Dividend Payers Return Lags The Return Of The Non Dividend Payers

S&P Dow Jones Indices recently reported the return for the dividend payers and non-dividend payers in the S&P 500 Index for the period ending June 28, 2019. Given the underperformance of the value style over the past several years then it is not surprising the dividend payers are underperforming the non-payers on an average return basis year to date and over the trailing twelve months. The dividend-paying stocks tend to be more defensive and have a value tilt.

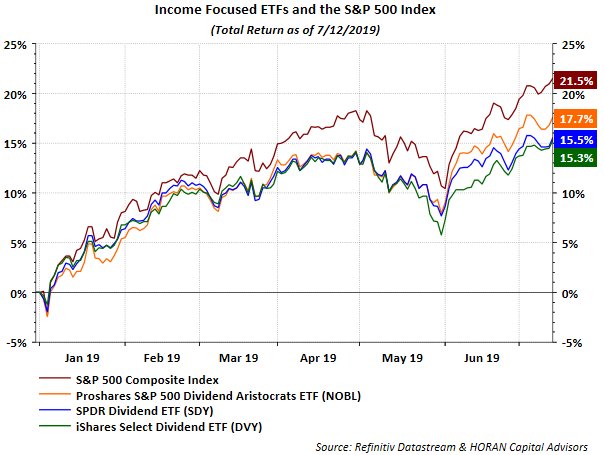

Further evidence of the underperformance of dividend-paying stocks is can be seen when comparing the performance of several dividend-focused ETFs to the S&P 500 Index. Below is a chart that includes the S&P 500 Composite along with the Proshares S&P 500 Dividend Aristocrats ETF (NOBL), SPDR Dividend ETF (SDY) and iShares Select Dividend ETF (DVY).

Although the dividend payer underperformance is fairly significant, historically, in a market pullback dividend-paying stocks have a tendency to hold up better than the broader market. As a result, incorporating dividend payers in one's portfolio might provide some downside cushion in a market pullback.