Duration Is Not Defensive

WHAT THE GLOBAL FINANCIAL CRISIS CAN TELL US ABOUT FIXED INCOME

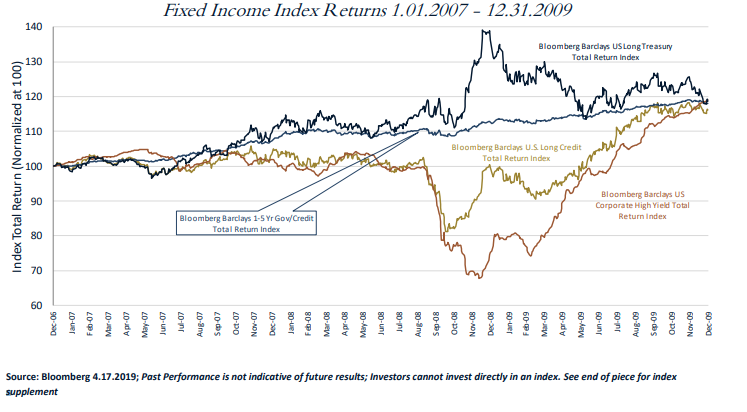

Above is a chart tracking the performance of various fixed income indices before, during, and after the Global Financial Crisis in 2008. Before I continue, I want to clarify that we do not expect another financial crisis in the near future.

However, we have recently adopted a defensive stance as we see a growth slowdown in the United States in the near future and asset valuations are at the upper end of their historical range. As such, it is a worthwhile exercise to study the last recession as it provides a good case study (albeit extreme) on which fixed-income subsectors tend to do well in a difficult macro-economic environment. As illustrated in the chart, the Bloomberg Barclays US Long Treasury Total Return Index (dark blue) performed the best during the most acute sell-off of the Financial Crisis. From November 2008 until the beginning of 2009, the Index returned approximately 24%. Meanwhile, High Yield (light red) investors experienced a 33% loss by 2009 had they invested at the beginning of 2007. Even investment grade corporates with longer duration took a hit, despite longer-term yields moving lower. The Bloomberg Barclays U.S. Long Credit Index (beige) was down over 20% in the Fall of 2018. Notably, the Bloomberg Barclays 1-5 Govt/Credit Total Return Index (light blue) was relatively resilient. It did experience a 2.4% drawdown in the second quarter of 2008, but nothing on the magnitude of the other longer duration credit indices.

The 2008 case study is an extreme one, however, it illustrates the double-edged sword that duration can be. Duration is a measure of the sensitivity of a bond relative to the change in its underlying yield. The longer the duration, the more risk, both upside, and downside. In the case of treasuries in 2008, duration helped its return profile. However, in the case of investment grade corporate bonds, duration had the opposite effect. Credit indices also fail to take into account for credit downgrades since there is survivorship bias. As such, longer duration holdings may have experienced sharper drawdowns.

Again, we are not calling for a systemic meltdown like the 2008 analog. However, in a late-cycle environment where a growth slowdown is plausible, maybe even likely, we think it is prudent to be positioned defensively. High yield and preferred securities have been pared back substantially. Credit quality has been increased. And our weighted average maturity profile has gone from over six years to four years.

WILL LONGER MATURITY TREASURIES BE THE BUFFER THAT ASSET ALLOCATORS NEED?

The playbook for asset allocators and risk parity funds for a growth slowdown is to have exposure to longer-dated treasuries which, in theory, should perform well in a risk-off environment. Indeed, in 2008, the playbook performed admirably, and correlations between longer-dated Treasuries and risk assets were negative. We expect that there will be times during the next slowdown that a similar inter-asset relationship exists. However, we do not think that extending duration in treasury securities offers a good risk-reward proposition. First, we could always be wrong. We think we are late in the cycle, but nobody really knows for sure. In an environment where wage growth continues to accelerate and inflation increases to over the Fed’s 2% target, thirty-year treasuries could be the worst place to be. And second, even if there is a growth slowdown, that does not preclude inflation from being stubbornly resilient. Going into the last recession, the thirty-year bond was yielding 5.5%. Today, it yields less than 3%. As such, we believe there is considerably less upside in a risk-off scenario. And finally, there are a number of trends we believe pose a risk to the long-end of the curve. Term premiums are negative. Fiscal deficits are likely to remain above $1 Trillion per year – potentially inundating the market with supply. We believe increased global issuance from Japan, Eurozone, and China will also provide investor alternatives, further crimping demand for U.S. Treasuries. The Federal Reserve, we believe, will be faced with the “Sophie’s Choice” of Central Banks. They will have to choose between fighting inflation and promoting growth. We believe they have tipped their hand and will choose growth over inflation in an environment where the two are not moving together. Since the Federal Reserve has much more control over the short-end of the yield curve, we believe the better risk-reward proposition is to shorten duration and increase credit quality.

Index Supplement:

Bloomberg Barclays U.S. Long Credit Total Return Index – The Bloomberg Barclays US Credit Index measures the investment grade, US dollar-denominated, fixed-rate, taxable corporate and government-related bond markets. It is composed of the US Corporate Index and a non-corporate component that includes foreign agencies, sovereigns, supranational and local authorities.

Bloomberg Barclays 1-5 Govt/Corp Total Return Index- The Bloomberg Barclays US Government/Credit Bond Index is a broad-based benchmark that measures the non-securitized component of the US Aggregate Index. It includes investment grade, US dollar-denominated, fixed-rate Treasuries, government-related and corporate securities.

Bloomberg Barclays U.S. Long Treasury Total Return Index – The Bloomberg Barclays US Treasury Index measures US dollar-denominated, fixed-rate, nominal debt issued by the US Treasury. Treasury bills are excluded by the maturity constraint but are part of a separate Short Treasury Index.

Bloomberg Barclays U.S. Corporate High Yield Total Return Index - The Bloomberg Barclays US Corporate High Yield Bond Index measures the USD-denominated, high yield, fixed-rate corporate bond market. Securities are classified as high yield if the middle rating of Moody’s, Fitch, and S&P is Ba1//BB+/BB+ or below. Bonds from issuers with an emerging markets country of risk, based on Barclay's EM country definition, are excluded.

Disclosure: This article is distributed for informational purposes only and should not be considered investment advice or a recommendation of any particular security, strategy or investment product. ...

more