Earnings Distortion Scorecard: Week Of 4/20/20-4/24/20

Our Earnings Distortion Scores empower investors to make smarter investments with superior data as well as defend against management efforts to obfuscate financial performance. Earnings distortion for the overall market recently reached levels not seen since right before the tech bubble and the financial crisis.

Weekly Earnings Distortion Insights

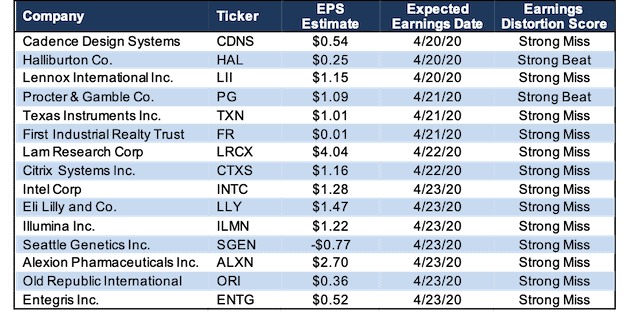

Figure 1 contains the 15 largest (by market cap) companies that earn a “Strong Beat” or “Strong Miss” Earnings Distortion Score and are expected to report the week of April 20, 2020.

Figure 1: Earnings Distortion Scorecard Highlights: Week of 4/20/20-4/24/20

Sources: New Constructs, LLC and company filings

The appendix shows the Earnings Distortion Scores for all the S&P 500 companies, plus those with market caps greater than $10 billion, that are expected to report the week of April 20, 2020.

Details: Entegris Inc. (ENTG) Earnings Distortion

We first featured Entegris at the beginning of filing season in our report “Danger Zone: Investors Who Ignore the Real Earnings Season.” While the stock has fallen less than the market since our report, its earnings remain overstated. In 2019, Entegris had $60 million in net earnings distortion that cause earnings to be overstated. Notable unusual income in ENTG’s 2019 10-K includes:

- $122 million in other income related to the Versum termination fee

This unusual income was partially offset by notable unusual expenses, such as:

- $9 million in severance and restructuring costs – Page 36

- $4 million in costs associated with the acquisition of MPD – Page F-15 (Page 75 total)

- $2 million in costs associated with the acquisition of DSC – Page F-16 (Page 76 total)

- $2 million in severance and restructuring costs – Page 37

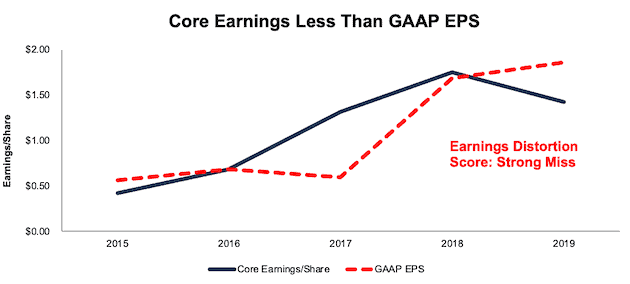

In total, we identified $0.44/share (24% of GAAP EPS) in net unusual income in ENTG’s 2019 GAAP results. After removing this earnings distortion, ENTG’s 2019 core earnings of $1.43/share are lower than GAAP EPS of $1.87, per Figure 2.

With overstated earnings, ENTG gets our “Strong Miss” Earnings Distortion Score and is likely to miss consensus expectations.

Figure 2: ENTG Core Earnings Vs. GAAP: 2015 – 2019

Sources: New Constructs, LLC and company filings

Figure 1 shows that ENTG is one of 13 companies that earn our “Strong Miss” score for this week.

