Dollar Index Price Set Rise Beyond 93.00, Awaiting Market’s Data Reaction

The Dollar Index price is trading in green at 92.93 level. It could jump towards fresh new highs if the US data comes in better than expected later. Moreover, DXY’s growth signals that the USD appreciates versus its rivals. So, a further bullish fly could really announce that the Greenback could dominate the currency market.

Image Source: Pixabay

DXY dropped after the ECB and the US unemployment claims indicator increased unexpectedly from 368K to 419K in the previous week. However, the drop was only temporary caused by these weak fundamental factors.

The index maintains a bullish bias. However, it remains to see how it will react later today after the Flash Manufacturing PMI and the Flash Services PMI publication. The Flash Services PMI is expected to remain steady at 64.6 points, while the Flash Manufacturing PMI could drop to 62.0 from 62.1 points.

Fundamentally, better than expected data could help the Dollar Index to resume its growth. This scenario could help the dollar to appreciate versus the other major currencies.

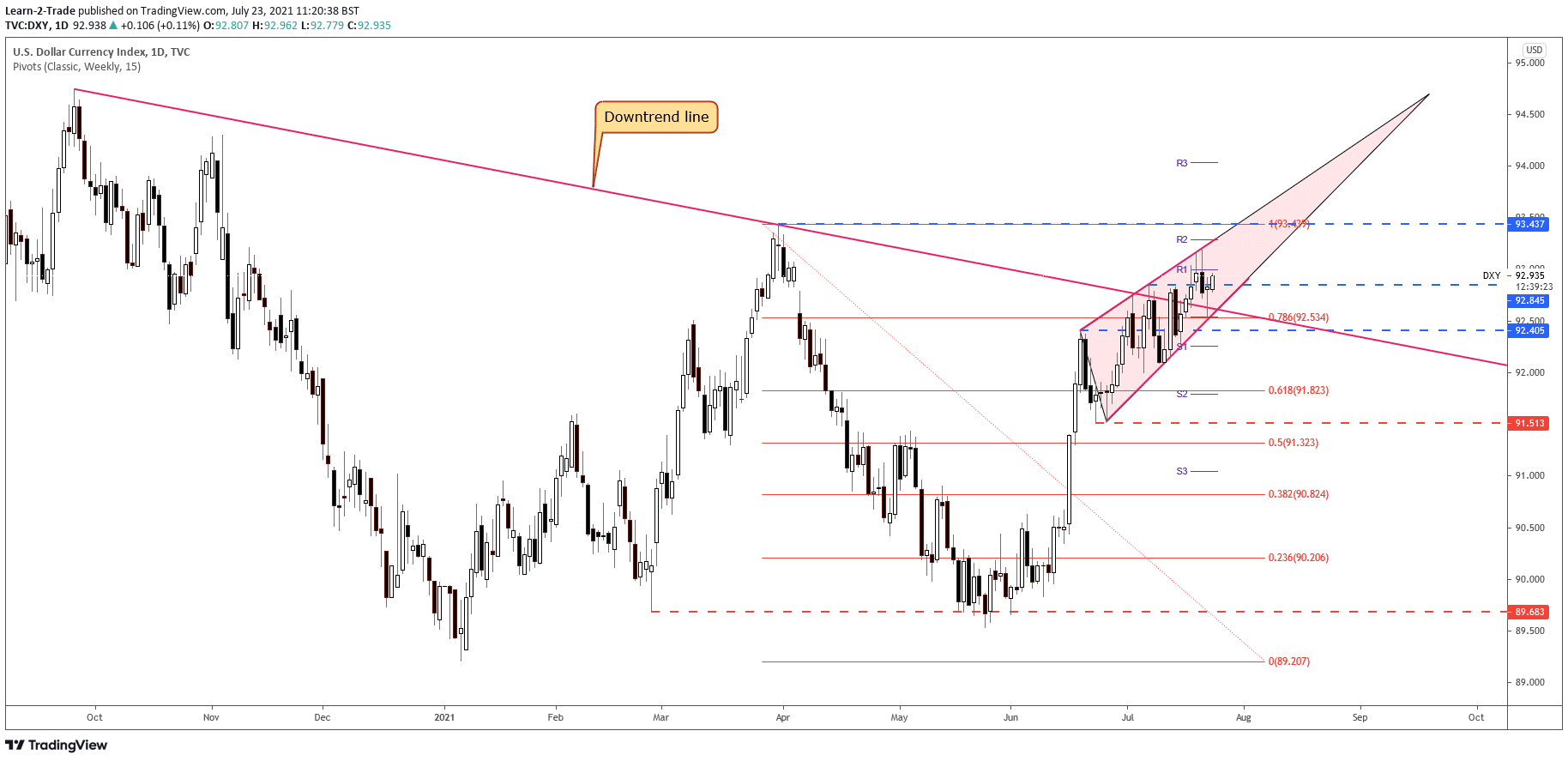

Dollar Index price technical analysis: downtrend breakout

(Click on image to enlarge)

