Dividend Aristocrats In Focus: Caterpillar

One of the newest members of the Dividend Aristocrats list is industrial heavy equipment supplier Caterpillar Inc. (CAT).

Caterpillar made the 2019 Dividend Aristocrats list by raising its dividend for the 25th year in a row. Even more impressive is the fact that Caterpillar operates in a cyclical industry. However, Caterpillar management has proven its commitment to returning cash to shareholders even though the inevitable ebbs and flows of the business.

Some recent weakness in the share price has led the yield back up to 2.8%, making Caterpillar not only a long-term dividend growth story, but one that offers strong current income as well.

Caterpillar’s 2.8% current yield and the potential for 10%+ annual dividend increases for many years to come to make the stock attractive for long-term dividend growth investors.

Business Overview

Caterpillar was founded in 1925, and today competes in the manufacturing and selling of construction and mining heavy equipment. The company also manufactures ancillary industrial products such as diesel engines and gas turbines. Caterpillar generates annual revenue of $58 billion and the stock has a market capitalization of $77 billion, making it one of the largest industrial stocks.

Industrial stocks have struggled in the recent past as fears over slowing – or even declining – global economic growth have compressed valuation multiples in the industry. Caterpillar is particularly beholden to commodity prices of all sorts, from metals to crops, so this fear has hit the share price significantly in the past couple of years. However, we see shares as quite meaningfully undervalued at current prices even if some of these fears over growth and commodity prices come to fruition.

Caterpillar reported fourth-quarter earnings on 1/28/19 and the results were strong. Revenue was up 11% during Q4 to $14.3 billion, as the company saw each of its major segments grow revenue at sizable rates. The construction segment produced an 8% increase in revenue while the resource segment rose 21%, and energy and transportation saw an 11% rise in the top line.

The company’s financial services business was a small drag on Q4 results with its 4% revenue increase, but overall, Q4 was tremendous from a revenue perspective.

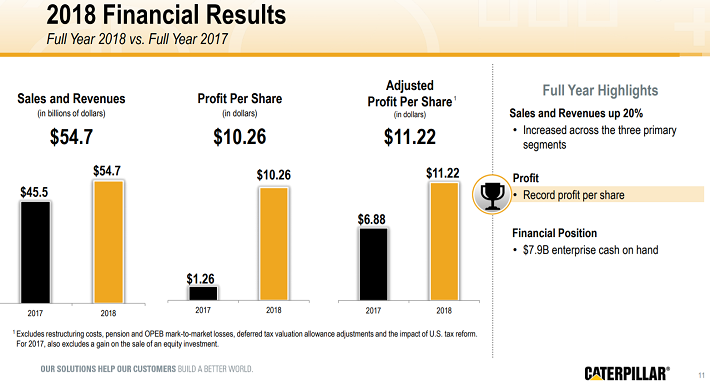

Source: Q4 earnings presentation, page 11

For the full year, results were even better as the top line rose 20% and adjusted earnings-per-share soared 63%. That earnings-per-share growth to $11.22 was good enough to be a new record for Caterpillar, which is hardly what one would expect based upon the way the share price has behaved recently.

Caterpillar, however, is not just a revenue growth story, as its operating margins continue to move higher, which helped immensely with earnings-per-share growth in 2018.

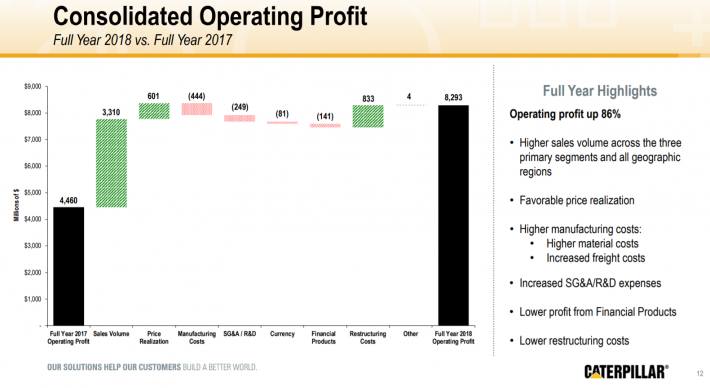

Source: Q4 earnings presentation, page 12

We can see from this slide Caterpillar managed to boost operating profits by a staggering 86% despite some headwinds from variable costs during the year. Selling, general, and administrative (SG&A) costs and research and development expense increased, removing $249 million from operating profits during 2018. Higher material and freight costs took away another $444 million.

