Early Endings

Better to end a difficult story early than prolong it with more hope and dreams. “Sometimes you have to walk,” quips Trump as he departs Hanoi. The difference good and bad books or movies pivots on their length and their endings letting the imagination of the audience drive to bigger conclusions and future sequels. Perhaps this is the way to end the best start to equities since 1987. This is the logic in play today for the early endings of the bull market. The causality of if A then B is under investigation as we all react to the early ending of the Trump/Kim summit with no deal drives a sniff failure for China/US trade talks as deadlines don’t matter there even as the US drops its threat on tariffs. Markets are fickle and the heavy load of economic data hasn’t helped counter the steady flow of difficult geopolitical news – from India/Pakistan where a captured pilot seems the key to peace; to North Korea where sanctions and action on denuclearization block a deal; to EU/UK on Brexit where Labour’s Corbyn backs a second referendum after Parliament again votes down May’s plan. The markets had plenty of economic news to analyze overnight as well with weaker China NBS PMI – manufacturing at 3-year lows with export orders at decade lows and the January and February combined output weak enough to give pause to what happens to China growth even with a US deal. The Korea and Japan industrial production in January was weaker than expected as well making clear that China weakness is exported to the region and world. The EU flash inflation reports from France, Spain and Italy were in line and leave the German story as the tie-breaker – but there isn’t anything to prevent the ECB from being dovish. The Sweden GDP was better than expected but the India weaker and world 4Q GDP waits for the US data next. This is the rub as the US slowdown in 4Q bleeds into 1Q logically making divergence difficult to believe in and the USD looking set for even more pain as carry and growth views collide – with 95.50 and 94.30 both in play for a larger ending to the USD rally.

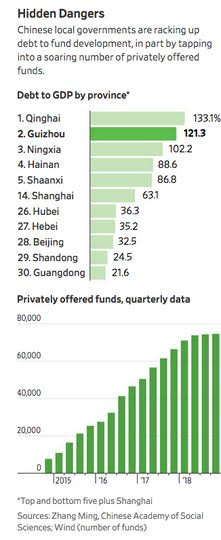

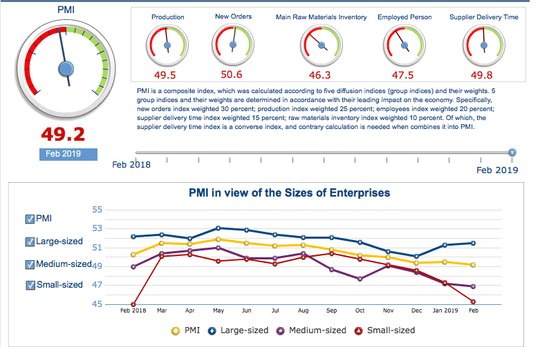

Question for the Day: Is the China PMI a foreshadowing for larger growth troubles in 1Q globally? The hope was that US/China trade deals and China stimulus plans mixed with a big push on banks to led to private companies will drive a recovery in 2019. Many see that in play already with green shoots for growth showing up in some reports but not today. The WSJ article on China local government debt for development is a chilling reminder that the present spending there has been done before and that there is a real risk for “pushing on a string” for more debt inspired building and spending.

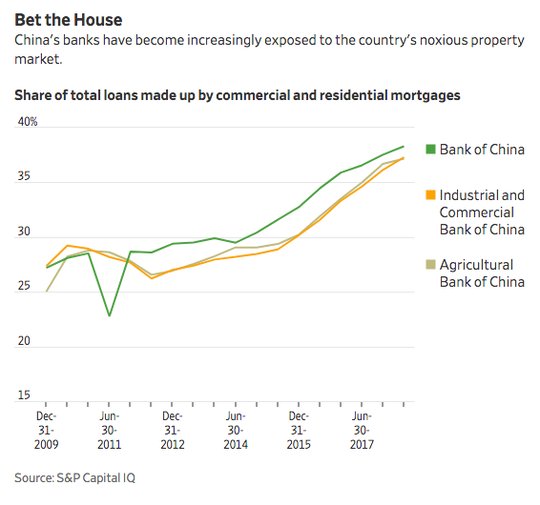

The big banks in China seem more linked than ever to property risks and that makes the present moves and focus on trade less important to the bigger picture for 2019 in China growth. Lending to smaller business will pivot on how big banks see property prices and sales.

