E-Mini S&P 500 Daily And Weekly VWAP Update (ESM0)

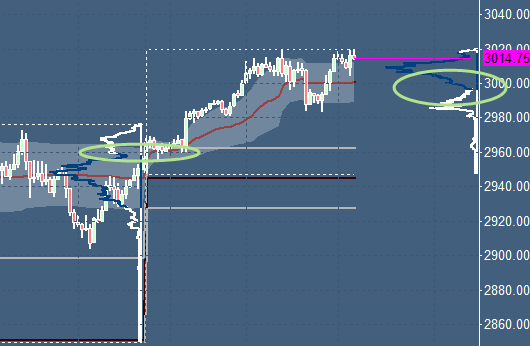

Looking at the daily periodicity with a Yearly VWAP plotted on it we can observe the test of the higher value extreme with resistance and a balanced behavior around that area yesterday. Today we retesting this particular level and the market could move towards the bracket high which could be the next level to test once we break above the Year's VAH close level.

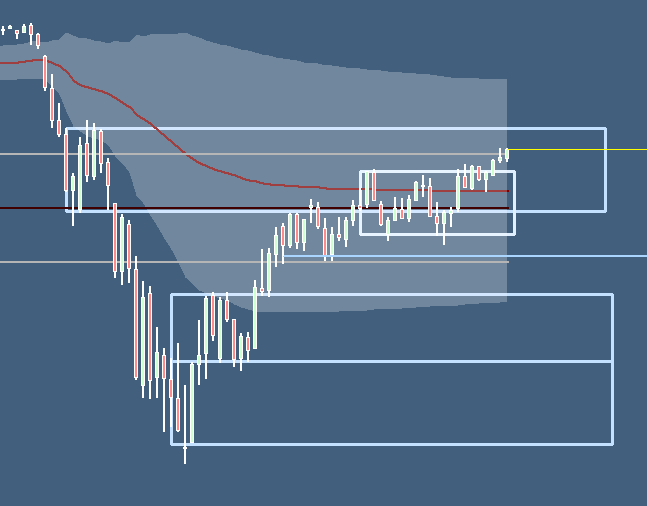

Moving forward quickly to the weekly perspective we can observe a rotational behavior around the DVAH and DVAL (1.0 deviation levels of the VWAP). The slope of the current developing value is to the upside flat. Currently the market dips above the swing high. Looking for absorption or bearish patterns around this area should be a good idea for us for now. This could lead the market to a pullback towards the developing VWAP which should be confluent with the LVN area. Larger LVN areas tend to be revisited and filled.

Visit our trading community to learn a more indepth analysis process with various tools such as the VWAP or Footprint chart.

Disclosure: ...

more