Dividend And Treasury Yield Spreads At Multiyear Highs

Risk assets are selling off in dramatic fashion today as the major indices are all down well over 3%. These declines have led the dividend yield on the S&P 500 to jump over 5 bps since Friday. Now at 1.94%, the S&P 500’s dividend yield is at its highest level since late October 2019.

Meanwhile, Treasury yields are cratering with the 10-Year down over 10 bps. That is the largest one-day decline in the 10-Year yield since August 14th of last year when it fell 12.43 bps. That brings the yield down to 1.37%, which is the lowest level since July 2016.

Going further out on the curve, the yield on the 30-Year Treasury bond is now at a record low of 1.82%. Similar to the 10 Year, that is nearly a 10 basis point decline from Friday.

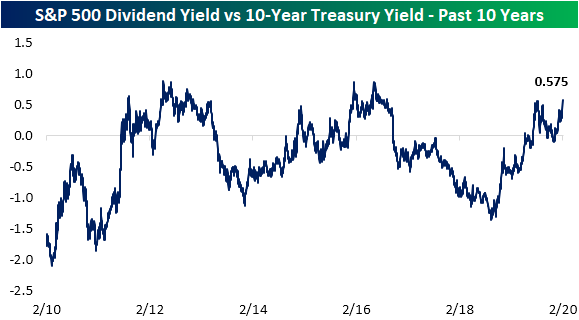

Given these moves, holding constant the difference in risks associated with the two assets, the spread between the S&P 500’s dividend yield is higher than the 10-Year yield by its widest margin since September of 2016 at 0.575, eclipsing the previous high from last August. Prior to 2016, the spread was higher throughout much of 2012.

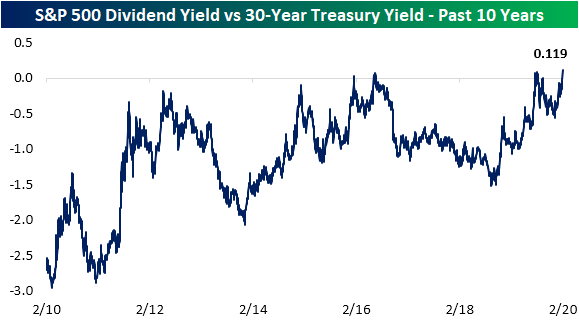

The spread between the S&P 500’s dividend yield and the 30-Year Treasury, on the other hand, is at its highest level in over a decade. The spread now stands at 0.119 which is the widest the spread has been since January 2009 and is favoring stocks (positive spread) for the first time since September. Unlike the spread between the S&P 500’s dividend yield and the 10-Year yield which has flipped back and forth between favoring stocks and Treasuries over the past decade, the 30-Year yield has much more consistently favored bonds. In fact, outside of today and briefly last September, the only other time we’ve seen a positive spread was in 2016.

Disclaimer: To begin receiving both our technical and fundamental analysis of the natural gas market on a daily basis, and view our various models breaking down weather by natural gas demand ...

more