CoT: Peek Into Future Through Futures, How Hedge Funds Are Positioned - Wednesday, Feb. 20

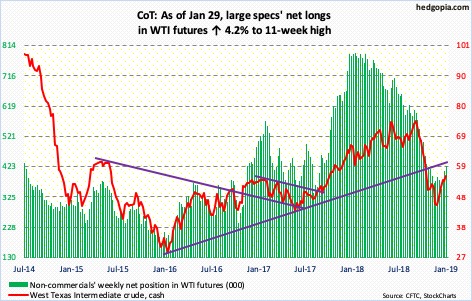

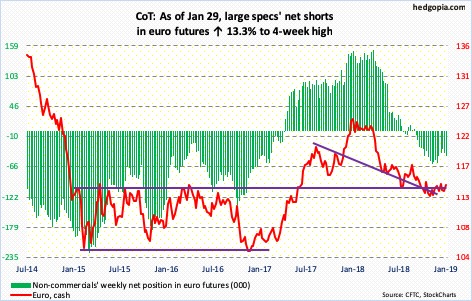

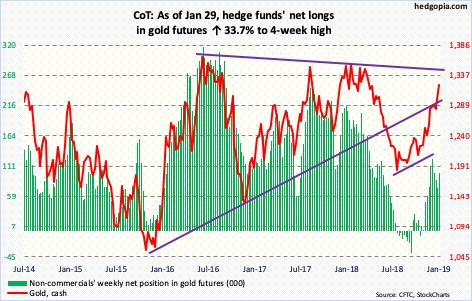

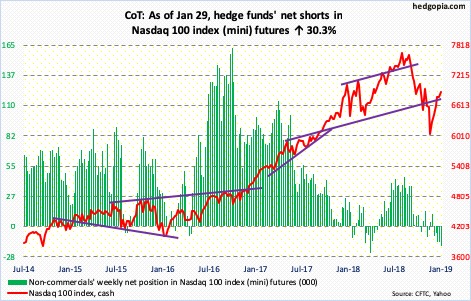

Following futures positions of non-commercials are as of January 29, 2019.

Beginning December 21, the CFTC was not able to publish reports on time due to the partial shutdown of the federal government, which has now reopened. The CFTC expects to publish one report on Tuesday and another on Friday of each week until the reports are current as per the normal schedule. It will be two more weeks before due reports are published. Until then, we will only present the charts below, but not commentaries.

10-year note: Currently net short 134.4k, up 8.7k.

30-year bond: Currently net short 16.8k, down 4.2k.

Crude oil: Currently net long 426.6k, up 17k.

E-mini S&P 500: Currently net short 23.2k, up 18.6k.

Euro: Currently net short 46.5k, up 5.5k.

Gold: Currently net long 99.6k, up 25.1k.

Nasdaq 100 index (mini): Currently net short 18.5k, up 4.3k.

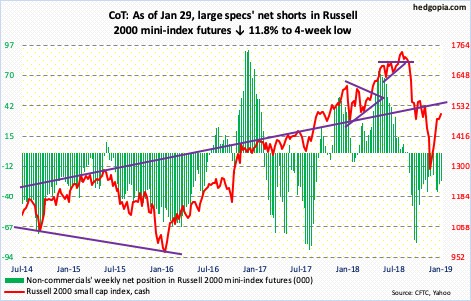

Russell 2000 mini-index: Currently net short 25.1k, down 3.3k.

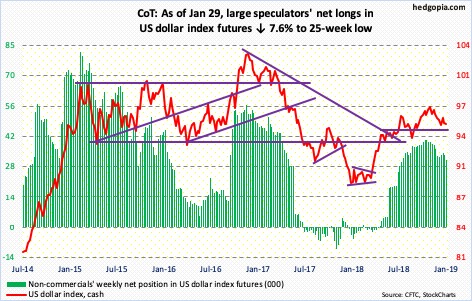

US Dollar Index: Currently net long 31k, down 2.5k.

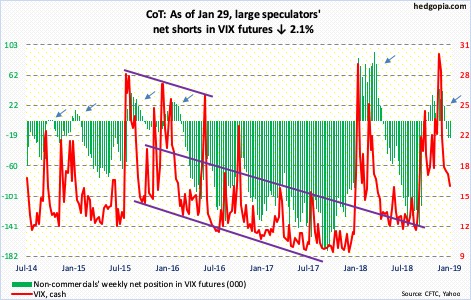

VIX: Currently net short 22.1k, down 470.

Disclaimer: This article is not intended to be, nor shall it be construed as, investment advice. Neither the information nor any opinion expressed here constitutes an offer to buy or sell any ...

more