Dividends By The Numbers For September 2018 And 2018-Q3

September is typically the worst month of the year for tracking positive changes for dividends in the U.S. stock market. While the month of June can provide it with real competition, in most years, September ranks the lowest for the number of announced dividend increases.

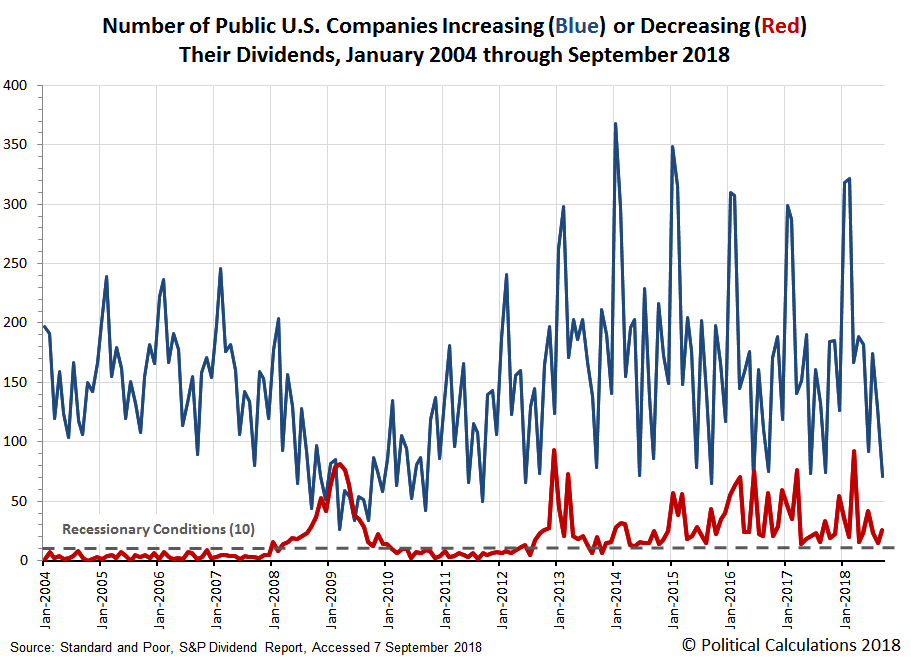

Having now set the stage for what you're about to see, the following chart illustrates the number of dividend increases and decreases that have been declared in each month from January 2004 through September 2018.

Let's run through the dividend numbers for both September 2018 and 2018-Q3 to see how it compares to the previous month, the same month in the previous year, and the same quarter in the previous year....

- 3,623 firms issued some kind of announcement about their dividend policies in September 2018, which is up month-over-month by 71 from the 3,552 that declared dividends in August 2018, and also up year-over-year by 90 from the 3,533 that declared dividends in September 2017. For 2018-Q3, there were a total of 10,428 dividend declarations, which was up 404 from 2017-Q3's total of 10,024.

- September 2018 saw 24 U.S. firms announce that they would pay a special (or extra) dividend to their shareholders. This total is down by 7 from the 31 that paid special dividends in August 2018, but up by 7 from the 17 that were recorded in September 2017. While 2017-Q3 saw the announcement of 67 extra dividend payments, 2018-Q3 saw 77, an increase of 10 in the quarter-over-quarter measure.

- Just 71 companies that announced they would increase their dividends in September 2018, which is down by 57 from the 128 that were recorded in August 2018, and also down by 3 from the 74 recorded in September 2017. Meanwhile, 2018-Q3 had 373 dividend increases, which is greater than the 367 dividend rises recorded back in 2017-Q3.

- Standard and Poor noted a total of 26 dividend cut announcements in September 2018, up 11 from the 15 documented in August 2018, but down by 7 from the 33 recorded by S&P for September 2017. For 2018-Q3, the total number of dividend cuts was 64, which is 8 less than 2017-Q3's total of 72.

- Finally, only 1 firm declared that they would omit paying dividends during the month, down by one from August 2018's total of 2, but up by one from September 2017's null entry. For 2018-Q3, the total number of firms omitting dividend payments was 3, where 2017-Q3 had seen 21 firms skip making dividend payments to their shareholders during the quarter.

With the end of the third quarter of 2018, we suspect that Standard and Poor's report on September 2018's dividend cuts is double-counting a number of previously announced dividend cuts, because the reported figure of 26 cuts is much higher than the number of ordinary dividend cuts that we identified from our near real-time sources of dividend declarations, similar to what we observed for June 2018. We reached out to S&P's Howard Silverblatt, who provided a listing of recently recorded dividend cuts, which appears to confirm that is the case.

