Draghi Clears The Way For The Fed To Cut, But Can’t Save Amazon

Powell Can Relax

The Fed must be breathing a sigh of relief tonight, with the ECB passing on cutting the deposit rate or implementing a fresh round of QE. Instead, we got a pretty dire growth outlook for Europe. So with that, we got an equity market in Europe that sold off, along with a currency and bond market that appeared confused as it began to unwind its positioning before the meeting, which was clearly setup for easing.

The chart below is that of the German DAX index; you can see the exact moment in time that the market was not happy with what it heard on rates.

The next chart is the German 10-year yield, which shows you the massive mid-day reversal. The yield went from a -42 bps to -32 bps in nearly a straight line higher. Incredible.

Just look at the havoc it created in the Euro.

S&P 500 (SPY)

More important it gives Powell the room he needs only to cut rates by 25 basis points, which is why the S&P 500 likely fell today, as whatever holds out that remained for a 50 bps cut, had to throw in the towel. The good news is that the S&P 500 managed to hold 3000 all day, and the level continues to be a healthy level of support.

Russell (IWM)

The Russell is a little bit more concerning to me. We can see a clear falling wedge, with the breakout and reversal. The problem is that we failed to rise above the June uptrend. It may very well be suggesting that the Russell’s path of least resistance is lower, and a retest of 1,540 may be on the way. We will know better tomorrow.

Facebook (FB)

I know Facebook fell today, and the company didn’t do much to help itself with the decelerating revenue comments. But the technical chart still looks bullish, and the more I look at the chart, the more comfortable I feel with that call. I went through the results in a video today and the call.

I still think the stock is heading higher to the previous ATH.

Tesla (TSLA)

Tesla fell sharply after its less than inspiring results. The company is at a point where it now needs to execute. The technical chart had some damage done, but $225 was a floor, and more critical the TSLA is holding the break out from its December downtrend. Believe it or not, I think the stock works higher and recovers the losses over the next few weeks.

Amazon (AMZN)

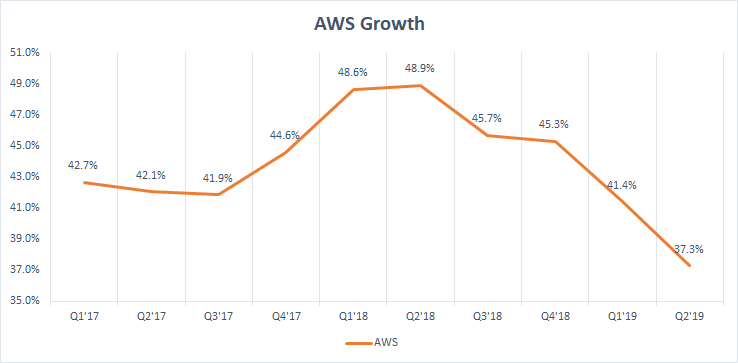

Amazon fell after reporting lower than expected earnings per share. That is what happens when AWS is responsible for delivering nearly all of your operating income, and then growth slows. AWS growth fell below 40% for the first time, to 37.3%.

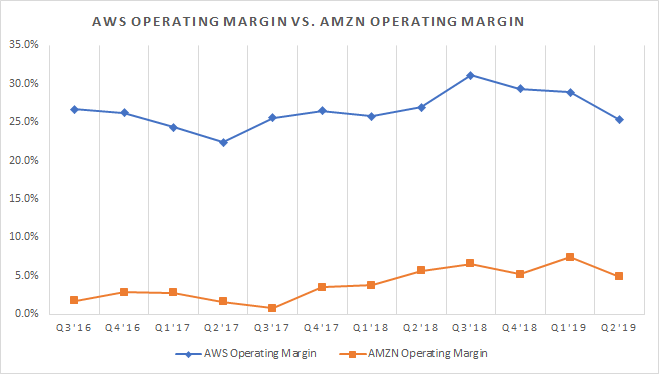

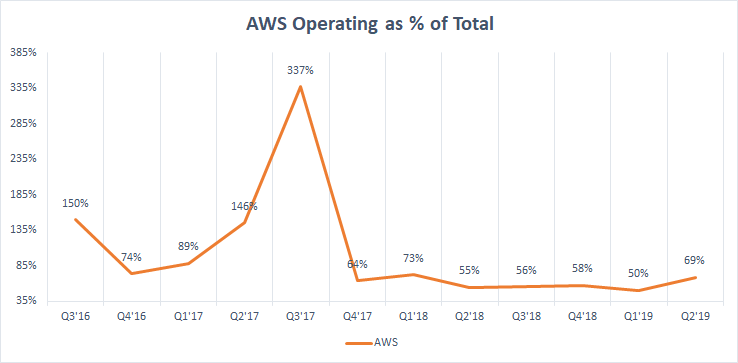

AMZN had a total operating income of $3.084 billion, and AWS represents 69% of that. Operating margin for AWS fell to 25.3% from 28.9% last quarter. The next chart shows you the tale of slower AWS revenue growth and higher cost. Lower margins.

Unfortunately, in this quarter, the lower AWS margins hurt the overall operating income. It seems that AMZN needed AWS to be much stronger this quarter because, despite the weaker margins, AWS operating income represented nearly 70% of Amazon’s total operating income. Without AWS, Amazon’s profits quickly disappear.

The big question is whether AMZN is now in a making profit mode or a spending mode. If it is in a spending mode, earnings estimates may be too high. We’ll see.

The descending triangle broke, and I still think we head below $1900, to probably around 1825 to $1850. I guess those options traders got it right.

Alphabet (GOOGL)

After lasts quarters mess, Alphabet had no choice but to show investors it could make money. They did. Operating margins improved to 24% from 18% last quarter. The stock is trading up at $1,225, rising about $90. I wouldn’t be surprised to see this stock at a new all-time high in the not to distance future.

Intel (INTC)

Intel is rising after reporting better than expected results and upping its full-year guidance. The stock is working on filling the gap up to $57.20, as we expected.

Back in the morning, if I don’t oversleep! Have a great night!

Disclosure: Michael Kramer and the clients of Mott Capital own GOOGL and TSLA

Disclaimer: This article is my opinion and expresses my views. Those views can change at a moment's notice ...

more