December 2020 BLS Jobs Situation - Employment Declines

The headline seasonally adjusted BLS job growth declined and was well below expectations, with the unemployment rate unchanged at 6.7 %.

Analyst Opinion of the BLS Employment Situation

Employment recovery from the coronavirus has now stalled.

A summary from the report:

Total nonfarm payroll employment declined by 140,000 in December, and the unemployment rate was unchanged at 6.7 percent, the U.S. Bureau of Labor Statistics reported today. The decline in payroll employment reflects the recent increase in coronavirus (COVID-19) cases and efforts to contain the pandemic. In December, job losses in leisure and hospitality and in private education were partially offset by gains in professional and business services, retail trade, and construction.

Revision of Seasonally Adjusted Household Survey Data: Seasonally adjusted household survey data have been revised using updated seasonal adjustment factors, a procedure done at the end of each calendar year. Seasonally adjusted estimates back to January 2016 were subject to revision. The unemployment rates for January 2020 through November 2020 (as originally published and as revised) appear in table A on page 7, along with additional information about the revisions.

The economically intuitive sectors were positive for economic growth.

The rate of further recovery will be dependant on the coronavirus effects.

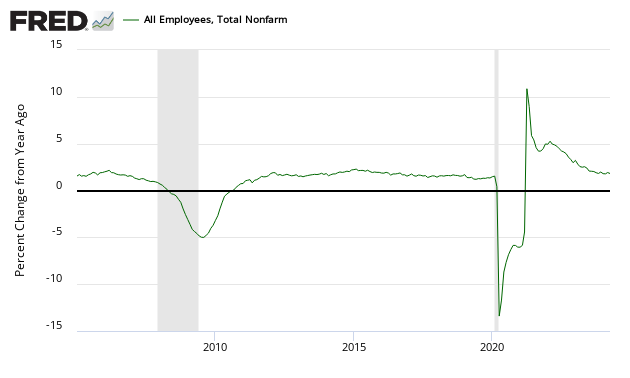

- The year-over-year rate of growth for employment declined by 0.03 % this month (red line on the graph below). The year-over-year growth rate is 6.1 % below the rate of growth one year ago.

- This month's report internals (comparing household to establishment data sets) did not correlate with the household survey showing seasonally adjusted employment grew 21,000 vs the headline establishment number declining 140,000. The point here is that part of the headlines are from the household survey (such as the unemployment rate) and part is from the establishment survey (job growth). From a survey control point of view - the common element is job growth - and if they do not match, your confidence in either survey is diminished. [note that the household survey includes ALL job growth, not just non-farm).

- The household survey added 31,000 people from the labor force.

- The National Federation of Independent Business (NFIB)'s monthly Jobs Report is at the end of this post.

A summary of the employment situation:

- BLS reported: -140K (non-farm) and -95K (non-farm private). The headline unemployment rate was unchanged at 6.7 %.

- ADP reported: an employment decline of 123,000 (non-farm private)

- In Econintersect's December 2020 economic forecast released in late November 2020, we estimated non-farm private payroll growth at 200,000 (based on economic potential) and 500.000 (fudged based on current overrun / under-run of economic potential). [because the decline was so steep and the recovery so steep, our forecast methodology is not accurate in this period]

- The market expected (from Econoday):

| Seasonally Adjusted Data | Consensus Range | Consensus | Actual |

| Nonfarm Payrolls - M/M change | -50,000 to 302,000 | 100,000 | -140,000 |

| Unemployment Rate - Level | 6.6 % to 6.9 % | 6.8 % | 6.7 % |

| Private Payrolls - M/M change | 50,000 to 300,000 | 140,000 | -95,000 |

| Manufacturing Payrolls - M/M change | 11,000 to 40,000 | 26,000 | 38,000 |

| Participation Rate - level | 61.3 % to 61.6 % | 61.5 % | 61.5 % |

| Average Hourly Earnings - M/M change | 0.1 % to 0.4 % | +0.2 % | +0.8 % |

| Average Hourly Earnings - Y/Y change | 4.2 % to 4.7 % | 4.4 % | 5.1 % |

| Avg Workweek - All Employees |

34.7 hrs to 34.8 hrs |

34.8 hrs | 34.7 hrs |

The BLS reports seasonally adjusted data - manipulated with multiple seasonal adjustment factors, and Econintersect believes the unadjusted data gives a clearer picture of the job situation.

The following chart compares the job gains/losses this month with the same month historically.

The worst year-to-date growth ever. Cumulative employment growth this year is -7,891,000.

The last month's headline employment gains were revised upward. Generally speaking, the INITIAL employment gain estimate is overstated when the economy is slowing and understated when the economy is accelerating.