What Happened?

- South Korea central bank (BOK) kept rates unchanged at 1.75% as expected. Shift to cautious stance as focus is to support economy with falling exports and slowing global growth.

- Korea January industrial production up 0.5% m/m, up 0.1% y/y after revised -0.8% m/m (prel -1.4%), 0.7% y/y –weaker than 1% y/y expected. The manufacturing output 0.2% y/y after 1.2% y/y – also weaker than 1% y/y expected. The Manufacturing Shipment Index climbed 1.5% m/m but fell 0.3% y/y. The Manufacturing Inventory Index shed 1.2% m/m, but jumped 6.8% y/y.

- Korea January retail sales up 0.2% m/m, 4% y/y after revised -0.2% m/m (prel +0.8% m/m), 3% y/y – better than 2% y/y expected.

- Japan January retail sales -2.3% m/m, +0.6% y/y after 0.9% m/m, 1.3% y/y – weaker than -1% m/m, +1.1% y/y expected. Large retailers fell 3.3% m/m after -1% m/m – also missing -1.8% m/m drop expected.

- Japan January industrial production -3.7% m/m, 0% y/y after -0.1% m/m, -1.9% y/y – weaker than -2.5% m/m expected – worst drop in a year. The ministry said “industrial production is pausing” and said production is expected to increase by 5 percent in February before a decrease again in March. The industries dragging down output – autos, electrical machinery and phones, while chemicals and oil products supported.

- Australia 4Q Private Capex +2% q/q after -0.5% q/q – better than +0.5% q/q expected. By industry, investment from mining firms fell 2.7% from the prior quarter. It increased by 2.7% at manufacturers and was relatively unchanged at other selected industries, predominantly services firms. Looking ahead, the fourth estimate for CAPEX spend in 2018/19 jumped to $114.1 billion, up from the third estimate of $102 billion offered three months earlier.

- Australia January private sector credit rose 0.2% m/m, 4.3% y/y after 0.2% m/m, 4.3% y/y – less than 0.3% m/m expected. Housing rose 0.2% m/m after 0.2%, Personal -0.6% m/m after -0.4%, Business steady at 0.3% m/m.

- China February NBS manufacturing PMI slips to 49.2 from 49.5 – weaker than 49.5 expected– 3-year lows. The services PMI slips to 54.3 from 54.7 – also weaker than 54.5 expected.

- German January import prices down -0.2% m/m, +0.8% y/y after -1.3% m/m, 1.6% y/y – less than +0.2% m/m, 1.2% y/y expected. The imports ex oil -0.3% m/m, +1.1% y/y.

- French February flash HICP up 0.1% m/m, 1.5% y/y after -0.6% m/m, 1.4% y/y - less than 1.7% y/y expected. The National CPI rose 1.3% y/y after 1.2% y/y – in line with expectations

- Spanish February flash HICP up 0.2% m/m, 1.1% y/y after -1.7% m/m, 1% y/y – slightly more than 1% y/y expected. The National CPI rose 1.1% y/y from 1% y/y – as expected.

- Italy February flash HICP fell -0.2% m/m, +1.2% y/y after -1.7% m/m, 0.9% y/y – as expected. The National CPI rose 1.1% y/y after 0.9% y/y – also as expected.

