Daily Update: Labor Conditions Worsen

STOCK NEWS

Alcoa (AA): Reported Q3 EPS of 32 cents which missed estimates by 3 cents. Revenue of $5.21 billion was down 6.5% which missed estimates by $120 million. Lower alumina pricing and charges to aerospace delivery schedules hurt revenue. Alcoa is splitting up. The part of the firm which will be Arconic had revenue of $3.4 billion which was down 1%. This was caused by adjustments to delivery schedule, softness in North America commercial transportation, and pricing pressures. Alcoa’s global automotive forecast is for 1%-4% growth in 2016. Aircraft deliveries will be flat to up 3% in 2016.

Seagate (STX): reported preliminary results. Q1 revenue is expected to be $2.8 billion and GAAP and non-GAAP gross margins are expected to be 28%. Wall Street was estimating $2.74 billion in revenues. Operating expenses are expected to be $580 million which is an increase from $470 million last quarter. This rise was because of an increase in performance based compensation.

Twilio (TWLO): reported preliminary Q3 results. Total revenues are expected to be $70.25 million-$71.25 million. This an increase from $44.3 million last year. Gross profits are expected to be $39.75 million- $40.25 million which is better than last year’s $24.7 million. Gross margins are unchanged year over year at 56%. Loss from operations is $3.75 million to $4.25 million. This is better than the $4.6 million loss last year. Operating margins are negative 6% which is better than negative 10% last year. It’s expected to lose 4 to 5 cents per share which is better than the 7 cent loss last year.

Yum Brands (YUM): had its investor day event. Yum will return $13.5 billion to shareholders before 2019 and after it separates its China business. It will be 98% franchised by 2018. Capex spending will be cut by $100 million by 2019 and G&A will be cut by $300 million by 2019 as well. Yum’s CEO made the following statement "We will reinforce the distinctiveness of our brands and their relevance to customers, select the highest potential franchisees and help drive their success, expand more profitably in key markets across the globe."

ECONOMIC NEWS

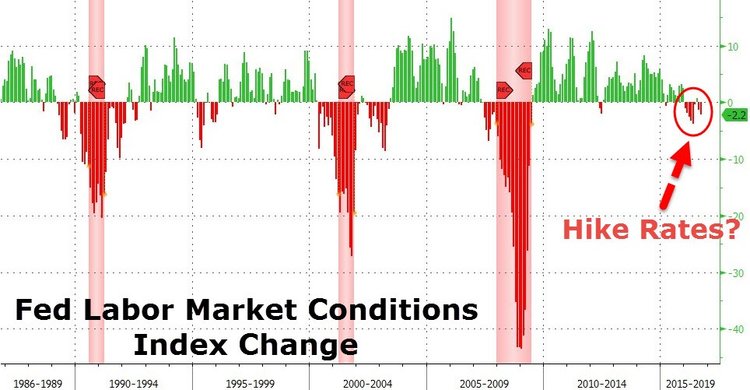

Economic growth continues to falter with the release of the Fed’s labor market conditions index showing deceleration today. The index fell to negative 2.2% which was a big miss from the 1.5% gain expected. August’s drop was also downwardly revised from negative 0.7% to negative 1.3%.