Could Bluerock Residential's Dividend Get ARCP'd?

It seems like I have been working overtime to turf up value in REIT-dom. You may have seen a few recent articles on several under-researched companies that have been neglected by the big guns. Although I haven't initiated a BUY on any of these REITs yet, they are all promising opportunities that scream:"BUY ME!"

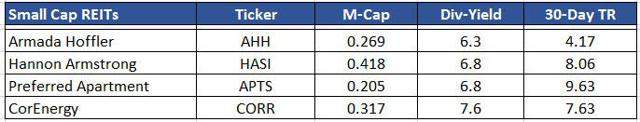

Note: TR = Total Return over previous 30 days.

The problem with a small cap stock is that if you don't act too quickly, you could miss out, at least in the short term. However, one of the reasons I like the Seeking Alpha platform is because it can provide small investors with significant insight into stocks that are trading at meaningful discounts.

It's extremely important to recognize that many small cap stocks appear cheap (in price) because they aren't known. In the case of the 4 above-referenced REITs, their combined market cap is less than $1.3 billion, and that means that the volatility risk is higher than many of the well-known companies that I research.

Another misconception with many small-cap REITs is that the high dividend yield is a BUY sign. Oftentimes, many investors consider a high-paying yield to be a BUY indicator, when in fact, it's the opposite. I like the way Frank J. Williams defined a speculative stock in the book, "If You Must Speculate, Learn the Rules":

People of the dupe type are hypnotized by the glare of gold. They stare so long at glistening fortune that their minds are brought under subjection to one of nature's strongest passions - greed.

Bluerock Residential: Superior Yield or Sucker Yield?

Bluerock Residential Growth REIT (NYSEMKT:BRG) was formed in 2008, and the Apartment REIT listed shares last year by selling 3,448,276 shares priced at $14.50 per share. Since the IPO, shares have declined by around 5.9% (closed at $13.65):

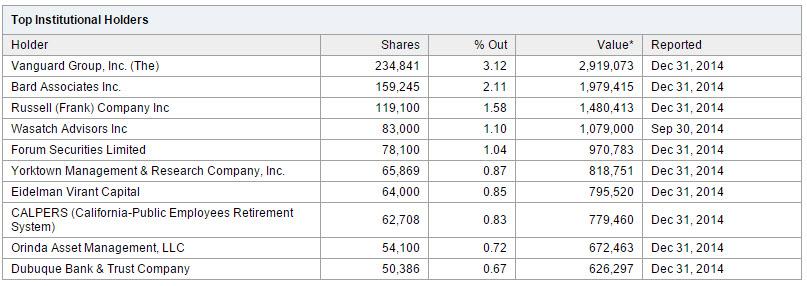

The company initiated a few secondary offerings since the IPO, and has started to grow its institutional investor base (47% institutional ownership). The largest investors include Vanguard and Bard Associates.

(Source: Yahoo Finance)

However, the market cap for Bluerock is just $180 million, making the company the smallest Apartment REIT (based on market capitalization).

Continue reading this article here.

Disclaimer: This article is intended to provide information to interested parties. As I have no knowledge of individual investor ...

more