Dollar Shrugs Off Soft CPI – Could We See The Buck Bounce?

When it comes to Federal Reserve policy, the big sticking point has been inflation, which has remained stubbornly subdued despite low unemployment and decent economic growth. Accordingly, today’s US CPI report was closely eyed by both policymakers and traders.

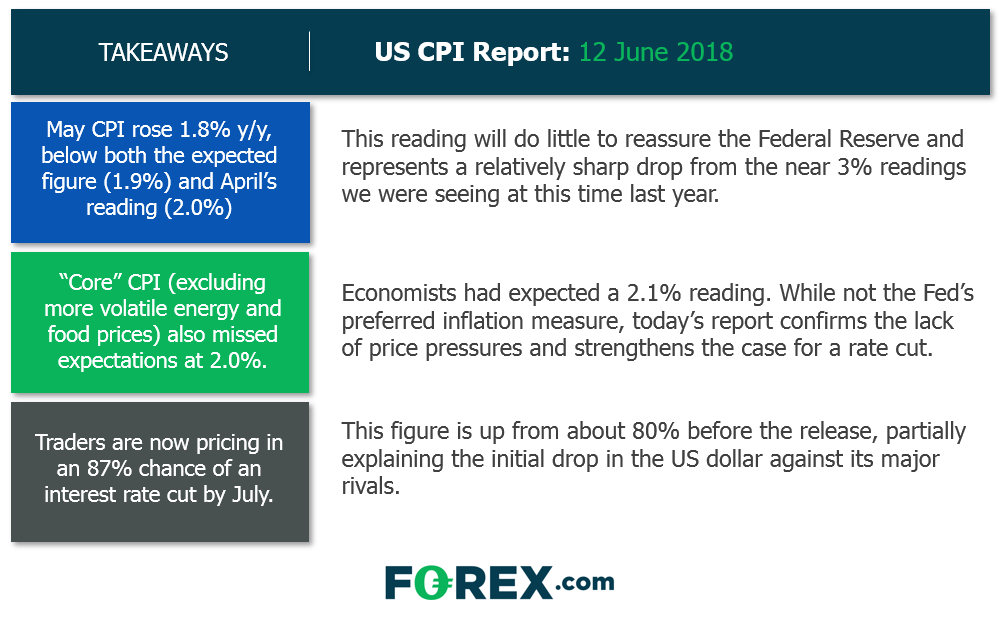

As my colleague Fawad Razaqzada noted earlier today, analysts were expecting May US CPI to ease to 1.9% y/y (from 2.0% previously), with core CPI anticipated to remain unchanged at 2.1%. The just released figures came in a tick below these expectations, with headline CPI rising at a 1.8% rate and core CPI printing at 2.0%.

Source: Forex.com

It’s premature to say that today’s inflation report cements the case for a Fed rate cut by July (at the latest), but it certainly solidifies it. Fed funds futures traders agree, with the market-implied odds of a rate cut by July rising to 87% from 80% before the release.

After an initial dip, the US dollar has recovered to trade essentially unchanged against most of its major rivals. With a rate cut in the next six weeks almost fully discounted (and the market looking for up to three rate cuts this year), the buck could see a bit of a relief rally on any positive economic surprises in the coming days. Friday’s Retail Sales report will be the next major US economic release, with economists expecting a bounce back to +0.7% m/m growth after last month’s disappointing -0.2% reading.