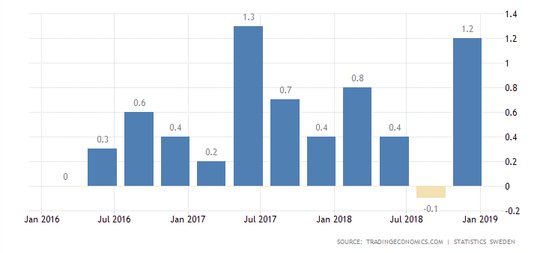

- Sweden 4Q GDP 1.2% q/q, 2.4% y/y after revised -0.1% q/q, 1.5% y/y (prel -0.2% q/q, 1.6% y/y) – better than 0.5% q/q 2.1% y/y expected. Household consumption up 0.7% q/q, government spending up 0.6% q/q while inventories added 0.3 pp and exports rose 3.1% while imports rose 1.4%. Gross capital formation fell 1.6%.

- Sweden January retail sales up 0.8% m/m, 2.2% y/y after revised -0.9% m/m, 0% y/y (prel -1.4% m/m, -1.1% y/y) – better than 0.7% m/m, 0.7% y/y expected.

- Sweden January PPI up 0.8% m/m, 5.6% y/y after -0.6% m/m, 5.6% y/y – more than 4.5% y/y expected.

- India 4Q GDP slows to 6.6% y/y after revised 7.0% y/y – less than 6.9% expected. 3Q revised lower from 7.1% and 2Q revised lower from 8.2% to 8.0% y/y.

Market Recap:

Equities:The US S&P500 futures are off 0.3% after losing 0.05% yesterday. The Stoxx Europe 600 is off 0.45% with focus on early Kim/Trump summit ending and weaker Chinese PMI. The MSCI Asia Pacific index fell 0.5% with focus on US/China trade talks

- Japan Nikkei off 0.79% to 21,385.16

- Korea Kospi off 1.76% to 2,195.44

- Hong Kong Hang Seng off 0.43% to 28,633.18

- China Shanghai Composite off 0.44% to 2,940.95

- Australia ASX up 0.31% to 6,252.70

- India NSE50 off 0.13% to 10,792.50

- UK FTSE so far off 0.8% to 7,050

- German DAX so far off 0.15% to 11,471

- French CAC40 so far off 0.15% to 5,219

- Italian FTSE so far flat at 20,504

Fixed Income: Risk off and weaker China PMI set bonds bid early in Asia, then an early end to Trump/Kim but even all that puts EU bonds mixed with German 10-year Bunds flat at 0.16% holding 0.15% breakout zone –French OATs flat at 0.56% while UK Gilts flat at 1.27% - all linked to hopes for soft or no Brexit.The periphery mixed with Italy off 1bps to 2.77%, Greece off 4bps to 3.65% but Portugal up 2bps to 1.47% and Spain up 1bps to 1.17%.

- US Bonds are bid waiting for more data– 2Y off 2bps to 2.48%, 5Y off 2bps to 2.47%, 10Y off 2bps to 2.67%, 30Y off 1bps to 3.05%.

- Japan JGBs see curve flattening– 2Y up 1bps to -0.15%, 5Y flat at -0.15%, 10Y flat at -0.02% and 30Y off 1bps to 0.60%.

- Australian bonds curve steepen, sold off on Capex bounce– 3Y up 1bps to 1.64%, 10Y up 4bps to 2.11%.

- China bonds steady after weaker PMI– 2Y flat t 2.73%, 5Y up 1bps to 3.03%, 10Y flat at 3.21%.

Foreign Exchange: The US dollar index off 0.25% to 95.92. However, the USD is bid in emerging markets - EMEA: RUB off 0.15% to 65.831, ZAR off 0.2% to 13.956, TRY off 0.15% to 5.317; ASIA: INR up 0.1% to 71.11, KRW off 0.5% to 1122.9

- EUR: 1.1415 up 0.4%.Range 1.1365-1.1419 with EUR up on rates, USD broader weakness 1.1420-1.1450 restistance for 1.15 next.

