Dividend Aristocrats In Focus: Linde Plc

The Dividend Aristocrats are among the highest-quality dividend growth stocks in the entire stock market. For this reason, we individually review every Dividend Aristocrat each year.

The 2019 series concludes with Linde plc (LIN), which qualifies on the list as a result of its acquisition of Praxair, a former Dividend Aristocrat.

Linde is an industry leader with a highly profitable business and a solid 2.1% dividend yield. The Praxair acquisition should be a meaningful growth catalyst for many years to come. As a result, we view Linde favorably as a dividend growth stock.

Business Overview

Linde plc, which was created through the merger of Linde AG and Praxair, is the world’s largest industrial gas corporation. Linde AG is headquartered in Munich, Germany. The company produces, sells, and distributes atmospheric, process, and specialty gases, along with high-performance surface coatings.

Linde is a global supplier of industrial, process, and specialty gases. Linde products and services can be found in nearly every industry, in more than 100 countries around the world. Last year, Linde generated sales of approximately $19 billion.

The company operates in two core divisions: Industrial Gases & Healthcare; and Engineering.

Linde gases are used in a variety of industries, including energy, steel production, chemical processing, environmental protection, food processing, electronics, and more. The company also has a healthcare business consisting of medical gases and services.

Linde’s Engineering division focuses on market segments such as olefin, natural gas, air separation, hydrogen, and synthesis gas plants. It is involved in the planning, project development, and construction of industrial plants.

Linde has performed well in recent periods.

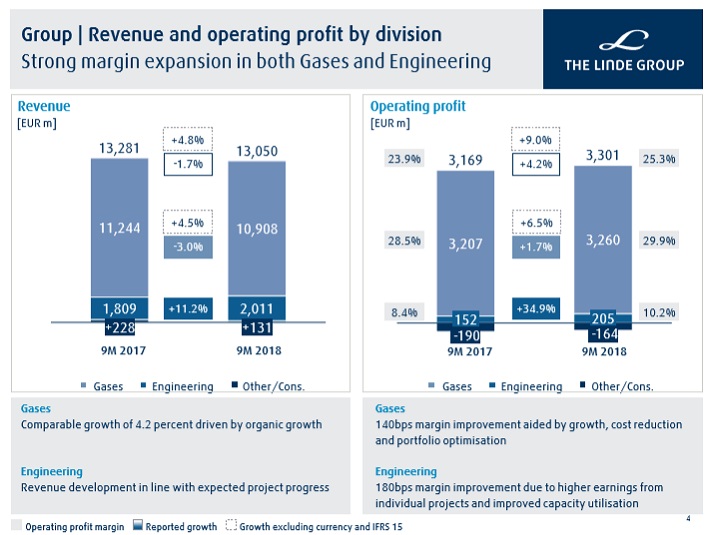

(Click on image to enlarge)

Source: Investor Presentation

Through the first three quarters of 2018, Linde’s total revenue increased 4.8% from the same period the previous year. Operating profit increased 9% in the nine-month period, thanks to revenue growth as well as 140-basis point operating margin expansion.

Currency-neutral revenue increased 4.5% in the Gases division, thanks to 5.1% growth in the Asia-Pacific region. Meanwhile, Engineering revenue increased 10% over the first three quarters of 2018.

During the last year, the major development for the company was the merger with Praxair. In late October the two companies received approval for the merger-of-equals by U.S. regulators, with some conditions such as divestment of certain assets.

Growth Prospects

The merger with Linde will be the primary growth catalyst moving forward. The deal creates an industrial gas giant. Combined, the two companies will generate approximately $29 billion in annual revenue.

Bringing Praxair on board will add to Linde’s existing gases business, which was already performing well with strong growth and margin expansion.

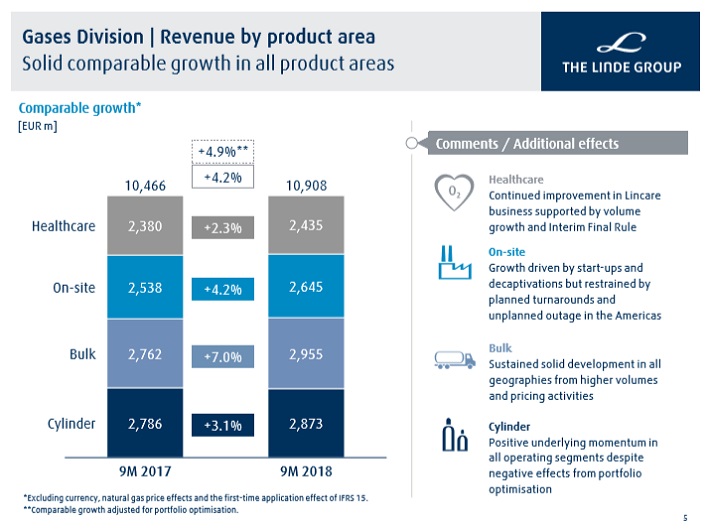

(Click on image to enlarge)

Source: Investor Presentation

Praxair will contribute positively to Linde. Praxair reported its standalone third-quarter earnings results last November (11/9/18). Revenue of $3.0 billion increased 3% year over year.

