December 2018 Trade Data Mixed With Imports Improving And Exports Now Contacting

Trade data headlines show the trade balance worsened from last month - and the rolling averages for exports and imports declined.

Analyst Opinion of Trade Data

The data in this series wobbles and the 3 month rolling averages are the best way to look at this series. The 3 month averages slowed for both exports and imports. However, for this month - exports improved and exports declined - hence a worsening trade balance.

Econintersect uses the trade balance as a factor in determining the acceleration or deceleration of the economy - but does not believe the negative trade balance per se is an economic issue.

Note that the headline numbers are not inflation adjusted - and if one inflation adjusts, the year-over-year growth is less than economic growth for exports.

- Imports of goods were reported up month-over-month - import goods growth has positive implications historically to the economy. Econintersect analysis shows unadjusted goods (not including services) growth accelerated 0.3 % month-over-month (unadjusted data) - up 3.4 % year-over-year (up 3.9 % year-over-year inflation adjusted). The rate of growth 3 month trend is decelerating (rate of change of growth declined).

- Exports of goods were reported down month-over-month, and Econintersectanalysis shows unadjusted goods exports growth deceleration of (not including services) 5.1 % month-over month - down 1.4 % year-over-year (down 2.5 % year-over-year inflation adjusted). The rate of growth 3 month trend is slowing.

(Click on image to enlarge)

- The headwind in seasonally adjusted (but not inflation adjusted) for exports was wide spread except for consumer goods and autos. The strength in imports was capital goods and consumer goods

- The market expected (from Econoday) a trade balance of $-58.2 B to $-45.0 B (consensus $57.6 B billion deficit) and the seasonally adjusted headline deficitfrom US Census came in at $59.8 billion.

- It should be noted that oil imports were down 11 million barrels from last month, and down 14 million barrels from one year ago.

- The data in this series is noisy, and it is better to use the rolling averages to make sense of the data trends.

The headline data is seasonally but not inflation adjusted. Econintersect analysis is based on the unadjusted data, removes services (as little historical information exists to correlate the data to economic activity), and inflation adjusts. Further, there is some question whether this services portion of export/import data is valid in real time because of data gathering concerns. Backing out services from import and exports shows graphically as follows:

(Click on image to enlarge)

Growing exports is a sign of an expanding global economy (or at least a sign of growing competitiveness).

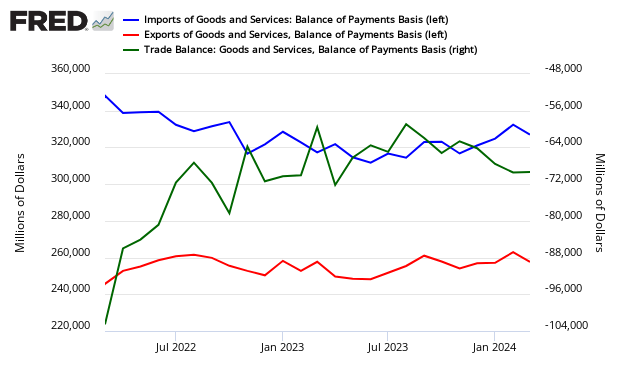

Seasonally Adjusted Total Imports (blue line), Exports (red line) and Trade Balance (green line)

(Click on image to enlarge)

Econintersect is most concerned with imports as there is a clear recession link to import contraction. Adjusting for cost inflation allows apples-to-apples comparisons in equal value dollars between periods. The graph below uses seasonally adjusted data.

Seasonally and Inflation Adjusted Year-over-Year Change Imports (blue line) and Exports (red line)

(Click on image to enlarge)

Note: In general this is a rear view look at the economy - however, imports do have a forward vision of up to three months ahead of expected economic activity.

Caveats on Using this Trade Data Index

The data is not inflation adjusted. Econintersect applies the BLS export - import price indices to the data to adjust for inflation - total exports, total imports, and imports less oil. Adjusting for cost inflation allows apples-to-apples comparisons in equal value dollars between periods.

Although Econintersect generally disagrees with the seasonal adjustment methodology of U.S. Census, in general this methodology works for this trade data series as the data is not as noisy as other series. Another positive aspect of this series is that backward revision has usually been very minor.

Econintersect determines the month-over-month change by subtracting the current month's year-over-year change from the previous month's year-over-year change. This is the best of the bad options available to determine month-over-month trends - as the preferred methodology would be to use multi-year data (but the New Normal effects and the Great Recession distort historical data).

Oil prices, and also quantities of imported oil, wobble excessively year-over-year and month-over-month. In 2010, the percent of oil imports varied between 10.4% and 14.6% of the total. In 2008 the variance was between 11.5% to over 20%. No amount of adjusting - short of removing oil imports from the analysis - allows a clear picture of imports.

An improving trade balance historically is a sign of a slowing economy.

(Click on image to enlarge)

Disclaimer: No content is to be construed as investment advise and all content is provided for informational purposes only.The reader is solely responsible for determining whether any investment, ...

more