you get a sense for how things are going to be very different for industries as we progress along this health crisis.

As certain sectors have gained from this crisis, it has led many advisors and their clients to consider “tactical” sector allocations focused on technology, real estate, and healthcare. It also stresses the importance of a bottom-up approach to sector investing in this current environment. Source: Vanguard

Casey Smith is owner and president of Wiser® Wealth Management, a wealth management firm based in Marietta, GA. Wiser® Wealth Management helps clients identify, understand, and commit ...

more