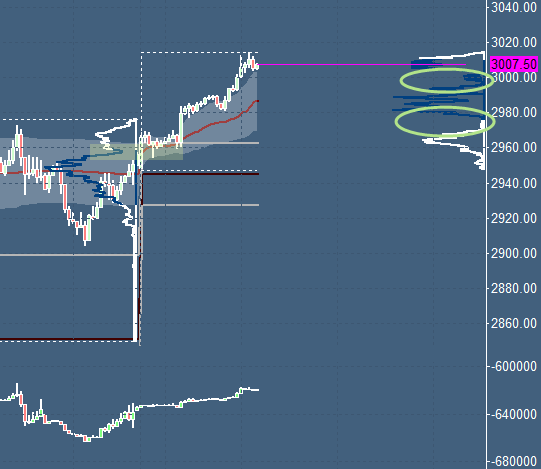

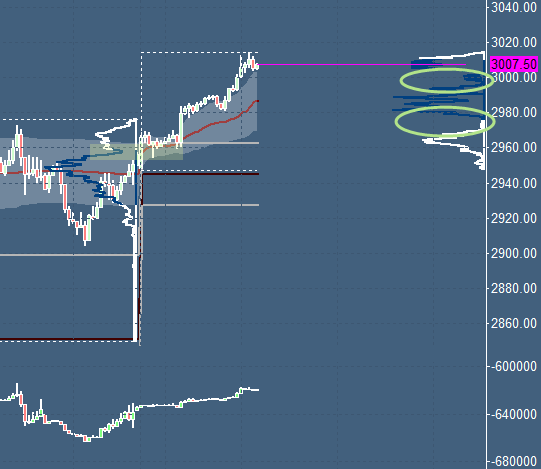

E-Mini S&P 500 Testing Value Extreme (SPX)

The E-mini S&P 500 surged higher to test the previous Year's VAH close once the market found support with a bullish inside day failure and with that broke out of the balance area which occurred for several days now. The next level would be another bracket high. Support of balance area high and the mean of that bracket probable. However, looking for bearish patterns as of possible resistance from the mentioned VAH close level should be a good idea in our opinion.

Looking at the weekly structure we can observe the confluence between the LVN area of the volume profile and VWAP VAH close level (+1.0 Standard Deviation of the VWAP) from the previous week. Also, the open above VPOC was a bullish sign which brought the market to higher prices. Currently we can see an upside slope of the weekly VWAP with two LVN areas that could be tested/filled.

Visit our trading community to learn a more indepth analysis process with various tools such as the VWAP or Footprint chart.

Disclosure: ...

more