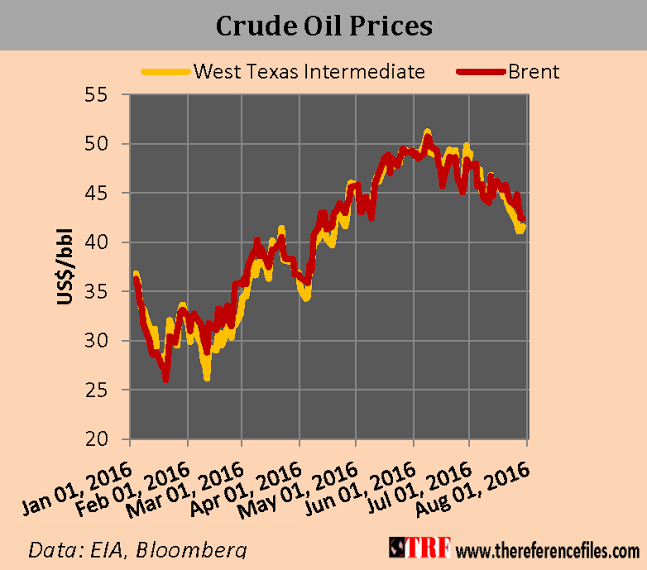

Crude Oil Prices And An Uncertain Rebalancing

The rise in crude oil prices from twelve-year lows seen in the first quarter of the year led many analysts to project a complete oil market rebalancing between 4Q 2016 and 3Q 2017. Investment bankers Goldman Sachs Group Inc. as well as the Saudi Arabian government, the world’s largest-volume oil exporter had earlier declared the crude oil glut over and announced the beginning of a market rebalancing. With oil (technically) entering a bear market on Monday, those projections may have been a little hasty. However, analysts at the Paris-based intergovernmental organization, International Energy Agency (IEA), as well as bankers Barclays Plc, Citigroup Inc. and Société Générale SA, have expressed confidence that the rebalancing is on track.

False Re-balancing

Contrary to declarations, that “rebalancing” of the oil market never really began. Global oil imbalance ― excess of supply over demand ― grew steadily from 1Q 2014 through 2Q 2015 even as demand was increasing.

The unplanned supply outages in Canada (wildfires), Nigeria (militancy), and Libya (factional discord) among others in the early part of the year sent about 3.5 million barrels per day (bpd) of oil supply offline. This led to a decline in imbalance, which was mistaken for the significant cut in supply deemed necessary for a rebalancing of the market. Most of that outage has since been brought back on-stream.

Crude oil demand fell by 510,000 bpd between 3Q 2015 and 1Q 2016 according to IEA data and is likely to continue in that trajectory over the next few months. Global crude oil and product storage facilities are currently bloated. In the U.S., crude oil inventories are well above the five-year average range while gasoline and other product stocks stand at multi-seasonal highs.

Outlook

This oil glut has been exacerbated by further increases in supply. Iraq and Iran, both members of the producer-group, Organization of the Petroleum Exporting Countries, OPEC, ramped up their July oil output. According to the country’s oil ministry, Iraqi oil output rose to an average of 3.202 million bpd; Iran saw her combined output of crude and condensate rise by more than 25% since the lifting of nuclear-related sanctions in January. Russia’s July output ticked up to 10.85 million bpd, a twenty-four-month run of year-on-year gains, according to World Oil, while Brazil posted a record output of 2.58 million bpd, 6.8% over the year-ago level, the country’s industry regulator, ANP, reports.

In addition, Saudi Arabia may have fired the first shot, in what is seen as a resurgence of price war with regional rival Iran as well as other suppliers. In the fight for market share, the state-controlled Saudi Aramco cut the price of its Arabian Light oil grade for September delivery to Asia by US$1.30 per barrel, the highest drop in about nine months, according to Bloomberg.

Hedge funds managers and other investors have gone into bearish mode and given the outlook for the global economy, particularly the underwhelming performance of the Chinese, British and European economies, such sentiment may be self-propelling.

The concomitance of high inventory levels, a faltering global economy, falling demand and increasing supply, will exert further downward pressure on oil prices. Crude oil prices will therefore likely remain low for some time, leaving that “rebalancing” largely in the balance.

Disclosure: None