Concentrating on the labor force growth Vs. employment growth - it should be noted that the trend shows that the slack between labor force growth and employment growth was narrowing slowly before the coronavirus hit.

Most of the analysis below uses unadjusted data and presents an alternative view of the headline data.

Unemployment

The BLS reported U-3 (headline) unemployment was 6.7 % with the U-6 "all-in" unemployment rate (including those working part-time who want a full-time job improved from 12.0 % to 11.7 %. These numbers are volatile as they are created from the household survey.

BLS U-3 Headline Unemployment (red line, left axis), U-6 All In Unemployment (blue line, left axis), and Median Duration of Unemployment (green line, right axis)

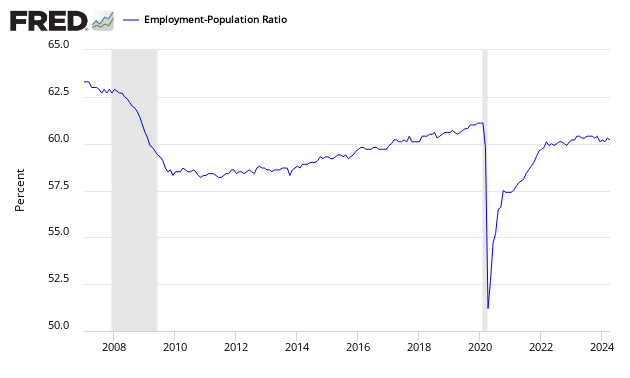

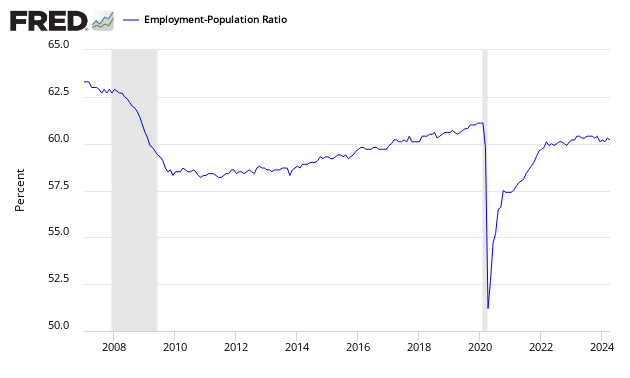

Econintersect has an interpretation of employment supply slack using the BLS employment-population ratio, demonstrated by the graph below. The employment-population ratio was unchanged at 57.4

Employment-Population Ratio

The employment/population ratio is determined by the household survey.

- Econintersect uses employment-population ratios to monitor the jobless situation. The headline unemployment number requires the BLS to guess at the size of the workforce, then guess again who is employed or not employed. In employment-population ratios, the population is a given and the guess is who is employed.

- This ratio has been in a general uptrend since the beginning of 2014. The employment-population ratio tells you the percent of the population with a job. Each 0.1 % increment represents approximately 300,000 jobs. [Note: these are seasonally adjusted numbers - and we are relying on the BLS to get this seasonal adjustment factor correct]. An unchanged ratio would be telling you that job growth was around 150,000 - as this is approximately the new entries to the labor market caused by population growth.

- The growth in employment since the Great Recession was in full-time jobs.

Employment Metrics

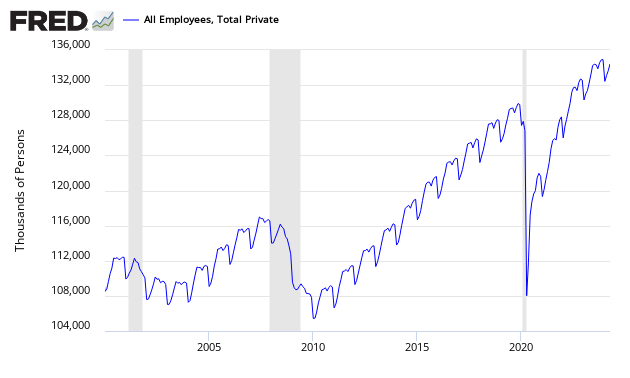

The growth trend in the establishment survey's non-farm payroll year-over-year growth rate was trending up in 2018. The year-over-year growth rate declined in 2019 but 2020 was hit by the coronavirus pandemic.

