Crashing Consensus, MS Now Sees Fed Hiking 4 More Times On Coming Inflation Surge

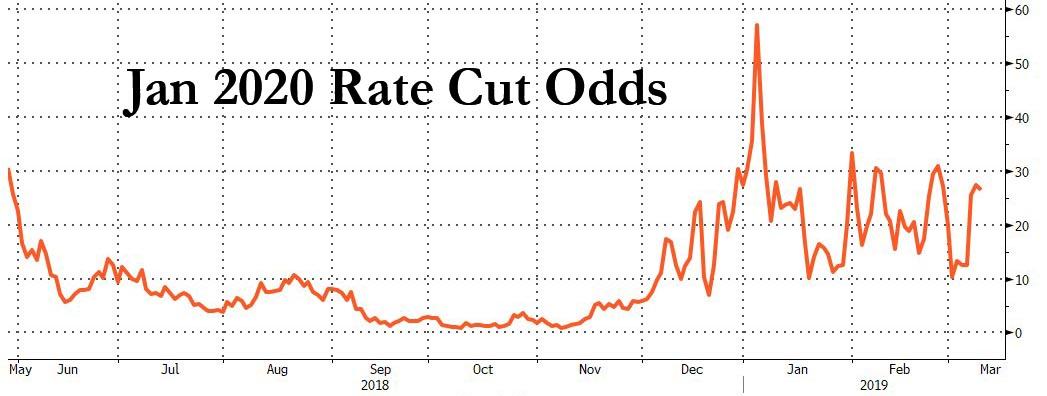

Following the Fed's sudden, unexpected dovish reversal in January, few things are as consensus in the market as the narrative that the Fed's rate hikes have ended and Powell's next move will be to cut rates. According to the Fed Funds market, whereas odds of any futures hikes are now 0, the market sees a 25% probability of a rate cut at the Fed's January 2020 meeting.

(Click on image to enlarge)

Others are even more aggressive and are confident that the Fed's may resume QE as soon as next year, as Bloomberg detailed in "Bond Investors Are Daring to Whisper About a Return to Fed QE. " And while a return to quantitative easing is distinct possibility, especially if foreign buyers accelerate their boycott of Treasury purchases, forcing the Fed to monetize the soaring US budget deficit, one bank has decided to crash the consensus party, and not only expect the Fed to hike at least once more in 2019 (in December), but follow with another 3 hikes in 2020.

In a note released overnight, Morgan Stanley writes that in its 2019 year-ahead outlook it "envisioned a Fed that continues to hike gradually into 2019, but hits a wall by September when financial conditions ratchet tighter and growth sputters at 1.0% in 3Q." Well, as recent events showed, that outlook has unfolded much more quickly than Morgan Stanley had anticipated as financial conditions tightened severely over the turn of the year, GDP growth is tracking just 0.5% in 1Q, and the Fed has moved to the sidelines and set a high bar for resuming its hiking path.

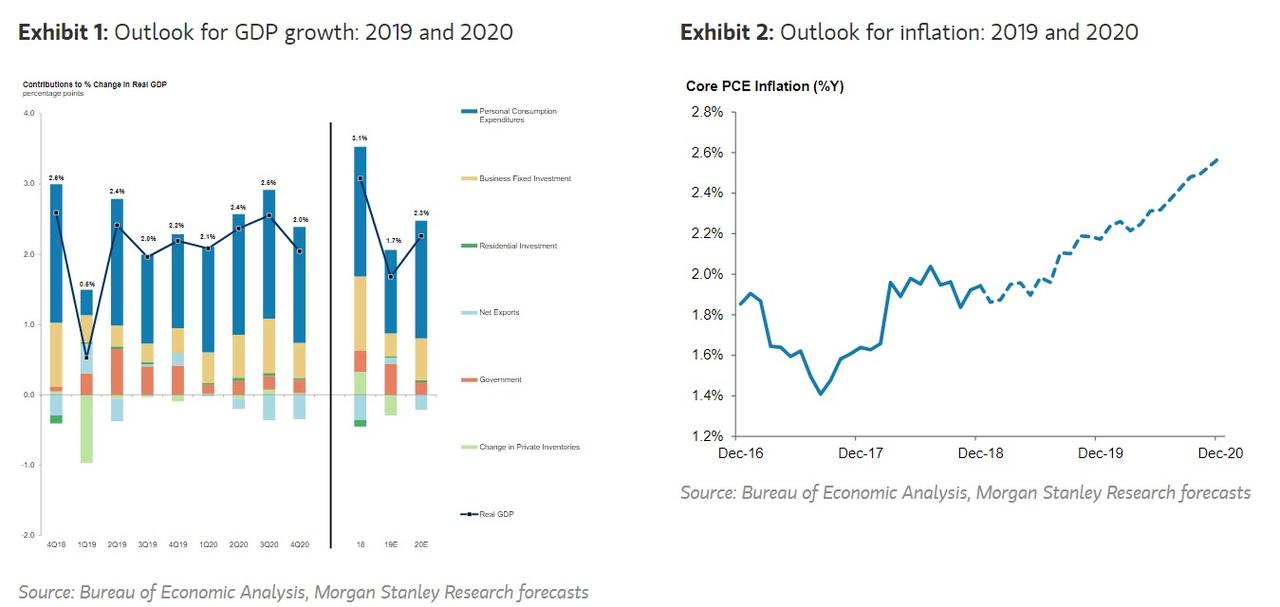

Discounting the recent strong Q4 GDP print, MS then notes that economic activity weakened sharply in the final month of the year, with personal consumption clocking its largest monthly decline (-0.5%) since 2009, and "the utter lack of momentum coming into the year has helped to level set 1Q19 at 0.5%." Additionally, the bank notes various other "transitory factors" which have weighed on growth such as a large inventory drawdown, the 35-day partial government shutdown, the Polar Vortex, and a rattled consumer combined to depress growth at the start of the year, but importantly set up the economy for a strong rebound in the second quarter.