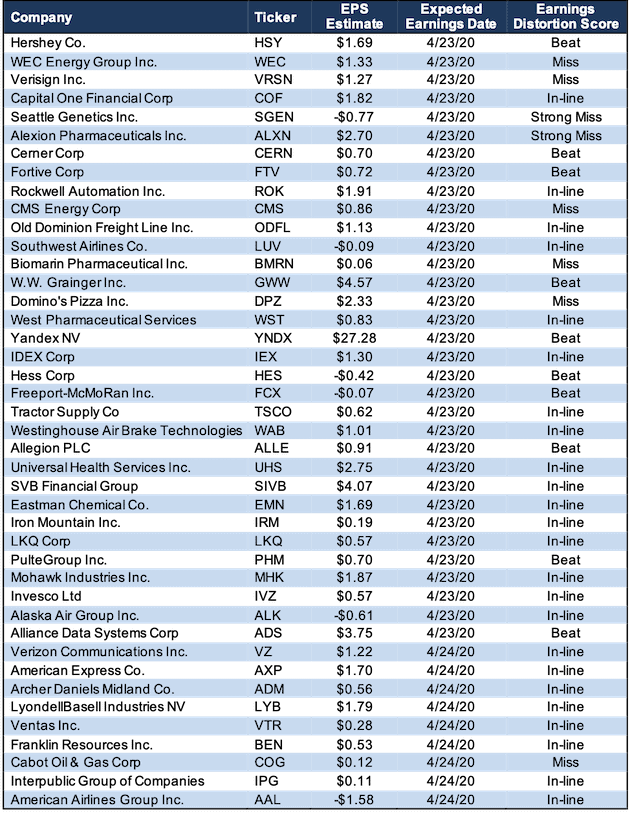

Appendix: All Major Companies Expected to Report April 20 – April 24

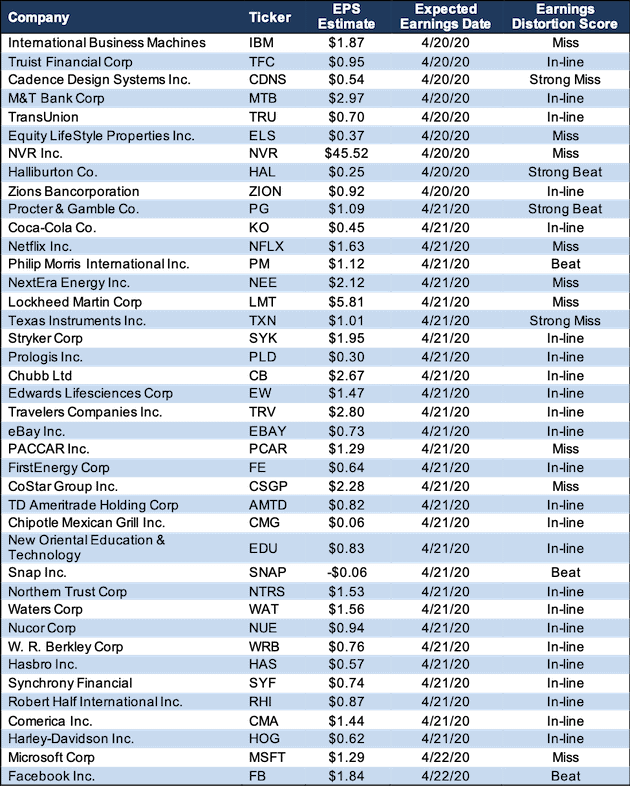

Figure 3 shows all the S&P 500 companies, plus those with market caps greater than $10 billion, that are expected to report the week of April 20, 2020.

Figure 3: Earnings Distortion Scorecard: Week of 4/20/20-4/24/20

Sources: New Constructs, LLC and company filings

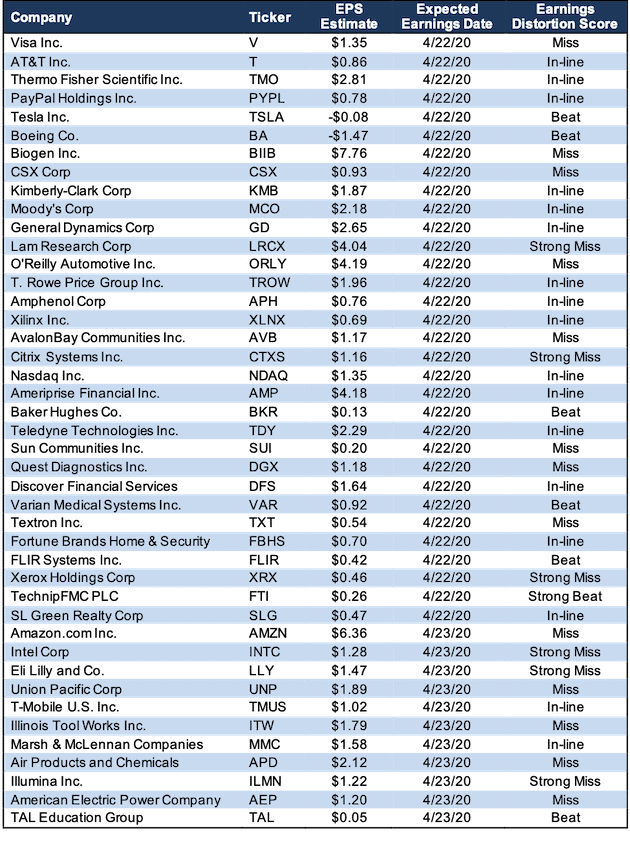

Figure 3: Earnings Distortion Scorecard: Week of 4/20/20-4/24/20 (continued)

Sources: New Constructs, LLC and company filings

Figure 3: Earnings Distortion Scorecard: Week of 4/20/20-4/24/20 (continued)

Sources: New Constructs, LLC and company filings