DR Horton Offers Value, Momentum, And Growth

A) Introduction

DR Horton (NYSE:DHI) is the biggest builder of homes in the United States, servicing the entire spectrum of customers from affordable housing through their Express Homes segment to high-end homes through their Emerald homes segment. The company released earnings on Monday, and smashed analyst estimates on both the top-line ($2.253B vs. $2.111B estimate) and bottom-line ($0.39 EPS vs. $0.35 estimate). The company saw its stock price rise accordingly, gaining 5.5% on big volume. The stock gave up most of those gains on Tuesday, after Citi downgraded their stock from a Buy to Neutral, though the stock recovered to finish down less than a percent. In this article we'll outline why DHI offers good value as well as price momentum, EPS growth, and return on equity. These metrics are the ingredients to outperformance and DHI's statistical profile makes it prime candidate for outperformance in 2015.

The report will start with a breakdown of DHI's valuation profile, followed by an analysis of the price and profit growth, and concluding with some qualitative analysis and conclusions. We take a quantitative approach to investing, preferring to focus our analysis on metrics that have strong predictive ability. Thus, we tend to analyze academic papers and perform historical back tests on different metrics before including them in our analysis. We will provide links to the academic papers we draw inspiration from as we progress through our breakdown of the stock so investors can see for themselves what we base our conclusions on.

B) Valuation Breakdown

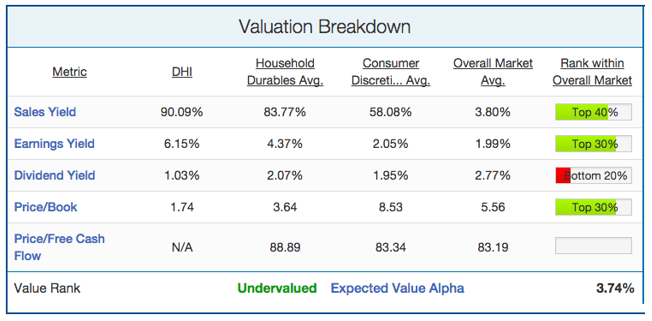

We'll start by analyzing DHI's value profile. This is important to look at as Nobel laureate Eugene Fame found that "Value stocks (with low ratios of price to book value) have higher average returns than growth stocks (high price-to-book ratios)". DHI's valuation profile is shown below:

As you can see in the table above, DHI has very favourable value metrics relative to its industry group, sector, and overall market. On a revenue basis, DHI's sales yield of 90% is higher than each of its industry group (84%), sector (58%), and overall market (4%) averages. It bears mentioning that both its industry group and sector look very attractive relative to the overall market. Consumer discretionary has been one of the weakest sectors in the current bull market, and may represent one of the last avenues of value left in the market. This observation holds on an earnings basis, with DHI's earnings yield of 6.2% being higher than it's industry group (4.4%) and sector (2.1%) averages. The stock looks relatively cheap with a price/book of 1.74 especially when the overall market is commanding a +5 price/book. Overall, we rate DR Horton as "Undervalued" and expect the stock to outperform the market by 3.74% because of this undervaluation.

C) Growth Profile

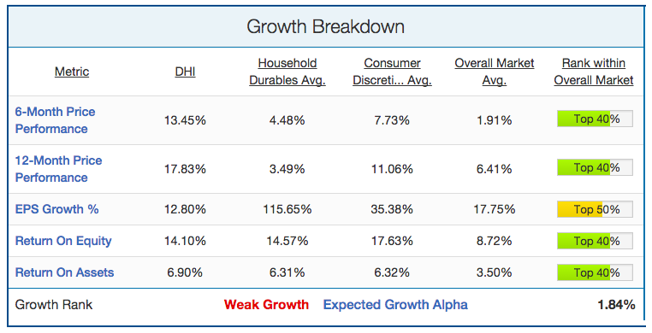

There are a variety of different growth metrics that have been shown to predict stock returns. Most important among them is price momentum. Winning stocks keep winning, and losing stocks tend to keep losing. DHI's growth profile is shown below:

DHI started 2014 off relatively slowly, but had a big second half of the year (gaining 13.5% over the last 6 months). This mirrors the rally in the overall consumer discretionary sector, which gained 7.7% over that same time frame on average versus 1.9% for the entire market average. DHI outperformed the market over the last twelve months, gaining 18% versus 3.5% for its industry group, 11% for the consumer discretionary sector, and 6.4% for the overall market average. On a EPS growth basis, DHI falls within the top half of the entire market (barely) with annual EPS growing 13%. The stock's ROE (14%) and ROA (7%) are both solid, and mirror the averages for its industry group (15% & 6%). We rate DHI as a growing, albeit weakly, company. We expect the company to generate a modest 1.84% of outperformance over the market due to its moderately favourable growth metrics.

D) Qualitative Analysis & Conclusion

We'll now supplement our quantitative analysis with a qualitative discussion of some of the major growth catalysts and risk factors that could impact the stock price in the near future. Through reading the earnings call transcript from Monday's earnings release, analysts were very worried about the impact of falling oil prices on DHI's revenues. This makes sense as a significant portion of DHI's revenue comes from Texas, which has been hurt badly by the collapse in crude prices the last few months. Surprisingly, management hasn't seen a slowdown from Texas house spending. In fact, management believed the decrease in oil prices was beneficial as the savings from lower gas prices was leading to increased demand for housing. Another potential worry is the potential for squeezed margins as revenue comes increasingly from DHI's express homes segment, which has lower margins as a results of selling to customers on the lower end of the spectrum (affordable housing). While this is a cause for concern as the express markets business now accounts for half of new orders, management noted that margins had been much better than expected and were also expected to improve in the future. Thus, the roll out of Express Homes into markets offers even more potential than previously expected.

Overall, we feel DR Horton offers good value along with solid price momentum, EPS growth, and strong rates of return on equity. The company seems poised to capture new demand as the US consumer increasingly gains confidence and benefits from the huge inherent stimulus of lower gas prices. We rate DR Horton as a 'BUY', and expect the stock to see moderate outperformance in 2015. Investors looking to learn more about our analytical style can do so here.

Disclosure: The author has no positions in any stocks mentioned, but may initiate a long position in DHI over the next 72 hours. The author wrote this article themselves, and it expresses their ...

more