Deep Dive Into Latest Consumer Data

Consumer Improves: Redbook & Chase

Before discussing the May retail sales report, let's look at the most up to date data from June. With the changes to the data coming quickly, you can say the high-frequency results are more valuable than the older official results. When you are trying to decide whether retail sales growth will be 3% or 4%, the high-frequency data doesn’t help.

However, as you probably know this quick recovery has seen results improve to the point where there are high vacillations in the data. May retail sales estimates were dramatically off base, signaling how volatile the data is.

Redbook same-store sales growth in the week of June 13th improved from -9.7% to -8.3%. Redbook was an important data point last week because while almost all the data shows spending growth is improving, Redbook showed one of the worst readings ever. We won’t know the official truth until next month when the June retail sales report comes out.

Obviously, that won’t give us clarity into the weekly data. If Redbook sales growth dramatically improves, we will have no clue which signal was correct for the first week of June. To be clear, the 8.3% decline in the 2nd week of June is terrible. It’s far from the best growth of the past 2 months.

The chart above shows Chase card data differs from Redbook. Chase data looks like the Visa and Mastercard data, namely, growth is improving. Obviously, there is a lot of white space to improve when the states that are still shut down come back online.

In other words, the difference in consumer spending growth between America and New York will shrink. That’s what has been happening in the past couple weeks. The solid blue line shows growth in the 7 day moving average of non-recurring Chase card spending has accelerated. It’s near that of Texas and California.

COVID-19 Cases Exploding In Some States

On the other hand, it will be interesting to see what happens in Texas, Florida, and California over the next few weeks because they are seeing a spike in new cases. Instead of New York underperforming, the other states might. It's unlikely that their spending growth rates will plummet back to the bottom in March.

Instead, their growth rates will likely improve at a lesser rate or stay the same. However, that could be too bearish because their growth rates look fine in this chart even though they’ve seen problems for the past couple weeks. Obviously, a shutdown of a major city such as Houston would change that for the worse.

In California, the 7 day moving average of daily new cases increased from 1,714 on May 16th to 3,144 on June 16th. It will be interesting to see when the spike in cases causes more shutdowns and economic weakness. In Texas, the 7 day moving average of new cases per day has increased from 1,133 on May 30th to 2,400 on June 16th. There has been a vertical spike in the moving average because on the 16th, there were 4,413 new cases.

That pushed the overall national total to the highest level since the 12th. Finally, in Florida, the daily average rose from 1,230 on the 10th to 2,016 on the 16th. It nearly doubled in a few days. On the positive side, national deaths have been low. The 16th was an unusual day where 849 people died. The 7-day average is 712 and has been falling since mid-April.

As you can see from the chart above, that divergence is occurring because younger people are living normally and catching the virus, while old people are staying at home. The age composition of cases has dramatically shifted to people under 50 catching it. This is good because less people are dying, but it means the virus hasn’t been stamped out like it seems to have been in areas like South Korea.

Big Retail Sales Beat

It was wrong to say the tougher economic expectations would make it tougher for stocks to rally when specifically mentioning the high bar for monthly retail sales growth. Analysts completely whiffed as they were way too negative. Monthly sales growth increased from -14.7% to 17.7% which more than doubled estimates for 7.5%.

That’s even though the prior reading was revised by 1.7% higher. The best estimate was beaten by 5.5%. This was likely the biggest beat ever by a landslide. Just because monthly growth was high, doesn’t mean the economy is back to normal obviously.

As you can see from the chart above, yearly retail sales growth was still -6.1% which is only a little higher than it was in the last recession. We climbed from depressionary growth to recessionary growth. Data will get even better in June based on the Chase card results. Sales are still down 8.3% from before COVID-19.

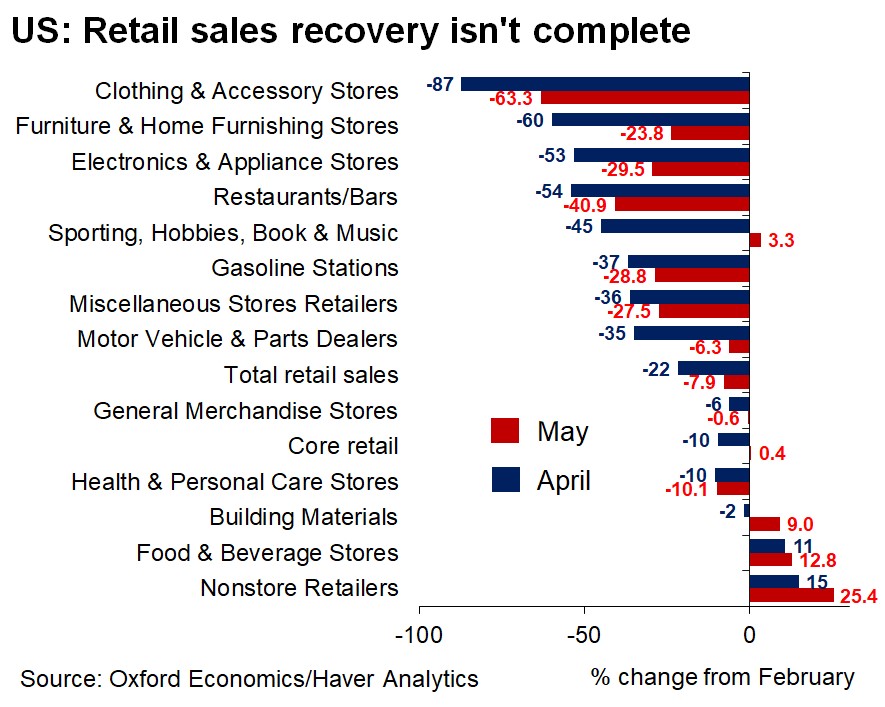

The chart below breaks down the sales change in April and May from February. As you can see, clothing and accessory sales in May were still 63.3% off February’s total. Best was online sales which are 25.4% better than February levels. Biggest improvement was in sporting, hobbies, books, and music which went from being down 45% from February to up 3.3%.

Restaurants and bars are still off 40.9%. Furniture and home furniture stores had a massive improvement as they went from down 60% to only down 23.8%.

Other headline readings were similarly great as you’d expect. Sales growth excluding autos was 12.4% which improved from -15.2% which more than doubled estimates for 5.2% growth. It beat the highest estimate which was 8.6%. Prior reading was revised up 2 points.

Retail sales growth without autos and gas was also 12.4%. That more than tripled estimates for 4% growth. The prior reading was revised from -16.2% to -14.4%. Finally, control group sales growth was 10.6% which beat estimates for 4% and the highest estimate which was 8.9%. April rate was revised up from -15.5% to -12.6%.

Disclaimer: Neither TheoTrade or any of its officers, directors, employees, other personnel, representatives, agents or independent contractors is, in such capacities, a licensed financial adviser, ...

more