Unadjusted Non-Farm Payrolls Year-over-Year Growth

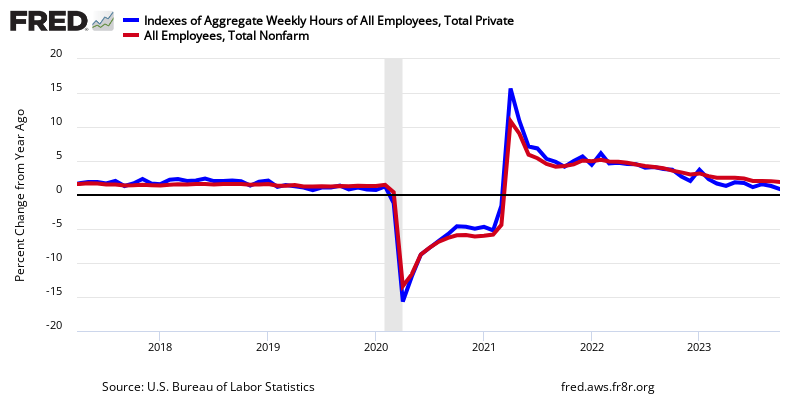

Another way to view employment is to watch the total hours worked where trends vary based on periods selected but the coronavirus has caused a significant loss of hours worked.

Percent Change Year-over-Year Non-Farm Private Weekly Hours Worked

The bullets below use seasonally adjusted data from the establishment survey except where indicated:

- Average hours worked (table B-2) slowed from 34.8 to 34.7. A rising number normally indicates an expanding economy

- Government employment declined 45,000 (45K) with the Federal Government up 6K, state governments down 19K, and local governments down 32K.

- The big contributor to employment decline this month was accommodation and food services decline of 395.6K

- Manufacturing employment was up 38K and construction was up 51K.

- The unemployment rate (from the household survey) for people between 20 and 24 (Table A-10) worsened from 11.9 % to 12.1 %. This number is produced by a survey and is very volatile.

- Average hourly earnings (Table B-3) was up $0.27 to $29.81

Private Employment: Average Hourly Earnings

Economic Metrics

Economic markers used to benchmark economic growth (all from the establishment survey).

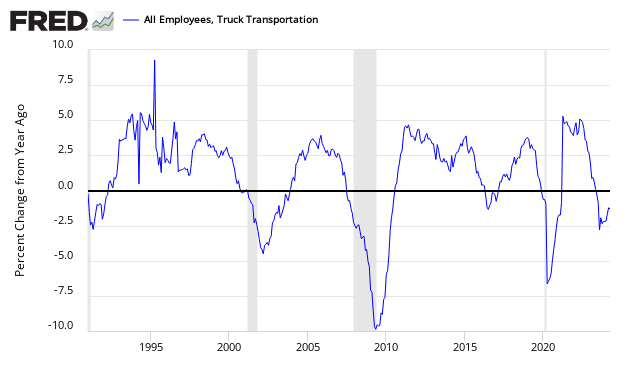

The truck employment was up 7.3K

Truck Transport Employment - Year-over-Year Change

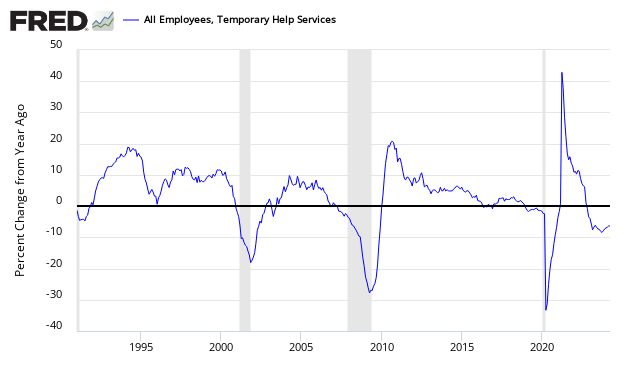

Temporary help was up 67.6K.

Temporary Help Employment - Year-over-Year Change

Econintersect believes the transport sector is a forward indicator. Others look at temporary help as a forward indicator.

Food for Thought

Who are the victims in this employment situation? It is not people over 55.

Index of Employment Levels - 55 and up (blue line), 45 to 54 (red line), 35 to 44 (green line), 25 to 34 (purple line), 20 to 24 (light blue line), and 16 to 19 (orange line)

Women are doing better than men.

Index of Employment Levels - Men (blue line) vs Women (red line)

Mom and Pop employment remains historically low.

The less education one has the less chance of finding a job.

Index of Employment Levels - University graduate (blue line), Some college or AA degree (orange line), high school graduates (green line), and high school dropouts (red line)

Here is an indexed view of employment levels.

Index of Employment Levels (from the BLS Establishment Survey) - Hispanic (blue line), African American (red line), and White (green line)

However, keep in mind that population growth is different for each group. Here is a look at employment to population ratios which clearly shows NO group has recovered from the Great Recession:

Employment/Population Ratios (from the BLS Household Survey) - Hispanic (blue line), African American (red line), and White (green line)

National Federation of Independent Business (NFIB)'s monthly Jobs Report Statement:

Small Business Job Growth Continues in December

Small business job growth continued in December, but the gains remain uneven as certain sectors of the economy are slowing due to state-mandated business closures and consumer resistance to spend, according to NFIB's monthly jobs report.