However, stronger sales and better price realization were more than enough to offset those costs, and operating profits soared from $4.46 billion to $8.29 billion year-over-year. Caterpillar’s years-long effort to boost operating leverage has paid off and 2018 was yet more evidence of that.

Caterpillar is not just an earnings growth story, however, as it returns billions of dollars of cash annually to shareholders via dividends and buybacks. The company repurchased $3.8 billion of stock in 2018, nearly half of which was purchased in Q4 alone.

The dividend was raised 10% for 2018, which is roughly congruent to other increases in recent years as Caterpillar is certainly doing much more than a low single digit increase simply to keep its streak going. The company also made a discretionary $1 billion payment to fund its pension program as it found a creative way to use its excess cash.

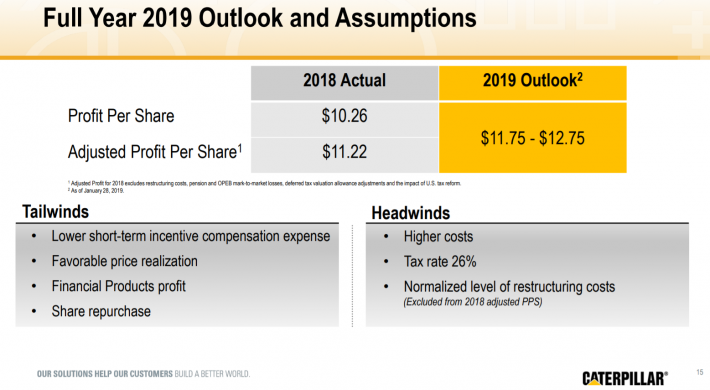

Source: Q4 earnings presentation, page 15

Management has guided for $11.75 to $12.75 in earnings-per-share for 2019, representing a potential range of growth of 5% to 14%. Caterpillar sees tailwinds from continued revenue growth, including better pricing, as well as lower compensation expenses, combined with share repurchases.

Headwinds include a higher tax rate and higher manufacturing costs, as we saw in 2018. Considering all of this, we expect 2019 earnings-per-share of $12.25, which is the middle of the guidance range.

Growth Prospects

Caterpillar is closely tied to global economic growth, as well as commodity prices. Its customers extract resources from the earth as well as build and construct a wide variety of structures, so economic growth is key to fund that development. This leads to some fairly extreme cyclicality in Caterpillar’s results, which then sees the stock swing wildly between extremes of the sentiment scale.

However, today, Caterpillar appears to be firing on all cylinders as its customers are still spending, driving its revenue higher. Mining companies are expanding operations as commodity prices remain favorable, and construction continues to expand in the US, China and other key markets around the globe.

Further, Caterpillar’s own cost-cutting measures have driven operating margins higher for years and while the low-hanging fruit has certainly been picked, we don’t see that story as ending just yet.

The company’s rising cash flows afford it the ability to invest in its business where necessary, but also to return cash to shareholders in the billions of dollars.

