Does A “Blue Wave” = Higher Rates?

The question of the week in bond-land is, “what will the impact of the ‘blue wave’ be?” In our Market Insights: Planning for Potential 2020 Election Results, WisdomTree offered a variety of scenarios for investors to consider. One such outcome was a Democrat sweep, or “blue wave,” whereby the presidency and both houses of Congress would be controlled by the Democrat Party. Last week in the U.S. Treasury (UST) market, this possibility began to filter into the conversation—if not the outright pricing mechanism—to a certain degree.

In our aforementioned election piece, we outlined two possible outcomes from a “blue wave.” Interestingly, they are somewhat polar opposites. In one scenario, a potential higher tax increased regulatory environment, and less “business-friendly” setting could result in slower economic growth. However, in scenario #2, the removal of gridlock, increased government spending, and other additional fiscal stimuli would serve to boost economic growth potential.

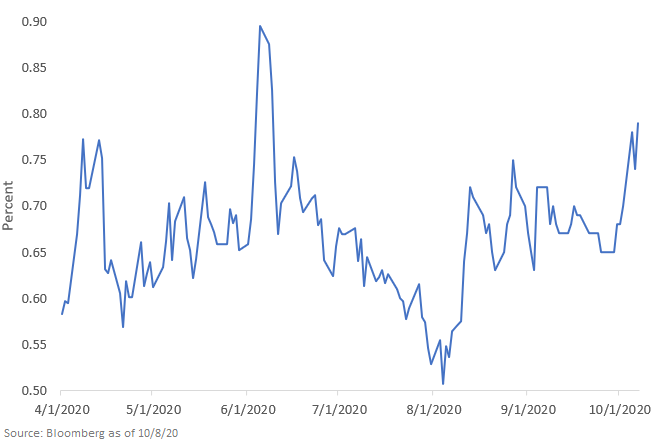

U.S. 10-Year Treasury Yield

We’ll let the reader decide which of these two scenarios they agree with, but the one common thread among them is that “deficit discipline” will go completely out the window. In other words, it seems likely trillion-dollar deficits for the U.S. will become the norm.

So how does the UST market view this? Based upon price action last week, combined with attendant market commentary, it appeared as if investors were coming down on the side of our scenario #2: Increased government spending will lead to higher growth. Put simply: higher government outlays/GDP + rising budget deficits = higher UST 10-year yields. As of this writing, the yield was just shy of 0.80%, and as you can see from the above graph, this level has not been penetrated since June.

Oh, and do you know what else would be a common thread no matter what the election outcomes are? Continued easy monetary policy from the Federal Reserve (Fed). Nevertheless, the important point is that even if the Fed doesn’t consider raising rates until 2023, UST 10-year yields can still rise.

Fixed Income Solution

If the UST market does embrace our second scenario, investors should consider a rate hedge within their fixed income portfolio that could also potentially take advantage of a narrowing in credit spreads, such as the WisdomTree Interest Rate Hedged High Yield Bond Fund (HYZD). This strategy offers investors the following key attributes:

- A quality screen for high yield (includes only public issuers and those with positive cash flow)

- The opportunity for enhanced yield in a historically low rate setting

- A “zero-duration rate hedge” strategy to potentially mitigate the risks of higher yields

Unless otherwise stated, all data sourced is Bloomberg, as of October 9, 2020.

Disclaimer: Investors should carefully consider the investment objectives, risks, charges and expenses of the Funds before investing. U.S. investors only: To obtain a prospectus containing this ...

more