Digital Realty Is A Moat-Worthy REIT Worth Owning

Digital Realty (NYSE:DLR) is a core position in my Durable Income Portfolio and I have been pleased with the performance since I initially established a position in September 2013. As a value investor, I'm always looking to own securities that offer structural advantages - or wide moats - that can fend off the competition and earn high returns on capital.

Almost two years ago, one of Digital's adversary hedge funds decided to launch a short thesis aimed at some of the data center REIT's moat-worthy characteristics, citing the fact that the barriers to entry were weakening and that Digital's business model was going the way of the dinosaur. The argument centered on the notion that Digital was no longer a sustainable business and that the decade-long earnings record was short-lived.

Although I have respect for many hedge fund operators, I was in complete disagreement with the rocks being thrown at Digital's fortress, and I decided to defend the castle by tripling down on my position (so on December 3, 2013, I took a sizeable position in DLR).

As you can see, the bet paid off, and one the primary reasons that I felt convicted to increase my position in Digital was because I recognized the value of the fortress brand. There is no doubt that highly profitable businesses are magnets that attract competitors making it difficult to generate strong growth; however, I recognized that Digital was prepared to withstand the onslaught while continuing to generate wealth compounding.

Digital Realty: Staying True To The Fortress Brand

Recently, Digital Realty announced it was acquiring Telx, a leading national provider of colocation and interconnection data center solutions for $1.9 billion. According to Digital's CEO, Bill Stein,

…we believe Telx fits squarely within the box in terms of our strategic priorities, and that is product offerings and geographic footprint are highly complementary to our current portfolio.

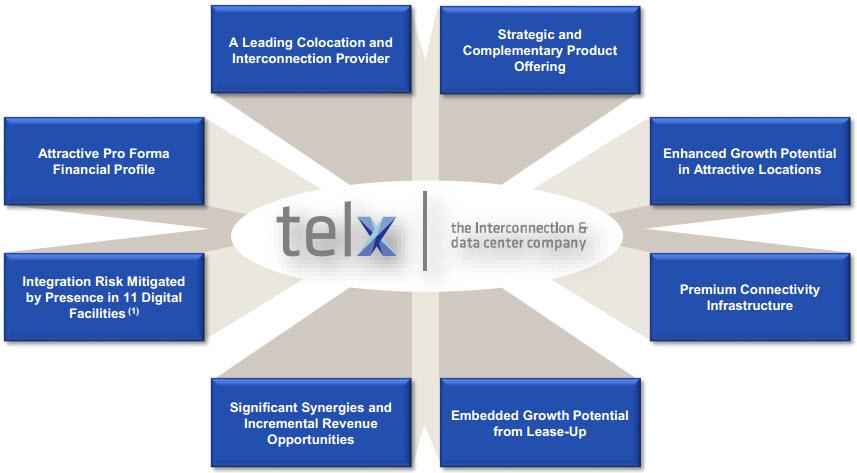

The chart below highlights the complementary nature of the Telx transaction. Digital's existing business consists primarily of meeting the large footprint data center space and power requirements of creditworthy customers.

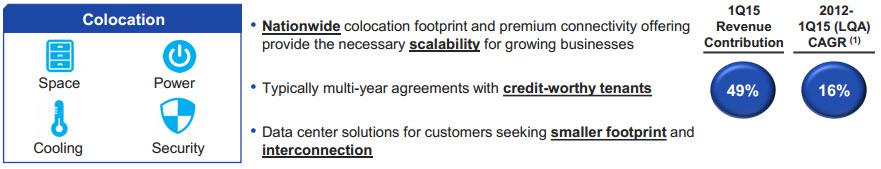

Telx's colocation business is similar, but in smaller increments to a far greater number of customers.

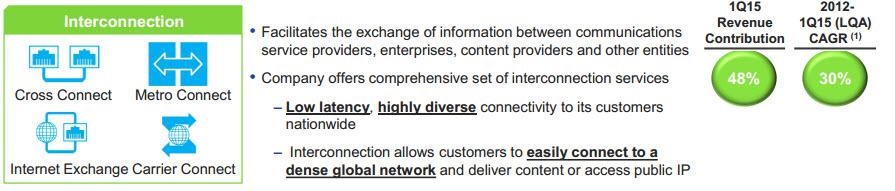

As indicated by the bubbles on the right-hand column, interconnection represents nearly half of Telx's top line and has grown at a very healthy rate. By combining Digital's businesses, the combined companies are creating a more differentiated business model, with a strong, large footprint business and a solid, rapidly-growing colocation business within a truly interconnected network.

In essence, Digital is widening and deepening the economic moat between the company and its competitors.

There are significant barriers to growing Digital's portfolio of either a global large footprint platform or a colocation and interconnection business, but with all three under the same roof, Digital believes that the sum of the parts will be greater than the whole. In addition, the properties that make up the physical infrastructure are almost entirely owned by Digital. As Bill Stein explained,

This makes future growth that much more significant since we control our own real estate and the residual value from incremental growth opportunities accrues to us rather than a third-party landlord. In the long run, we believe this will further set us apart from our competitors in terms of products and services offered.

As you can see below, Digital's key acquisition criteria are focused on investments that are strategic and complementary to the existing business and also financially accretive and prudently financed.

Telx is headquartered in New York and has a very strong presence on the East Coast with leaseholds in three highly strategic Internet Gateway buildings in Lower Manhattan. Telx has a direct lease with the owner of 111 8th Avenue, the third largest building in Manhattan and one of the key Internet hubs on the East Coast. Digital also has a leasehold interest in 111 8th Avenue, and Telx in turn subleases a portion of this space from Digital.

Reviewing the summary performance statistics on the left-hand side of the page (above), you can see that there are three West Coast properties that are less than 50% leased. That means there is significant embedded growth potential from these underutilized properties in Digital's backyard (west coast).

Also the chart (above) illustrates, there is significant opportunity for Digital to roll out the Telx platform across the global portfolio, particularly in the campus environment. As you can see from the overlapping logos at the top, Telx has an existing presence in Digital campuses in Chicago, Dallas, New York and Silicon Valley.

Continue reading this article here.

Brad Thomas is the Editor of the Forbes Real Estate Investor.

more