Dollar Stuck In The Middle; And China Jumps Into Hong Kong (CNH)

Dollar continues to trade in the middle of the pack today. It seems stuck between JPY and EUR on one end; and commodity currencies and GBP on the other…

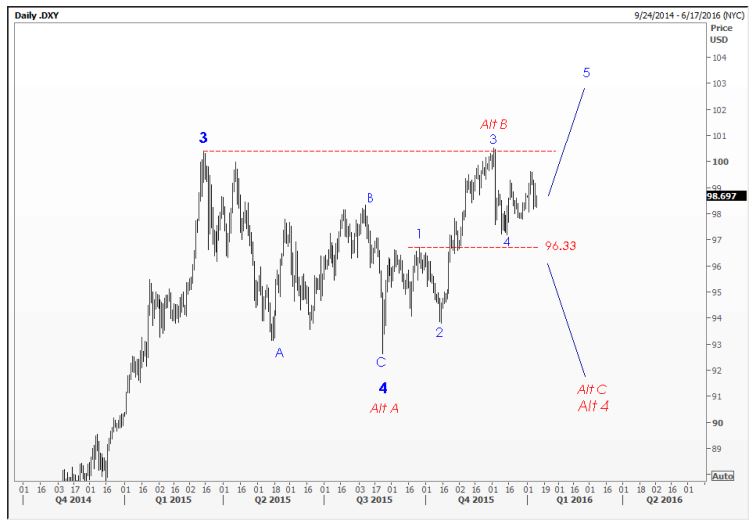

US Dollar Index still in a range…a deeper correction or a thrust higher in Wave 5? Poor relative price action in the buck despite a very good jobs number on Friday can’t excite the bulls.

On the recent risk off days, JPY and EUR have acted well, while the others (AUD, CAD, & GBP) have been hit against the dollar; today we have the opposite, i.e. with US stocks stable this morning, commodity currencies and pound higher, but yen and euro are lower. It is an interesting pattern and will have more on this later—some rationales in the Part II of the 2016 Outlook.

The bound in commodity currencies this morning comes on the heels of more trouble for China—its stock market was down 5.3% and the People’s Bank of China (PBoC) intervened heavily into the Hong Kong market (primary facility for CNH trading) to support what is known as the “offshore” market for its currency—symbol is CNH instead of CNY (onshore market). CNH is less prone to Chinese government control and has been trading more cheaply than CNY, on anticipated further weakness in CNY; i.e. CNH is seen as a better measure of market forces, whereas CNY is still quite controlled by Beijing. The game being played with CNH is the carry trade, i.e. borrowing CNH, selling it, and using the proceeds otherwise as needed.

To thwart this, the PBoC stepped in and bought a lot of CNH, and effectively push short-term borrowing rates in Hong Kong sharply higher—note Hong Kong stocks took a hit for this, falling 2.8%; liquidity leaving markets does that (something we are seeing shaping up on a global scale; which was the key point of the analysis in Part I 2016 Outlook).

CNY (onshore) versus CNH (offshore) Weekly:

Here is a look at the money market interest rate spike in Hong Kong as a result of China’s actions to support it currency:

One of the reasons the PBoC was able to do so much is because, according to the Financial Times, Hong Kong renmimbi depostis are $130 billion; Chinese fx reserves are around $3.3 trillion. Thus, the pressure on those short sellers of CNH is intense, many have closed positions. Onshore CNY is stronger this morning against the US dollar—the intended consequence. But despite the outcome, it does hint of a whiff of desperation on the part of PBoC. It suggests China is very concerned about hot money leaving the country, in the face of falling growth in foreign direct investment (FDI) given the decling growth propsects and transition of the economy, i.e. relatively less capital investment.

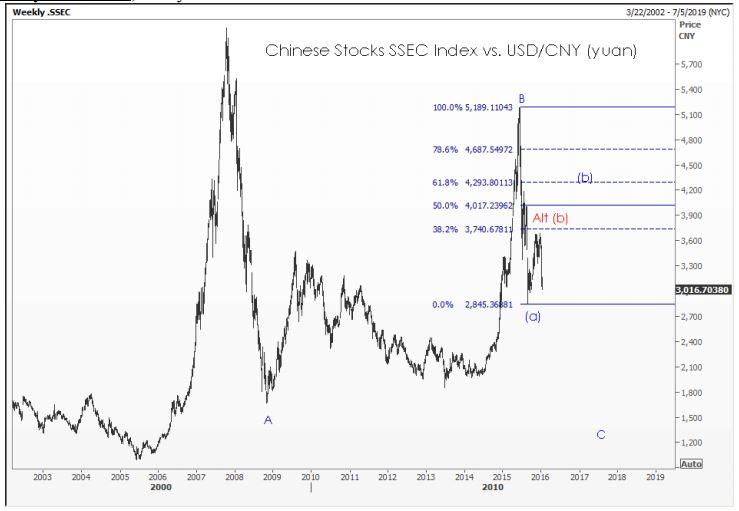

Despite my primary view that a fall in China’s stock market doesn’t necessarily lead to crisis, there is plenty of scope for stocks to tumble—and of course the knock-on impact of these global flows (hot money and foreign direct investment) out of China shouldn’t be minimized. It is especially dangerous for emering markets given their past contagion prowess.

Chinese Stocks (SSEC Index) Weekly: Key support at wave (a) 2,485—the swing low. But still scope for a bounce higher…another leg up to form a more complex wave (b) pattern before the big break. A rally higher in wave (b), back toward 61.8% retrace at 4,293 on the SSEC Index would definitely wrong-foot a lot of traders, as they say. And likely this would lead to a sharp rally in commodity currencies; likely the last before their final break lower.

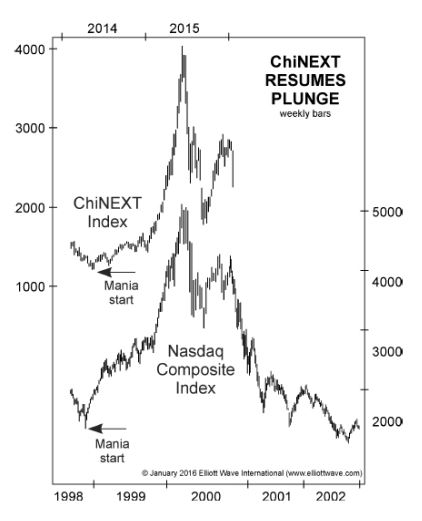

(See the next page an interesting chart from Elliott Wave International comparing the pattern in China stocks to the Nasdaq during the period of its bust in 2000).

ChiNext Index versus Nasdaq Composite Patterns….

Futures, Forex and Option trading involves substantial risk, and may not be suitable for everyone. Trading should only be done with true risk capital. Past performance, either actual or hypothetical, ...

more