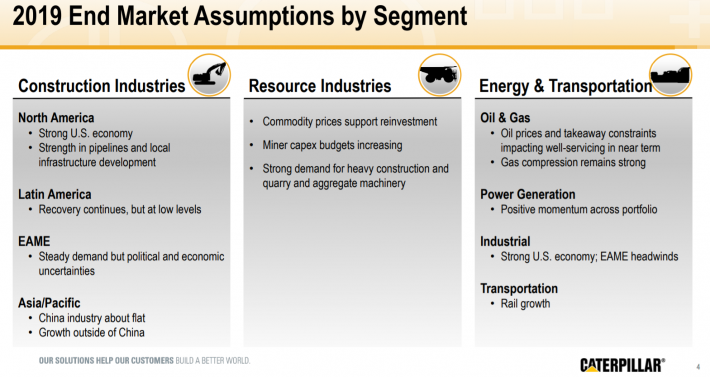

Source: Q4 earnings presentation, page 4

This slide shows management’s assumptions in terms of its major end markets for 2019, and overall, the picture is quite favorable. All three of the company’s major segments have fundamental tailwinds continuing at least through 2019, supporting what is very likely to be another record in earnings-per-share this year.

Competitive Advantages & Recession Performance

Competitive advantages in industrial applications can be difficult given that for most applications, there are competitors that make largely similar products. However, Caterpillar has built itself into one of the largest players in lucrative end markets such as construction, energy, and mining over the years.

Its global presence affords it some diversification of revenue by segment and industry, but also geographically, which has served it well in recent years. Its scale also gives it the ability to leverage down variable costs per unit, which boosts margins.

However, Caterpillar is certainly not immune from recessions as slowdowns in the global economy are generally accompanied by lower commodity prices and slowing construction spending. These factors took a major toll on Caterpillar’s bottom line during the Great Recession, as earnings were devastated, if only briefly.

Caterpillar’s earnings-per-share during the Great Recession are below:

- 2007 earnings-per-share of $5.32

- 2008 earnings-per-share of $5.71 (7% increase)

- 2009 earnings-per-share of $1.43 (75% decline)

- 2010 earnings-per-share of $4.15 (190% increase)

While Caterpillar certainly felt the pain from the Great Recession, its earnings rebounded fairly quickly and it reclaimed its pre-recession earnings-per-share number in 2011. The next recession likely won’t be as damaging for Caterpillar as the Great Recession, but it is almost certain to see a meaningful decline in earnings-per-share when it does strike.

Valuation & Expected Returns

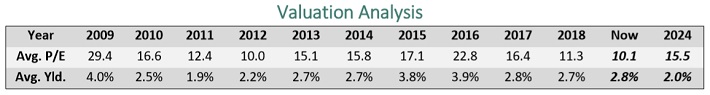

Caterpillar’s current price-to-earnings ratio is just 10.6 today, which compares very favorably to our fair value estimate of 15.5. This makes Caterpillar significantly undervalued in our view, and should provide shareholders with an annual tailwind to total returns of around 8%.

You can see a breakdown of Caterpillar’s historical price-to-earnings ratios in the table below:

Periods of cyclicality are normal for Caterpillar when it comes to the valuation, and today, we are certainly seeing a swing lower in the price of the stock relative to earnings.

Based upon the factors discussed above, we see total earnings-per-share growth at 6.2% annually. This will accrue from a combination of revenue growth, margin expansion, and the sizable share repurchase program. While Caterpillar has some potential headwinds in front of it should we see a global economic slowdown, overall, its fundamentals are quite strong.

In addition to earnings growth and a boost from the valuation, the current yield of 2.8% will help drive shareholder returns. Combining the three factors, we see total annual returns of around 17% for the next five years. That makes Caterpillar very attractively priced today and we rate the shares a buy as a result.

Final Thoughts

Caterpillar offers investors a wide variety of reasons to want to own the stock today. It has a nearly-3% yield in addition to 25 consecutive years of dividend increases. Its payout ratio is less than one-third of earnings, so its dividend has a very high safety rating and has lots of room to continue to expand in the coming years.

It also has favorable fundamental backdrops in its major segments, which means earnings growth should continue for the foreseeable future. Finally, the stock is very attractively priced as it trades for roughly two-thirds of our fair value estimate. Putting these factors together paints a bullish picture of Caterpillar, and we believe it is a buy today.

Disclaimer: Sure Dividend is published as an information service. It includes opinions as to buying, selling and holding various stocks and other securities. However, the publishers of Sure ...

more