Correction

Investors,

World markets are mostly in moderate correction territory, and I think it’s mostly a “correction” in the common usage of the term – we’ve eliminated most of the froth and excessive optimism in valuations in the US and Europe. The sell-off in the US was partially driven by falling earnings forecasts and growth estimates by US companies. I think US equities are now roughly fair (maybe a bit rich still). Looking globally, emerging markets are scared of the Chinese slow down. I think EM equity now represents excellent value generally, although I wouldn’t be surprised if China related panic brings us another 25% sell-off some time this year. In Europe and Japan, investors are concerned that quantitative easing is proving insufficient to create growth. Sweden, Japan, and the ECB have all discussed negative interest rates recently, but rather than having a stimulative effect on equity prices, this discussion has investors focusing on the weakness of central bank attempts to stimulate growth.

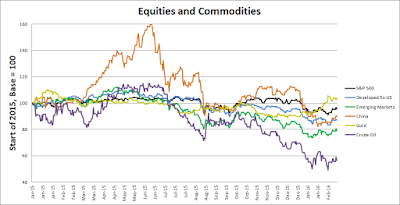

Below is a chart that starts with all indices set to 100 at the start of 2015. The S&P 500 is about 13% off its highs. Developed markets excluding the US are 24% off their highs. Emerging markets are off 35%, and China is almost 50% off its highs. A lot of these losses look less severe in the context of recent gains though. For example, the Chinese market is only 10% below where it started 2015.

China is facing continued problems. Their banking system remains insolvent – they have tons (possibly $5 trillion) of non-performing loans. Their equity market has continued falling even with huge government intervention. Some smart hedge fund managers like Kyle Bass think China will have to devalue the Yuan by up to 30%. Most financial analysts think 10% is more reasonable. Part of the problem is a fear of capital flight – China is afraid that if they make a small devaluation, that will scare the Chinese into pulling money out of the country (legally and illegally) in fear of further devaluations. No one is clear on how China deals with these problems. I don’t have great insight here, but I think similar to the US in 2009, China has the financial tools and capital to deal with the problems and come out strong. I’m happy to maintain my long-term bet on Chinese equity markets, and on EM more broadly.

Commodities have recently started recovering, and I think they are good value (both as direct investments and by buying equity in companies that produce them.) I like commodities at these prices for both fundamental reasons (global demand has likely troughed) and also as a currency hedge. As countries continue competing to devalue their currencies, investors and average citizens will be looking to protect their wealth. This makes gold and bitcoin particularly attractive.

Credit spreads have been steeply increasing and are now above historical averages. I’ve never invested substantially in credit before. Credit is a “hybrid” instrument with lower return and lower risk than equity – I think that it’s almost always better to “barbell” by investing in a mix of equity for the high return and cash or treasuries to dampen risk. Credit tends to be overpriced because lots of investors (like pensions) are legally required to invest in credit instead of equity, and investors like the payoff profile of lots of small wins and only the rare big loss. In financial jargon, investors overvalue the high sharpe ratio of credit, and underweight its negative convexity. But…we may be nearing an exception. If credit spreads continue widening over the next 6 months, I think they we’ll see an attractive opportunity to lock in some very high yields with only moderate risk.

The best way to invest will be to buy closed end high yield bond funds. During market declines, these funds often trade at steep discounts to their NAV. So, for example, we can buy a fund that holds bonds yielding 8%, at a 20% discount to the market value of the bonds. This increases our yield from 8% to 10%. We can win by either the discount to NAV narrowing, or we can simply hold the fund and collect the extra yield as dividends. US economic fundamentals are relatively strong, but I’m pessimistic about equity returns – this provides a good environment to lock in a high yield that is safe unless the US falls into a very deep recession.

My own portfolio is: long emerging market equity, long commodities and commodity producers (overweight gold), long bitcoin, and long cash. I’ll look to invest in high yield US credit via closed end funds trading at a discount to NAV if spreads widen a bit more. If US equities or European equities fell another 15% I’d be interested in buying.

I’ll be in Florida next week representing the University of Chicago endowment at two conferences. I’ll be presenting on our tail hedging program at the CBOE RMC and on a panel discussing smart beta at the Credit Suisse Global Trading Forum. If either topic peaks your interest, I’d be happy to chat about them. Cheers, Ari

Disclosure: None.

Disclaimer: We present commentary on how to think about investing, markets, economics, macro forces, industries, securities, ...

more