"Small businesses continued to prove that they are the engine of the economy as we closed a chapter on a challenging year," said NFIB Chief Economist Bill Dunkelberg. "Owners continue to manage various obstacles related to the COVID-19 pandemic but are doing their best to remain open and continue hiring employees."

Small businesses increased employment by 0.3 workers per firm on average over the past few months, an increase of 0.14 workers per firm compared to November's reading.

Owners are still looking to hire as they reported a historically high level of job openings in December. Thirty-two percent (seasonally adjusted) of owners reported job openings they could not fill in the current period, down 2 points from November. Twenty-seven percent have openings for skilled workers and 11% have openings for unskilled labor.

Small business employers plan to fill their open positions with a net 17% (seasonally adjusted) reporting they are planning to create new jobs in the next three months, a historically strong reading. Overall, 54% reported hiring or trying to hire in December.

However, many owners are having trouble finding qualified employees for their open positions. Eighty-nine percent of those hiring or trying to hire reported few or no qualified applicants for the positions they were trying to fill in December. Down one point from November, 26% of owners reported few qualified applicants for their open positions and 22% reported none (up two points).

Forty-seven percent of the job openings in the construction industry are for skilled workers. Fifty-nine percent of construction firms reported few or no qualified applicants and 33% cited the shortage of qualified labor as their top business problem.

A net 21% (seasonally adjusted) reported raising compensation and a net 14% plan to do so in the coming months. Six percent of owners cited labor costs as their top business problem and 21% said that labor quality was their top business problem.

Caveat on the use of BLS Jobs Data

The monthly headline data ends up being significantly revised for months after the initial release - and is subject also to annual revisions. The question remains how seriously can you take the data when first released.

Econintersect Contributor Jeff Miller has the following description of BLS methodology:

- An initial report of a survey of establishments. Even if the survey sample was perfect (and we all know that it is not) and the response rate was 100% (which it is not) the sampling error alone for a 90% confidence interval is +/- 100K jobs.

- The report is revised to reflect additional responses over the next two months.

- There is an adjustment to account for job creation — much-maligned and misunderstood by nearly everyone.

- The final data are benchmarked against the state employment data every year. This usually shows that the overall process was very good, but it led to major downward adjustments at the time of the recession. More recently, the BLS estimates have been too low.

ADP (blue line) versus BLS (red line) - Monthly Jobs Growth Comparison

However, there is some discussion that neither the ADP nor BLS numbers are correct - as both are derived by a sampling methodology. The answer could be that there is no correct answer in real-time - and that it is best to look at the trends. As has been noted, all eventually end up correlating.

The BLS uses seasonally adjusted data for its headline numbers. The seasonally adjusted employment data is produced by an algorithm. The following graph which shows unadjusted job growth - seasonal adjustments spread employment growth over the entire year. Employment does not really grow in the second half of the year and always falls significantly in January.

Non-Seasonally Adjusted Employment - Private Sector

There is the proverbial question of what is minimal job growth each month required to allow for new entrants to the market. Depending on mindset, this answer varies. According to Investopedia, the number is between 100,000 and 150,000. The Wall Street Journal is citing 125K. Mark Zandi said 150K. Econintersect is going with Mark Zandi's number:

- In Econintersect's June 2014 economic forecast released in late May, we estimated non-farm payroll growth at 160,000 (unadjusted based on economic potential) and 229,000 (fudged based on current overrun of economic potential).

- If Econintersect uses employment-population ratios, the correct number would be the number where this ratio improved. Using the graph below, the ratio began to improve starting a little after mid-year. This corresponds to the period where the 12-month rolling average of job gains hit 150,000.

Employment to Population Ratio

Note: The ratio could be fine-tuned by adjusting to the ratio of employment to working-age population rather than the total population. However, this would not change the big picture that an increase of somewhere around 150,000 (+/-) is needed for the growing population numbers. We have an estimated 140k - 160k. The number might possibly be within the range of 125k - 175k. Econintersect cannot find a reason to support the estimates below 125k.

The question of how changing demographics impact the employment numbers is at the margins of analysis. Econintersect will publish more on this fine-tuning going forward, both in-house research and the work of others

| 1,900,000 to 9,000,000 |

Disclaimer: No content is to be construed as investment advise and all content is provided for informational purposes only.The reader is solely responsible for determining whether any investment, ...

more