End In Sight For Philly Supply Chain Stress?

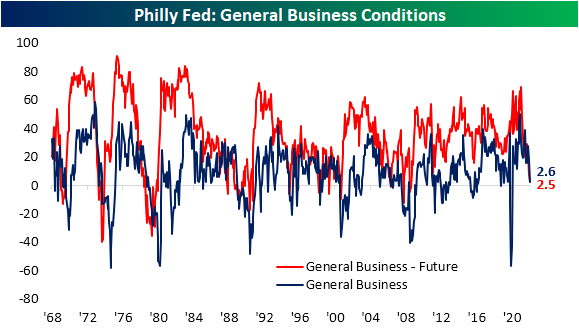

On the backs of a disappointing Empire Fed earlier this week, the neighboring Philadelphia Federal Reserve Bank’s own reading on its region’s manufacturing economy also came in well below expectations at the headline level. The index for General Business Conditions was anticipated to decline from a healthy reading of 17 to a more modest 15. Instead, it plummeted to a barely positive reading of 2.6. That would point to a significant moderation in activity in the month of May.

While the headline index fell sharply, the rest of the report was perhaps more mixed. Breadth was certainly weak with only three categories rising month over month (New Orders, Shipments, and Unfilled Orders). As for the indices that declined, on the one hand, some could be perceived as welcome drops with pullbacks in elevated readings of prices and delivery times. On the other hand, the moderation in the Number of Employees or CapEx expectations could be taken as a less positive sign for the broader economy.

As shown in the table above, overall most current conditions indices remain historically elevated even after recent declines. Expectations indices meanwhile are generally more depressed with some readings even near record lows. As such, the average normalized distance between the current conditions and expectations categories throughout the report have broken out to the highest level since February 1988 and mid-1975 before that. Put differently, there have rarely been times in which the region’s manufacturers have reported such a dramatic difference between healthy current conditions while also holding a pessimistic outlook.

Taking a closer look at individual categories, New Orders remain well off-peak but ticked higher in May rising 4.3 points to 22.1. There was an even larger jump in expectations, although the level of that index is not nearly as elevated. The modest increase in demand was met with a huge jump in Shipments and Unfilled Orders. With a 16.2 point jump month over month, Shipments are reported to be growing at the fastest rate since the fall of 2020. Given the region’s firms are getting orders out the door at a faster clip, inventories are growing only modestly with that index falling to a barely expansionary 3.2. Additionally, that evidence of improved fulfillment also resulted in a huge drop in expectations for Unfilled Orders. In fact, that index dropped to the lowest level since March 1995. That means the region’s firms expect to work off unfilled orders at a historic rate in the coming months.

(Click on image to enlarge)

The likely reason why companies are anticipating such a huge improvement in fulfillment is massive expected declines in lead times. Delivery Times remain elevated but have moderated significantly in the past couple of months. Six-month expectations meanwhile have fallen all the way down to -29.1 which, like unfilled orders expectations, is the lowest level since March 1995.

Another expectations reading that has fallen precipitously in May is CapEx expectations. The reading fell to the worst reading since September 2016 indicating huge moderation in planned investment. Likewise, hiring is expected to slow as has already been observed by the current conditions index. We would note that these readings remain positive, meaning firms are still expecting to take on more hiring and spending on net but at a more modest rate.

Click here to learn more about Bespoke’s premium stock market research ...

more