Did Shrinking The Fed’s Portfolio Worsen The Stock Market?

In January the Fed left its benchmark interest rate unchanged at 2.25% to 2.5% and indicated that rates may stay unchanged for some time.

Reinforcing a new more cautious tone, the Fed also announced it was prepared to slow or even reverse the steady trimming of its bond portfolio. This, too, represented a striking shift for the Fed.

Fed Chairman Powell indicated that the case for raising rates had weakened because of slowing growth in Europe and China, and the possibility of another federal government shutdown. He also reiterated that his overarching goal was to sustain the economic expansion.

Not surprisingly, investors warmly welcomed the Fed’s January 30th announcement to hold its interest rates steady and to stop shrinking its bond portfolio.

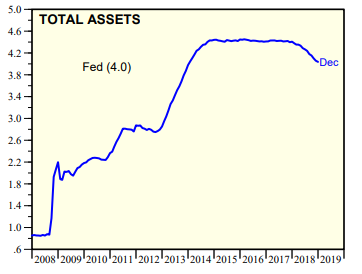

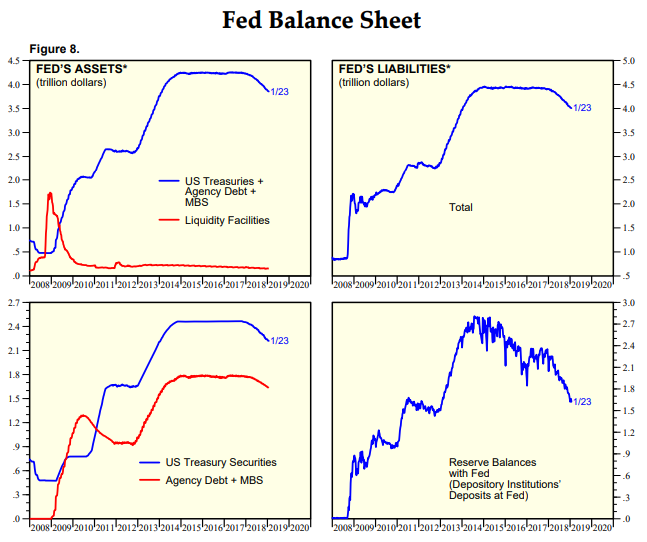

Regarding the recent slimming of its bond portfolio, The Fed had been shrinking its $4 trillion portfolio by allowing Treasuries and mortgage securities to mature without replacing them. The recent target for a maximum runoff was $30 billion a month in Treasuries and $20 billion a month in mortgage-backed securities.

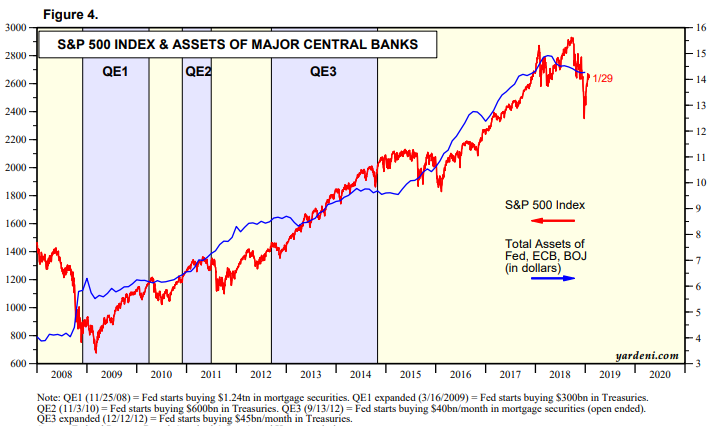

As well, the ECB had also been shrinking its balance sheet, while the Bank of Japan held its balance sheet more or less constant in 2018.

(Recall that it was because of the 2008-09 financial crisis that the Fed intervened to provide liquidity to the US financial system by purchasing huge sums of Treasury and mortgage-backed securities. The Fed’s balance sheet expanded sharply from $870 billion in August 2007 to a peak of about $4.5 trillion in early 2014.)

The shrinking of the Fed’s balance sheet began in 2017 as part of its shift out of quantitative easing. Concerns immediately arose over this shift, since it affected the liquidity of the financial markets and the growth of the money supply.

Pundits also worried that the shrinking of the balance sheet coincided with interest rate hikes that started in 2015. Of course, a related worry was that the shrinking balance sheet weakened the stock market and added to its volatility.

Nonetheless, Fed officials argued that the central bank’s portfolio reduction was not having a major financial impact, since long-term interest rates in the US have gone down of late, not up.

Focusing on one important item in the balance sheet statement, Bank Reserves (commercial bank deposits with the central bank) have been declining since 2014, over a period when the stock market was very strong. Moreover, the fact that Bank Reserves were declining hadn’t seemed to hurt commercial lending.

This writer agrees with the consensus that the run off in the balance sheet did not have a big effect on market conditions.

After all, the gradual reduction in the balance sheet was set in motion years ago and should have been easily digested by financial markets.

Total Asset Holdings Of The Fed

Disclosure: None.