Energy Shares Continues To Lead US Equity Sector Returns In 2021

Late last month I wondered if this year’s strong start for energy stocks would continue? The answer is a resounding “yes,” at least so far through yesterday’s close (Feb. 18).

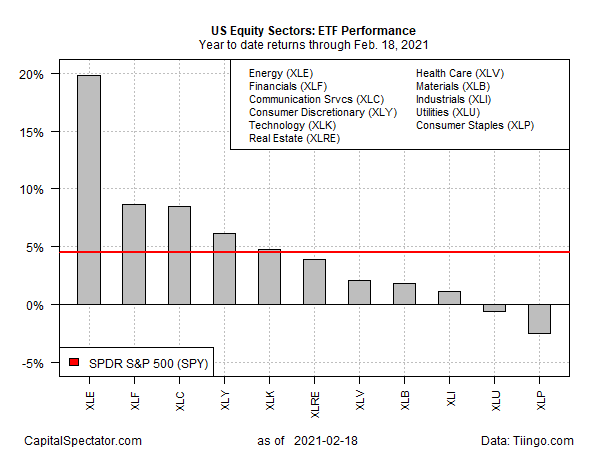

Using a set of ETFs to track the major US equity sectors shows that energy remains the clear leader year to date. In fact, Energy Select Sector SPDR (XLE) has widened its lead over the rest of the field this month: XLE’s 19.8% return so far this year is more than 10 percentage points ahead of its nearest competitor, Financial Select Sector SPDR Fund (XLF), which is up 8.7% year to date. Compared with the modest losses in utilities (XLU) and consumer staples (XLP) so far in 2021, energy’s gain is stellar.

The rebound in energy shares has been fueled by several factors, including recent news that “some of the world’s biggest investors” have been looking for bargains in the sector, which took a beating last year. CNBC on Thursday reported:

Warren Buffett’s Berkshire Hathaway bought more than 48 million Chevron shares, worth $4.1 billion, last quarter, making the oil name the conglomerate’s 10th biggest equity holding. Meanwhile, three energy companies — Energy Transfer, Occidental Petroleum and PG&E— made it into David Tepper’s top 12 holdings by the end of 2020, worth more than $800 million combined.

Goldman Sachs has been bullish on the sector, too. A strategist at the firm, Alessio Rizzi, noted that Goldman continues “to have a pro-cyclical tilt in our asset allocation” and “adding energy equity exposure is attractive at this juncture, especially considering our constructive commodity view.”

The severe winter storm in Texas this week unleashed a new, albeit temporary bullish catalyst to energy pricing by reducing US oil output by 40%, Bloomberg reports: “The Arctic blast that knocked out power in 13 US states in mid-February reduced oil production by more than 4 million barrels a day nationwide, according to traders and executives, as wells froze up and gas lines were clogged with ice.”

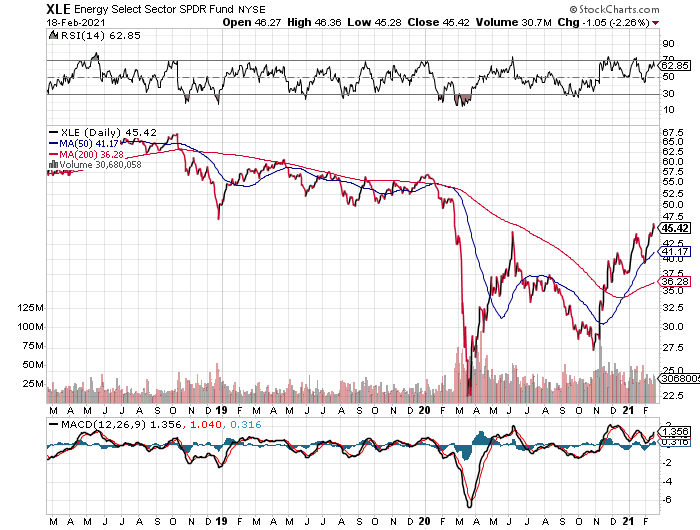

On a trending basis, XLE’s certainly looks strong. After bottoming in late-October, the fund has been rebounding – a revival that received a deeper level of technical support in December when the 50-day moving average moved decisively above the 200-day average for the first time in two years.

Alternative energy stocks continue to post strong year-to-date gains, too, but the sizzling bull run in this corner, which predates the rebound in conventional energy stocks a la XLE, appears due for a pullback. As an example, consider Invesco WilderHill Clean Energy (PBW), one of several ETF proxies for so-called green energy firms. PBW’s rally over the past year has been as strong as it’s been consistent, but there’s a case for arguing that the rally has gone too far too fast.

PBW’s recent retreat translates to a 14% drawdown, the deepest since June. With the fund hovering just above its 50-day moving average, additional selling in the days ahead may signal a higher risk for an extended correction. The good news: a pullback at this point would be healthy for PBW’s longer-term outlook.

Meantime, with an increasingly crowded trade betting on energy’s recovery overall, the sector’s near-term outlook may be approaching the risky priced-for-perfection scenario.

Disclosure: None.