So in response to the severe tightening in financial conditions over the turn of the year and a laundry list of downside risk factors, the FOMC pivoted to a 'patient' policy stance and removed any bias on whether the next rate move will be up or down. In light of these factors, some policy-makers had "nudged down" their growth estimates since December, pointing to a likely downgrade to the median growth forecast in the March Summary of Economic Projections. As a result, Morgan Stanley's economists expect this forecast revision to pass through into the expectation for rate hikes this year, where the bank thinks the dots will fall to a median of one hike in 2019.

It's not just growth: muted inflation pressures have also played an important role in the Fed's dovish flip. The statement noted that "market-based measures of inflation compensation have moved lower in recent months", and explicitly offered "muted inflation pressures" as a key reason alongside global economic and financial developments as a reason to be cautious on further interest rate increases in the near term. Chair Powell reiterated this point in the press conference, noting that amid muted price pressures, “the case for raising rates has weakened somewhat”. This follows a downgrade to the December FOMC inflation projections and means that developments in the inflation data over the coming months will be a crucial driver of the outlook for Fed policy decisions

Yet while the sharp slowdown in the economy took most economists - and the Fed - by surprise, the fact that it occurred as early as it did, and the Fed's subsequent response, is to Morgan Stanley an indication that the economy likely will trough in the first quarter, and then will rebound forcefully, prompting the Fed to resume hiking at the end of 2019 and into 2020, to wit:

Although we forecast the economy to be treading water in the first quarter, the good news is that 2Q19 GDP growth is expected to rebound to 2.3%, as many of the factors holding down 1Q growth either neutralize or turn more positive (the inventory drawdown lessens, severe weather effects are absent, and the direct effects of the government shutdown come off). Indeed, the US is moving through its trough in growth now. What's more, as our Global Chief Economist Chetan Ahya has noted, easing in global financial conditions supports our view that 1Q19 will mark the trough in this mini-cycle globally. Still, that puts 1H19 growth in the US on track to average 1.4%—growth that is too sluggish for the Fed to expect inflationary pressures to build. To be sure, core inflation moves sideways in the first half of the year, oscillating between 1.9-2.0%.

Furthermore, as a result of the H1 weakness, the second half of the year in the US now "looks much stronger," and Morgan Stanley forecasts an average 2.1% in 2H19 (3Q19 growth at 2.0% and 4Q growth at 2.2%), presaging the reacceleration in annual growth it expects for 2020. With growth sustaining above potential, the bank also forecasts core inflation to begin breaking above 2.0% in August and ending the year at 2.2%—a few notches above the Fed's expectation.

Together these events will, according to the bank, draw the Fed off the sidelines to deliver a hike at its December meeting.

(Click on image to enlarge)

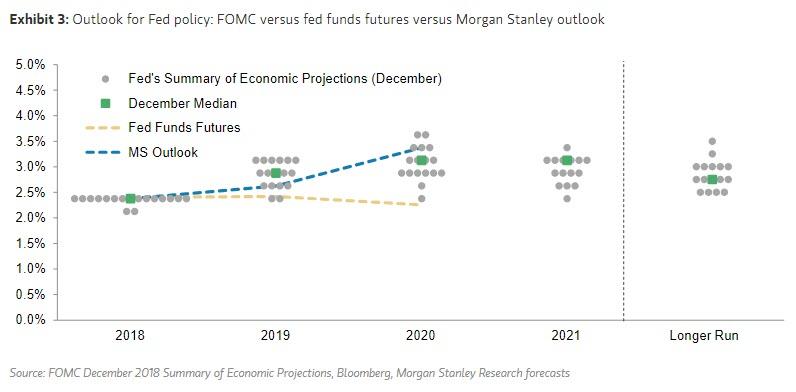

With inflation steady heading into 2020, the Fed will once again remain on hold in early 2020, before inflation begins to accelerate more noticeably coming into mid-year, driving further rate hikes in June, September, and December. The chart below lays out what Morgan Stanley expects for rates hikes compared with the Fed's December SEP as well as that implied by current market pricing.

(Click on image to enlarge)

How does Morgan Stanley's hawkish forecast foot with the surprisingly dovish Fed which is now ready to accept an inflationary overshoot? In other words, is a 3.375% federal funds rate at the end of 2020 consistent with the recent signals from the Fed that it will be more tolerant of an inflation overshoot than it has been in the past? Morgan Stanley thinks so, and notes that as it discussed in its 2019 year-ahead outlook, "standard Taylor rules predict a federal funds rate of at least 3.75% in the circumstances we are projecting at the end of 2020, especially if accelerating growth and continued declines in the unemployment rate prompt FOMC participants to nudge the median longer-run neutral rate of interest up to 3% or higher." Setting the fed funds rate at a level below standard Taylor rules is consistent with greater tolerance of an inflation overshoot by the FOMC or with the FOMC placing some implicit weight on a price-level target.

To be sure, if MS is correct and consensus is so dramatically wrong, expect another period of sharp market volatility, most likely toward the end of the year, when the economic rebound clashes with market expectations of no further rate hikes, wherein a rerun of events in late 2018, financial conditions will tighten considerably, with the market sliding, if for no other reason than to once again punk the Fed's plans, and delay any future rate hikes indefinitely while at the same time once again testing the strike price of the Powell Put, which we now know is roughly 20% below the market's all-time highs, or in other words, the Fed will do everything in its power to prevent another bear market.