Dow Jones, Nasdaq 100, S&P 500 Forecasts For The Week Ahead, Sunday, July 25

Dow Jones, Nasdaq 100, S&P 500 Forecasts For The Week Ahead

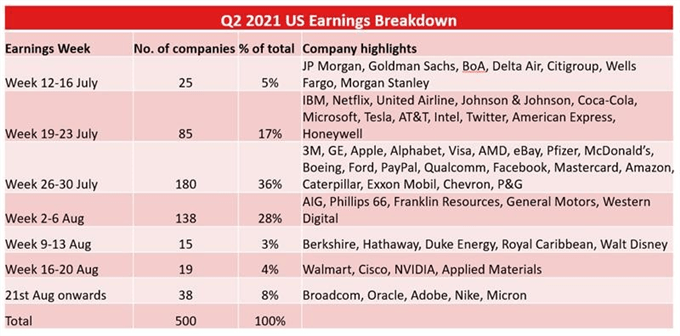

The US indices stand on the threshold of an action-packed week that could stoke volatility as we approach August. Earnings from some of the largest publicly traded companies will filter out as the week progresses while the July FOMC rate decision and US GDP data are set to be released Wednesday and Thursday respectively.

Suffice it to say, traders and investors will have their hands full as they attempt to digest a feast of new information on both the microeconomic and macroeconomic levels. With so much at stake, the filled docket may give rise to indecisive price action early in the week as traders avoid taking significant exposure ahead of the Fed rate decision.

While no change to the interest rate range is expected, the pace of the Fed’s tapering will remain a highly watched story as a surprise in either direction – hawkish or dovish – could disrupt investor’s expectations of the current monetary policy path. Despite delta variant concerns and the Fed’s shift in language regarding tapering at the last rate decision, US indices trade well within reach of record levels and a dovish lean could propel stocks even higher.

Source: Margaret Yang, Bloomberg, DailyFX

Either way, monetary policy updates will be joined by earnings from the country’s largest technology stocks including Apple, Amazon, Facebook, Google and Microsoft. Altogether, nearly 40% of S&P 500 components are set to report in the week ahead and strong results may be required to justify such hearty valuations for many of the leading names.

A Look At Earnings Season Expectations By Ryan Grace From Tastytrade

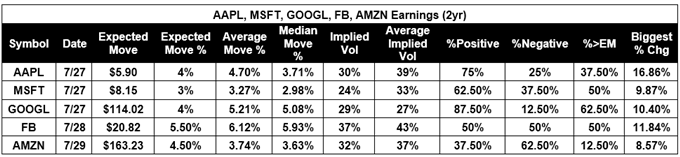

As we look to the options market to get a sense of how stock prices might react following earnings from Apple, Microsoft, Google, Facebook (FB), and Amazon (AMZN) next week, there are a few interesting takeaways.

Starting with market expectations -as a function of option prices - the market is looking for a one day move between 3-5.5% following each company’s respective earnings release. This generally aligns with how these names have reacted following earnings, on average, over the past eight quarters. With the exception of Amazon, the market is pricing in the potential for lower realized volatility around earnings, which likely reflects a lower market (SPX) implied volatility (VIX = 17%) relative to this time last year (VIX = 26%).

Source: Ryan Grace, Tastyworks

The perception of less uncertainty and possibly lower volatility as we emerge from the COVID-19 market regime can also be seen when comparing current implied volatilities to their average levels ahead of earnings over the prior eight quarters. Google (GOOGL) is the only stock with a slightly elevated implied volatility ahead of earnings, compared to its two-year average.

Though options traders might be anticipating less volatility this time around, when we analyze the past two years of earnings announcements, there certainly is the potential for an outsized reaction. Across the board, these stocks have experienced moves of 2-3 times greater than what’s currently being priced in the options market. Apple (AAPL) traded +16.86% higher following Q3 2020 earnings, for example.

Finally, with the Nasdaq at record highs, it’s possible Q2 earnings could be a fundamental catalyst that pushes prices even higher. That being said, over the past two years, Amazon has traded in negative territory 62.5% of the time, one day after earnings, while the market has shown a statistical tendency to react positively to results from Apple, Microsoft (MSFT), and Google.

Regardless, the market seems poised for an eventful week with catalysts coming in all shapes and sizes.

Disclaimer: See the full disclosure for DailyFX here.