Credit Spreads Reach Rare Heights

MONDAY AND TUESDAY’S SESSIONS

Credit spreads speak to economic and financial system confidence. Widening spreads mean market participants are growing increasingly concerned about an economic downturn and increasing odds of bond defaults. We covered spreads Sunday evening and as you might imagine they widened again during Monday’s extremely rare risk-off event. From the Financial Times:

”The S&P 500, the benchmark for the US equity market, lurched lower in the final minutes of trading Monday, eclipsing the worst performance of the pandemic and marking the biggest single-day loss since the crash of October 1987. The tech-heavy Nasdaq Composite had its worst day ever, down 12.3 per cent. The CBOE Volatility index (VIX), the market’s “fear gauge”, jumped to a record high.”

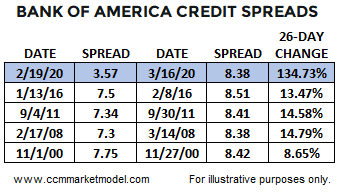

Spreads have reached levels that may help us differentiate between the four cases shown below. The top row of the table shows the extremely rare spike in spreads that took place between February 19 and March 16, 2020. Spreads closed Monday at 8.38, a level reached in only four other periods based on data going back to 1996. Notice how the change in spreads looking back 26 days was significantly higher in the current case, even when compared to high-stress periods in 2000, 2008, 2011, and 2016. The spike in the current case could lead to some unexpected surprises when companies begin to roll over debt at the end of the first quarter.

How did stocks perform after concern in the credit markets reached similar levels to what was seen during Monday’s risk-off event? It was somewhat of a mixed picture but it is possible that credit markets may help clear that up in the coming days and weeks. The highest reading during the 2020 event is thus far 8.38, which is very close to the highest readings posted in 2011 and 2016. Thus, if credit spreads exceed 8.41 and 8.87, the odds of an imminent low in stocks will diminish and the odds of a more concerning 2000 or 2008-like decline in stocks would increase (based on the historical cases).

We will continue to track present-day data to try to discern between “imminent low” odds and “a lot more downside in stocks is ahead” odds.

TUESDAY’S SESSION

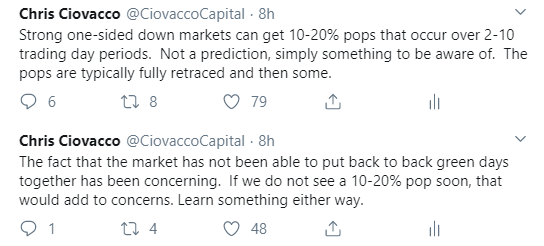

It is too early to say what Tuesday’s rally in stocks means or does not mean. If it is another one-day bounce, it means little. If the market can continue to rally for a time, it would be easier to remain open to the concept of a bottoming process. From Bloomberg:

“A bear market does not preclude rallies,” said Eleanor Creagh, market strategist at Saxo Capital Markets. “The biggest rallies can be in bear markets -- erratic swings are exacerbated by the present high-volatility regime and strained liquidity conditions. With VIX remaining significantly above the long-term equilibrium, alarm bells are still sounding and traders should be wary of relief rallies.”

We have specific things we are looking for to help identify a potential bottom/bottoming-process and we have several “that is not what we want to see here” items to look for as well. It is best to wake up every day and see how the data evolves.

More information about the current market can be found in Saturday’s and Monday’s posts.