- JPY: 110.75 off 0.2%.Range 110.66-111.00 with EUR/JPY 126.45 up 0.2%. Risk-off mood driving with 110 still key.

- GBP: 1.3310 flat. Range 1.3273-1.3319 with EUR/GBP .8575 up 0.4% - all about Brexit delay pushback and 1.3350-1.3400 sticky resistance.

- AUD: .7140 flat. Range .7127-.7166 with Capex insufficient to unwind US/China trade focus and commodities – NZD off 0.1% to .6840 – focus is on RBNZ and bank capital increase.

- CAD: 1.3165 up 0.1%.Range 1.3141-1.3179 with focus on oil, rates and crosses with 1.3050-1.3250 consolidation.

- CHF: .9935 off 0.8%.Range .9935-1.0015 with EUR/CHF 1.1340 off 0.4% - all about safe-havens still. .9880 key.

- CNY: 6.6840 flat.Range 6.6760-6.6880 with 6.70 pivot against 6.62 target. Focus is on US/China talks still.

Commodities: Oil off, Gold up, Copper off 0.4% to $2.9505

- Oil: $56.57 off 0.65%. Range $56.43-$57.04 with the 2.5% rally after EIA draw unwinding on weaker global equities, fears about US/China. $55-$58 key for WTI still. Brent $66.606 off 0.5%.

- Gold: $1328.40 up 0.5%.Range $1318.60-$1328.90 with rebound thanks to weaker USD and geopolitics. $1305-$1315 key support for $1340-$1350 again. Silver up 0.5% to $15.85, Platinum up 0.9% to $877.70 and Palladium up 1.5% to $1499.

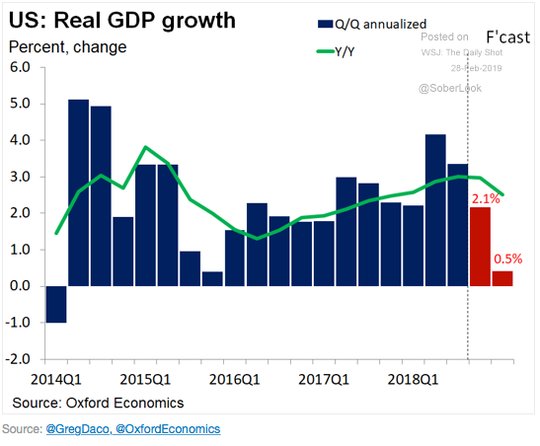

Conclusions: How much does 4Q GDP matter? The mood to start the US day is mixed with US/China trade deal hopes masked by Kim/Trump early endings and Trump political woes with Cohen. There is a sense that the government issues don’t matter as long as the private sector grows and so 4Q GDP today matters. The outlook is for 2-2.5% 4Q growth dropping off to something even weaker in 1Q. How markets react to the actual data will matter and set the tone for the larger reactions to other more forward-looking data – but perhaps more directly it could turn the USD selling and US FOMC focus a bit more sharply as well – watch 97.20 for upside surprises in USD.

Economic Calendar:

- 0800 am German Feb flash HICP (m/m) -1%p 0.6%e (y/y) 1.7%p 1.8%e / National CPI 1.4%p 1.5%e

- 0800 am FOMC Vice Chair Clarida speech

- 0815 am FOMC Chair Powell speech

- 0830 am Canada Jan PPI (m/m) -0.7%p 0.4%e

- 0830 am Canada 4Q C/A deficit C$10.3b p C$11.5bn e

- 0830 am US 4Q preliminary GDP 3.4%p 2.4%e / price index 1.5%p 1.7%e

- 0830 am US weekly jobless claims 216k p 220k e

- 0945 am US Feb Chicago PMI 56.7p 57.5e

- 1215 pm Fed Harker Speech

View TrackResearch.com, the global marketplace for stock, commodity and macro ideas here.