Adjusted for foreign exchange fluctuations, revenue increased 7% for the quarter. Operating earnings of $700 million increased 8% from the same quarter a year ago.

Earnings-per-share of $1.69 rose 13% compared to the year-ago quarter. Due to winning four new on-site projects, Praxair was able to grow its backlog by 29% compared to the prior year’s quarter. The growth in the company’s backlog (now at $2.2 billion) bodes well for Linde’s revenue growth outlook.

Linde will also be able to generate substantial cost-savings through synergies between the two companies. Linde management expects deal synergies of $1.1 to $1.2 billion annually, achievable within three years after closing.

Share repurchases will also be a major catalyst for Linde’s future earnings growth. Linde has an existing share repurchase program for up to $1 billion in buybacks.

On top of this, the company recently announced an additional $6 billion share repurchase program, for up to 15% of its outstanding shares through February 1st, 2021.

We expect Linde to grow its earnings-per-share by 6% per year over the next five years.

Competitive Advantages & Recession Performance

Linde enjoys multiple competitive advantages. As the leader in industrial gases, the company enjoys economic scale and greater operational efficiency than its smaller competitors.

In addition, Linde’s financial resources allow the company to invest heavily in research and development. Linde utilized $127 million on R&D expense in 2017, and $138 million in 2016, to build and maintain its competitive advantages.

For example, Linde filed 232 new patents in 2017 to protect its innovation from competitive threats. Linde has over 3,700 issued patents across its technologies.

Another competitive advantage is Linde’s strong financial position. The company has a healthy balance sheet, with high credit ratings of ‘A2’ from Moody’s and ‘A’ from Standard & Poor’s.

Maintaining investment-grade credit ratings helps the company access capital markets at an attractive cost.

Linde is not a recession-resistant business. As a global industrial manufacturer, its business model is sensitive to fluctuations in the global economy. An economic downturn typically sees lower demand from industrial customers.

Linde’s earnings-per-share during the Great Recession are as follows:

• 2008 earnings-per-share of $4.19

• 2009 earnings-per-share of $4.01 (4.3% decline)

• 2010 earnings-per-share of $3.84 (4.2% decline)

• 2011 earnings-per-share of $5.45 (42% increase)

The company did see a modest decline in earnings-per-share during the recession but fortunately saw its earnings improve alongside the broader global economic recovery. By 2011, Linde’s earnings had surpassed 2008 levels.

Valuation & Expected Returns

Linde is expected to generate earnings-per-share of $6.10 for 2018. Based on this, shares currently trade for a price-to-earnings ratio of 27.9. This is a fairly high valuation for the stock, even though the company is highly profitable and growing earnings at a satisfactory rate.

Over the past 10 years, shares of Linde traded for an average price-to-earnings ratio near 21. As a result, our fair value estimate for the stock is a price-to-earnings ratio of 20. This is a reasonable fair value target for a strong company with durable competitive advantages.

Still, Linde appears to be significantly overvalued. If shares were to experience a falling valuation to reach our fair value estimate, it would reduce annual returns by 6.4% per year. This could be a stiff headwind for investors buying at the current price level.

Future returns will be boosted by earnings growth and dividends. In addition to Linde’s expected earnings growth of 6% per year over the next five years, the stock has a current quarterly dividend of $0.875 per share.

Linde is a dividend growth stock. The most recent quarterly dividend payout was increased 6% from the previous dividend. On an annualized basis, Linde’s dividend of $3.50 per share represents a dividend yield of 2.1%.

The combination of valuation changes, earnings growth, and dividends results in total expected returns of 1.7% per year through 2024. This is a low expected rate of return, which makes the stock unattractive in our view.

Linde is a profitable company with a positive earnings growth outlook and a solid dividend, but the impact of overvaluation is enough to warrant a sell recommendation at the current price.

Final Thoughts

Linde stock has performed well since the merger with Praxair. Expectations are high for the potential of the combined company, but at this time we feel Linde’s stock is overvalued.

Linde will be an industry leader with clear and durable competitive advantages. The company should grow revenue and earnings at a steady rate going forward, assuming the global economy stays out of recession.

However, while Linde is a strong business, the stock is too richly valued to buy today.

Disclaimer: Sure Dividend is published as an information service. It includes opinions as to buying, selling and holding various stocks and other securities. However, the publishers of Sure ...

more