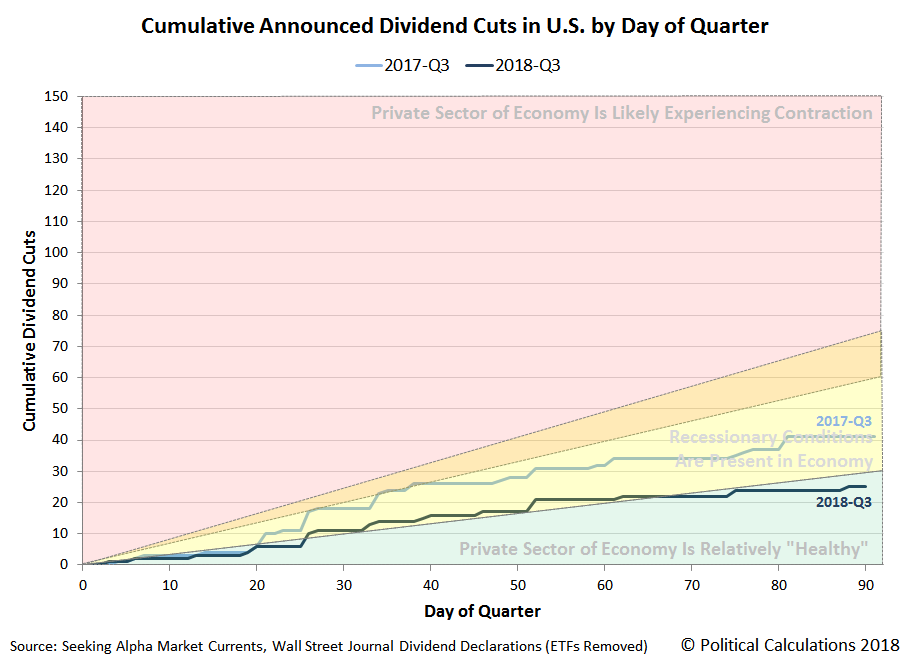

The following chart reveals that our sampled number of dividend cuts in 2018-Q3 is both much lower than what we sampled in the year-ago quarter of 2017-Q3 and also that for the first time in a very long time, the number of dividend cuts recorded among our sampling fell into the range that indicates the U.S. economy is not experiencing recessionary conditions.

Here's the full listing of all 25 dividend cuts for ordinary U.S. stocks that we were able to independently verify through sampling our two main sources of dividend declarations during 2018-Q3. Only three of these dividend reductions were recorded during September 2018.

- Horizon (NASDAQ: HBNC)

- Sabine Royalty Trust (NYSE: SBR)

- Mesabi Trust (NYSE: MSB)

- Mesa Royalty Trust (NYSE: MTR)

- Enduro Royalty Trust (NYSE: NDRO)

- Blueknight Energy Partners (NASDAQ: BKEP)

- SandRidge Mississippian Trust I (NYSE: SDT)

- SandRidge Mississippian Trust II (NYSE: SDR)

- Alliance Bernstein (NYSE: AB)

- Oaktree Capital Group (NYSE: OAK)

- American Midstream Partners (NYSE: AMID)

- Carlyle Group (NYSE: CG)

- R.R. Donnelley & Sons (NYSE: RRD)

- Sabine Royalty Trust (NYSE: SBR)

- Farmland Partners (NYSE: FPI)

- New Senior Investment (NYSE: SNR)

- Orchid Island Capital (NYSE: ORC)

- Marine Petroleum Trust (NASDAQ: MARPS)

- Permian Basin Royalty Trust (NYSE: PBT)

- PermRock Royalty Trust (NYSE: PRT)

- Cross Timbers Royalty Trust (NYSE: CRT)

- Spirit Realty Capital (NYSE: SRC)

- Capstead Mortgage (NYSE: CMO)

- DDR Corp. (NYSE: DDR)

- Pacific Coast Oil Trust (NYSE: ROYT)

Compared to last month, we've shortened the list by one firm because we were able to confirm that a reduced dividend announced for Pentair (NYSE: PNR) was not a true dividend cut. Here, the company's spinoff of its electrical division into a separate entity, nVent Electric (NYSE: NVT), which also pays a dividend, was picked up as a dividend cut by the automated systems that generate the reports we track in real-time. The combined value of both companies' dividend payouts however appears to align with what Pentair paid its shareholders prior to the spinoff, where Pentair shareholders who now also own shares of nVent Electric as a result of the spinoff appear to have not seen a reduction in their quarterly dividend income.

Meanwhile, the duplicated appearance of Sabine Royalty Trust (NYSE: SBR) is not an accident. The oil royalty trust pays out dividends as a fixed percentage of its variable earnings on a monthly basis, where it reduced its payment in both of the two consecutive months of July and August 2018. That it didn't make the list a third time suggests that it very likely boosted its monthly dividend payout in September 2018.

That more serious situation arises when these companies engage in share buybacks, which also work to disguise dividend cuts. In this case, they are reducing their total aggregate dividend payouts to their shareholding owners, even though they are not reducing their dividends per share, which helps preserve their share prices. While there may sometimes be some tax avoidance strategy behind this kind of move that can benefit shareholders, more often than not, this kind of strategy is employed to preserve cash at a firm that is running into growth problems.

To tell which scenario applies, check the trend for the company's total cash flow - if it's growing, then the steady dividend policy combined with share buybacks are likely a tax-based move that benefits at least some shareholders without necessarily harming the interests of others. If its cash flow isn't growing, then start looking for problems with the company's business or its future growth prospects, because there will almost certainly be trouble brewing.

Data Sources

Standard and Poor. S&P Market Attributes Web File. [Excel Spreadsheet]. Accessed 1 October 2018.

Seeking Alpha Market Currents. Filtered for Dividends. [Online Database]. Accessed 28 September 2018.

Wall Street Journal. Dividend Declarations. [Online Database]. Accessed 28 September 2018.

Disclaimer: Materials that are published by Political Calculations can provide visitors with free information and insights regarding the incentives created by the laws and policies described. ...

more