Daily Update: Consumer Confidence Falls

STOCK NEWS

JP Morgan (JPM): reported Q3 EPS of $1.58 which beat estimates by 19 cents. Revenues of $25.51 billion were up 8.4% and beat estimates by $1.52 billion. Consumer and Community Banking net income were $2.204 billion which was down 16%. Mortgage banking revenue was $1.874 billion which was up 21%. Card, commerce, and auto revenue were flat.

PNC Financial (PNC): Q3 EPS of $1.84 beat estimates by 6 cents. Revenue of $3.83 billion was up 1.3% from last year which was in-line with expectations. Return on equity was 8.74% which was down 87 basis points. Credit-loss provisions were $87 million which was down from $127 million last quarter. NPLs were down 5% and NPAs were down 6%. Tier 1 capital ratio was 10.2% which flat from Q2.

Wells Fargo (WFC): Q3 EPS was $1.03 which beat estimates by 2 cents. Revenue of $22.3 billion was up 1.9% year over year which beat estimates by $80 million. Cross selling ratio fell to 6.25 products per customer from 6.33 last year. The big story of the quarter was the fraudulent accounts being opened which ended up causing CEO John Stumpf to step down. The New CEO Tim Sloan made the following statement “I am deeply committed to restoring the trust of all of our stakeholders ... We know that it will take time and a lot of hard work to earn back our reputation."

Citigroup (C): Q3 EPS of $1.24 beat estimates by 8 cents. Revenues of $17.76 billion were down 4% and beat estimates by $420 million. Global Consumer Banking revenue was $8.227 billion which was up 1% from last year. Institutional Clients Group revenue was $8.628 billion which was flat year over year. Investment banking revenue was $1.086 billion which was up 15%. Fixed Income markets revenue was up 35% to $3.466 billion.

ECONOMIC NEWS

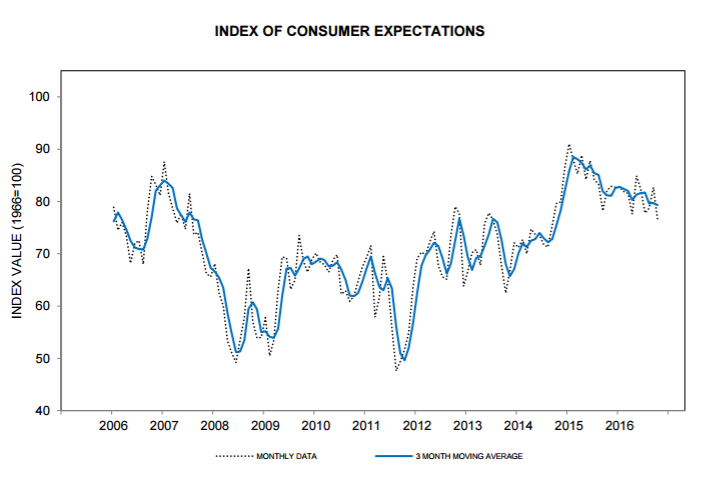

The economic data was terrible today as the Atlanta Fed had to lower its Nowcast from 2.1% GDP growth in Q3 to 1.9% GDP growth. This is down from a peak of 3.8% which was early in the quarter when the estimates are less reliable. Adding to this, the index of consumer expectations put out by the University of Michigan was 76.6 in October which was down 7.4 points from last month. You can see the cycle peaking in the chart below.

(Click on image to enlarge)

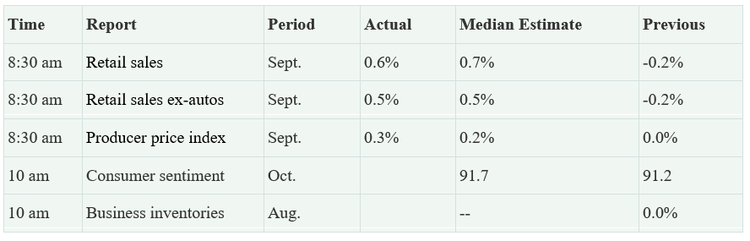

(Click on image to enlarge)