Desperately Seeking Yield: 23 December 2020

The pickings remain slim for yield-seeking investors when sifting through the global markets. But cheer up: relative to inflation, the current payouts look reasonable and arguably attractive.

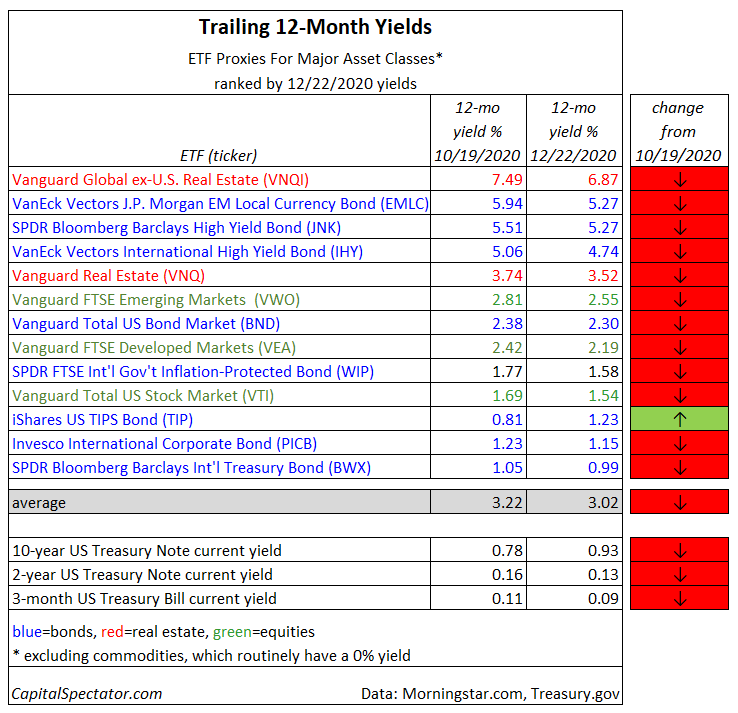

US consumer-price inflation at the headline level rose a mild 1.2% for the year through November. By that standard, the average 3.0% trailing yield (trailing 12 months) for a set of ETF proxies for the major asset classes looks relatively rich.

Meanwhile, financial and economic gravity continues to weigh on yields generally. The current 3.02% average yield (as of Dec. 22) for the major asset classes reflects a 20-basis-point decline from The Capital Spectator’s previous update on Oct. 20.

The highest-yielding slice for the major asset classes on a trailing 12-month basis: foreign property shares via Vanguard Global ex-US Real Estate (VNQI). According to Morningstar.com, the ETF’s current 6.87% payout rate over the past year is comfortably at the top of the list in the chart above.

VNQI’s yield is also a world above the thinnest payout rate for the major asset classes. At the moment, foreign government bonds in developed markets are posting the lowest one-year yield on the list: a thin 0.99% via SPDR Bloomberg Barclays International Treasury Bond (BWX).

Note, too, that all but one of the trailing ETF yields have slipped since our previous update in late-October. The lone exception: inflation-indexed Treasuries. The iShares TIPS Bond (TIP) has a 1.23% payout, up from 0.81% two months earlier.

Another observation: all the trailing yields for the ETFs exceed the benchmark 10-year Treasury’s 0.93%. That’s a low bar, but it beats a kick in the head.

Keep in mind that the ETF yields above are useful for relative comparisons, but you should curb your enthusiasm for assuming that you can earn these yields going forward. To quote our standard caveat on such matters: Stuff happens. Companies cut dividends, firms go bankrupt, foreign governments without the benefit of issuing the world’s reserve currency get squeezed by various macro and geopolitical risks, to name a few of the things that can go bump in the night.

Another risk factor: central banks can raise interest rates. Although that doesn’t appear imminent in the US or elsewhere, the recent chatter about rising inflation risk in the year ahead has directed minds to the subject in recent months.

Don’t forget that even if you earn a respectable yield in a given ETF, market volatility can create capital losses that wipe out the gain (and more) from a fund’s distributions.

Overall, the table above is presented as a first approximation of what’s available in global markets at the moment (via a rear-view mirror) when you cast a wide net in the desperate search for yield. Further research, however, is highly recommended. Proceed accordingly.

Disclosure: None.