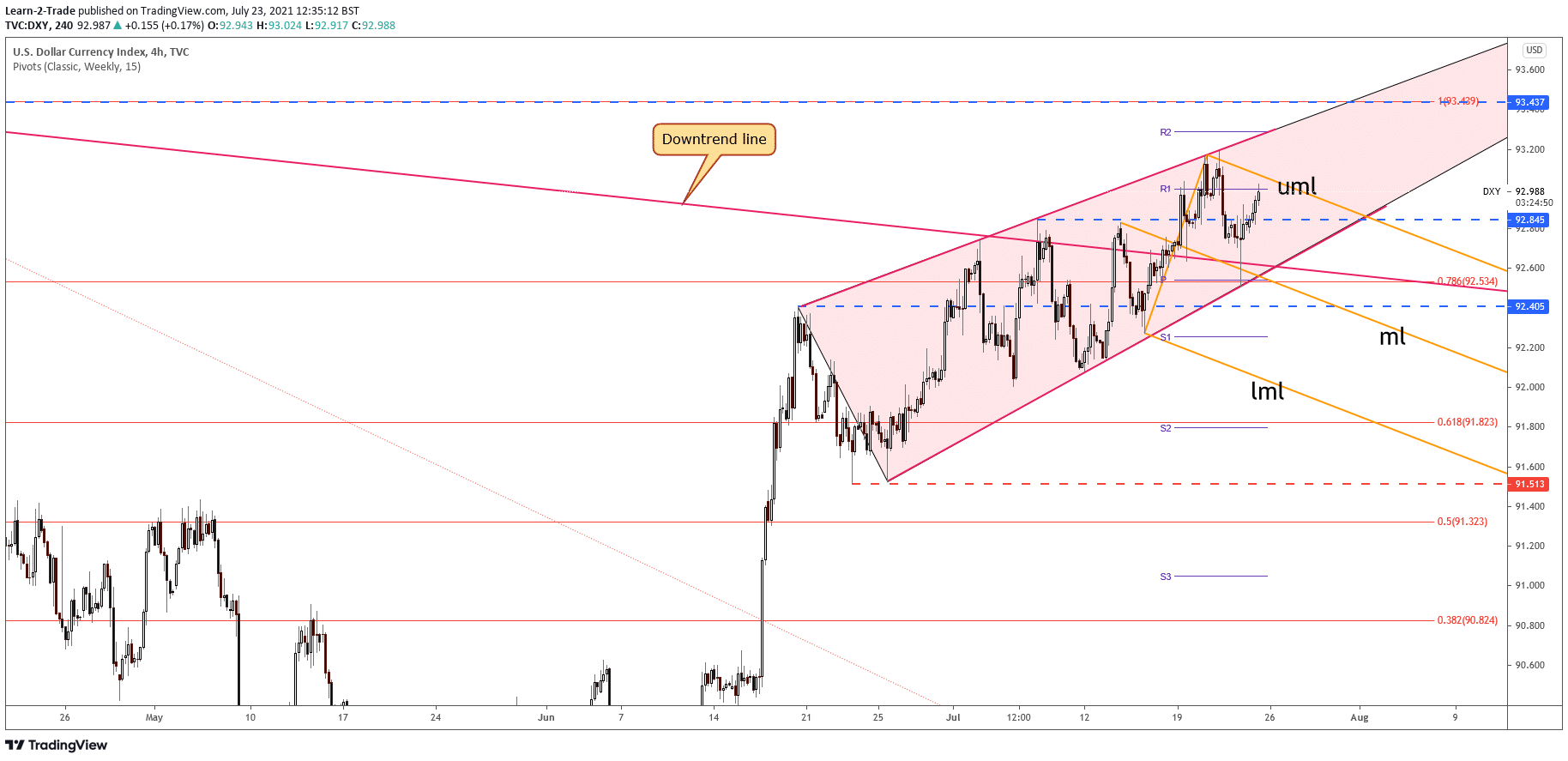

Dollar Index price on 4-hour chart

As you can see on the Daily chart, DXY has managed to break above the down trendline signaling further rise. Yesterday’s false breakdown below the broken down trendline signaled that it could resume its uptrend.

Actually, the pin bar shows that the breakout was validated. Still, we have to wait for DXY to make a new higher high to really confirm the upside continuation. However, the outlook is bullish as long as the index stays above the uptrend line, Rising Wedge’s support.

Dollar Index rising wedge invalidation

(Click on image to enlarge)

Dollar Index price rising wedge

DXY dropped as much as 92.50 yesterday, but it has closed higher at 92.74 developing a pin bar. Its false breakdown through the immediate downside obstacles indicates an upside breakout from the descending pitchfork’s body.

In the short term, we cannot exclude a temporary sideways movement before DXY resumes its upwards movement. The Dollar Index is still trapped within the Rising Wedge pattern. The reversal pattern is far from being confirmed. Escaping from the descending pitchfork’s body could lead to an upside breakout from this pattern and above 93.43.

Disclaimer: Foreign exchange (Forex) trading carries a high level of risk and may not be suitable for all investors. The risk grows as the leverage is higher. Investment objectives, risk ...

more