Dreamers Pay More Than $6B In Taxes Annually For Benefits They Cannot Take Full Advantage Of

With the U.S. Presidential Election just a few weeks away, there’s a lot of focus on some of the hot-button issues. Among the most contested topics is immigration policy.

One particular point of contention is the Deferred Action for Childhood Arrivals program (or DACA).

Sitting U.S. President Donald Trump campaigned in 2016 on a promise to repeal DACA. He once spoke of DACA holder saying, “Some are very tough, hardened criminals.” But in spite of his clear stance on the program and years-long effort to dismantle it, he’s been largely unable to affect meaningful change. Still, more than a third of his voters want to see the program ended.

But where does this disdain for the DACA program stem from?

Part of it, at least, is the misconceptions that Dreamers take away jobs from American citizens while not contributing to taxes or the economy.

It’s been widely covered that Dreamers do in fact pay taxes in the U.S. (you can read up on that here). What’s less covered, though, is how much DACA holders contribute to taxes and how much of their wages are pumped to the economy and into taxes.

With the DACA conversation about surely about to catch a new wind as the election approaches, we decided to dig into the data. We wanted to find out the actual impact of Dreamers on the U.S economy and tax funds in millions of dollars.

But what we found were numbers in the billions.

DACA Holders Contribute Billions in Taxes for Benefits They Do Not Get

One metric for measuring the economic impact of any group is to look at how much they are paying towards income taxes.

According to the Institute on Taxation and Economic Policy, the average salary of a DACA recipient in the U.S. is $36,231. With a base tax rate of 24%, they pay $8,695 each per year in taxes.

With approximately 700,000 Dreamers in the U.S., that’s a total income tax contribution of $6,086,808,000 per year for all DACA holders currently working in the U.S.

Some of that tax money is earmarked for tax benefits like Social Security and Medicare. What many people don’t realize, though, is that Dreamers can’t take care of most tax benefits — like federal funding for education — in spite of paying for those tax benefits.

Every year, DACA holders pay 6.2% of their annual income toward Social Security benefits, amounting to $2,246 (or $1,572,425,400 cumulatively across all DACA holders).

They also contribute 1.45% of their salaries toward Medicare, amounting to $525 annually (or $367,744,650 cumulatively across all DACA visa holders).

Overall, these contributions account for 7.65% of their annual income, or $2,772 each. Looked at another way, Dreamers contribute $1,940,170,050 annually to these taxes — which, again, they do not benefit from.

DACA Holders Spend $9.3B at Local Businesses Annually

One of the biggest criticisms of DACA holders (and immigrants, in general) is that they come to the U.S. and take away U.S. jobs while making not considerable contributions to the U.S. economy.

The perception is that Dreamers take away from the U.S. So, next we looked at how much DACA holders are contributing to the U.S. economy.

For this analysis, we looked at how Dreamers contribute to their local economies. We are defining local businesses as non-online shopping (restaurants, supermarkets, etc. – as opposed to Amazon or other online businesses) that operates within the United States.

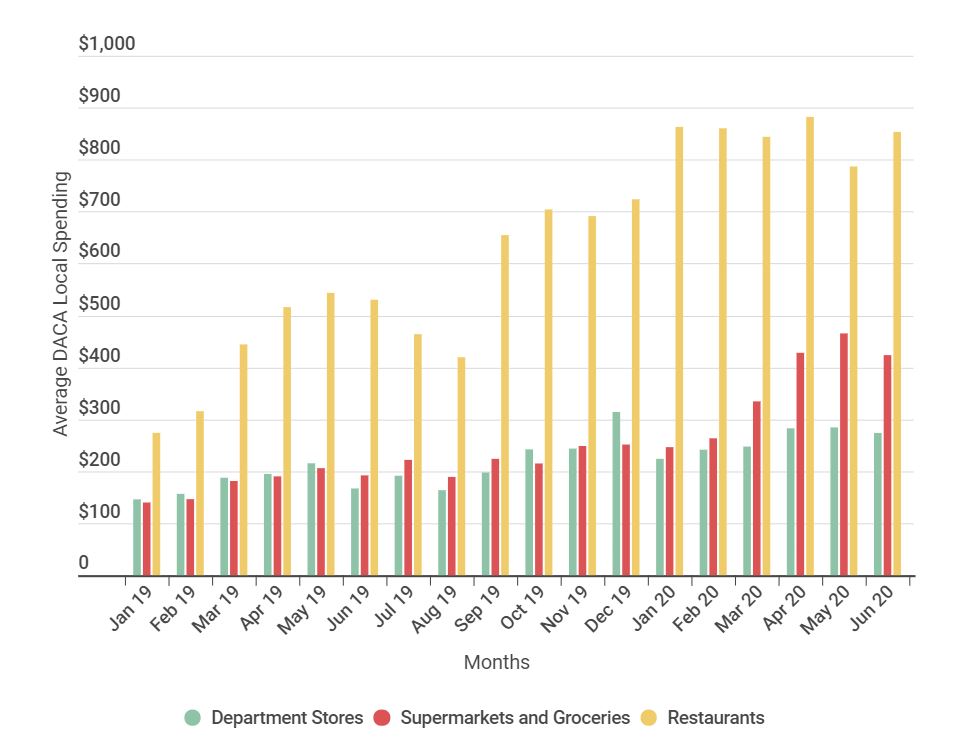

We found that individual DACA holders in the U.S. spend, on average, the following amounts every month on different segments of their local economy:

- $632 on restaurant purchases (or $7,581 annually)

- $221 on department store purchases (or $2,649 annually)

- $254 on supermarkets and groceries purchase (or $3,045 annually)

The average total local spend per Dreamer was $1,106 per month, or $13,275 per year.

Cumulative local economy spending for all DACA holders across those same for segments, however, shows the true impact of Dreamers on U.S. local economies every month:

- $442,231,000 at restaurants (or $5,306,775,000 annually)

- $154,518,000 at department stores (or $1,854,216,000 annually)

- $177,618,000 at supermarkets (or $2,131,416,000 annually)

All told, DACA holders spend $775,000,000 every month on local economies, or $9,293,000,000 every year.

Methodology

This study included transaction data from 1,600 Stilt applicants who are the DACA holders in the U.S. and applied for a loan between Jan 1st, 2019 and Jun 30th, 2020. All data was obtained from accounts Stilt borrowers connected with Stilt as part of the applications process. All transaction data for every borrower is complete for the period the study focusses on.

Final Thoughts

There’s a great deal of focus on what DACA holders supposedly take away from the U.S., but the data-backed truth is that they are contributing in the billions of dollars:

- contributing more than $6B dollars in taxes annually

- contribution nearly $2B in taxes to funds that do not benefit them

- spending $9.3B at local U.S. businesses annually

What the future has in-store for DACA after the 2020 election still remains to be seen. But for now, Dreamers will continue to contribute to the U.S. through taxes and putting cash into the economy — in spite of any misconceptions.