Earnings Estimates Keep Falling

Earnings Estimates - Small Caps Undervalued?

As you can see from the chart below, the forward PE of Russell 2000 firms is below the forward PE of Russell 1000 firms. At the end of October, the forward PE of Russell 2000 firms was 14.9 and the forward PE of Russell 1000 firms was 15.8.

This ratio is the lowest in 15 years and it’s below the average since 1978. This ratio seems to work in cycles, implying there is more to fall even though it’s below average. There are two important points to recognize. First, small caps have a lot of debt and rising rates are making that debt tougher to roll over. Because of that, the discount small caps are trading at might be justified.

The second point is the Russell 2000 PE ratio doesn’t include firms with no earnings which means the real PE is much higher.

It’s not ideal to buy highly indebted firms which aren’t profitable as interest rates are increasing.

I’m not bullish on small caps for the next year. If the tariffs are ended, the multinational stocks will rally while small caps won’t. American growth is slowing just like the rest of the world, ruining the potential outperformance of small caps which are usually domestically oriented.

Earnings Estimates - Review Of Q3 Earnings Season

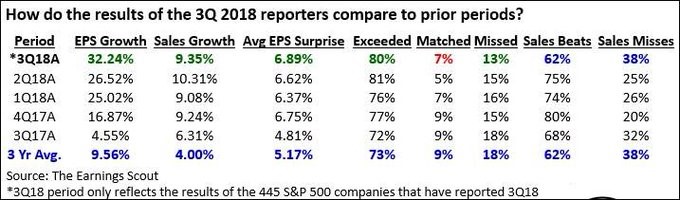

With 445 S&P 500 firms reporting earnings, it’s fair to say Q3 was amazing, but future estimates are disconcerting. As you can see from the table below, EPS growth has been 32.24% and sales growth is 9.35%. That’s peak earnings growth if the results are maintained. Sales growth is 0.96% away from Q2. The EPS surprise rate is 6.89% with 80% of firms beating estimates. That’s above the 3 year average of a 5.17% beat rate with 73% of firms beating estimates.

Unfortunately, EPS beats are the least important part of earnings season. Revenues and guidance are far more important. The EPS growth makes stocks cheaper, but future estimates determine current stock prices. As you can see, 62% of firms beat sales estimates which is way below the Q2 rate of 75% and the Q1 rate of 74% which gave us inklings growth would continue. The 62% beat rate matches the 3-year average.

The chart below shows the rate of change of EPS estimates for the past 2 years. As you can see, the slope of 1-year earnings estimates is negative, but the 2-year slope is positive. In the past 30 years, there hasn’t been a 20% correction when the 2-year slope is positive.

This makes sense because 10% corrections are tests for a recession.

Once stocks fall 20%, it’s close to verification that there is a recession or a very pronounced slowdown. I wouldn’t advise you to look at this chart as bullish justification that a bear market isn’t coming because the slope can quickly turn if the negative revisions continue.

The table below shows the latest earnings growth estimates. As you can see, the future estimates continued to fall. Estimates for Q4 have fallen 2.74% to 12.77% from August 1st to November 8th. The Q1 estimates have much less wiggle room because the comparisons are much tougher. Growth is now expected to be 7.71%. The estimates for Q2 are still immaterial because they are too far in advance. Even though the 2-year stack for earnings growth in Q1 will be strong, investors don’t care about the past. They only care about where future estimates are headed.

Earnings Estimates - Estimates need to fall more to justify a down year.

However, I’m not bullish on stocks in 2019 because the current estimates are the best case scenario. If everything goes right, I see stocks rising about 5%. That’s not much upside for buying stocks right as the economic cycle comes to its close. Bearish investors said the same thing about stocks in early 2016, but this won’t be the same type of buying opportunity because there won’t be another fiscal stimulus, the yield curve is closer to inverting, the labor market is closer to being filled, and the Fed is much more hawkish.

Earnings Estimates - Real Yields Are Rising

With the 10-year yield rising late in the business cycle, you would think inflation would be driving them higher since inflation increases at the end of the business cycle. However, the catalyst for rising rates is real yields. If it wasn’t for the 10-year real yield breaking out of its 5-year range between 0% and 1%, the yield curve may have inverted already.

As you can see from the chart below, in the past year the breakeven rate is only up less than 20 basis points, while the real rate is up over 60 basis points.

Generally, increasing real yields imply investors think growth will be strong.

As I mentioned earlier, some of the highly indebted small caps will be hurt by this increase. With oil prices falling, the breakeven rate might fall further, which will pressure real yields, even more, to keep up the 10-year yield. I don’t see why bond investors are the most optimistic about growth in 5 years since the growth peak caused by the stimulus has now passed. I keep coming back to the possibility that the increased supply of Treasuries due to heightened deficits is pushing treasury yields up.

Earnings Estimates - Another Strong Jobless Claims Report

The housing market is one leading indicator predicting a recession way out in advance. The jobless claims bring us back to 2018 where we see the labor market remained strong last week. The total claims were 214,000 which was 1,000 above estimates. The previous week was pushed up by 1,000 to 215,000. These are still very low numbers as the 4-week average fell from 214,000 to 213,750. Florida and Georgia claims fell again as they normalize after hurricane Michael. Continuing claims fell 8,000 in the week of October 27th to 1.623 million. The 4-week average fell 7,500 to 1.633 million. Those are both the lowest readings since the summer of 1973 when the labor market was much smaller.

Disclaimer: Neither TheoTrade or any of its officers, directors, employees, other personnel, representatives, agents or independent contractors is, in such capacities, a licensed financial ...

more