Consumer Sentiment Weakens In January

Consumer Sentiment - Redbook Growth Falls Sharply

Year over year same-store sales growth in the Redbook weekly report declined in the week of January 26th from 7% to 5.8%.

We are now back to the doldrums of early January where growth was decelerating sharply. This is perfectly in line with the consumer sentiment report I will review in the next section of this article.

Month to date sales from the prior month are down 1.8% which is the weakest reading in a year. To be clear, these results are seasonally adjusted, so it’s possible to compare January to December.

That being said, I wouldn’t be surprised if there was some funny business with that comparison. Either way, this data showed there was a spending growth slowdown because the full month year over year gain fell 0.3% to 6.5%. Growth was 9% at year-end.

This report wasn’t a disaster. But slowing growth confirms the economic uncertainty caused by the trade war, government shutdown, and volatility in the stock market hurt spending.

It’s interesting that as stocks were very low at the end of last year, Redbook same-store sales growth was near its record high. Now growth has slowed, but stocks have rallied.

Consumer Sentiment - Did Consumer Confidence Peak?

Consumer confidence as measured by the Conference Board slipped in January. The worst case scenario for any index in the rate of change terms is for it to come off of cycle highs.

That’s what has happened to consumer confidence as the index fell to 120 in January which missed estimates for 124.3. December’s reading was revised from 128.1 to 126.6.

As you can see from the chart below, since November, the index is down 16.2 points which is its sharpest decline since the 2008 recession.

(Click on image to enlarge)

The expectations index fell 10.4 points to 87.4 which is the lowest reading in 3 years. Usually, when the expectations index falls more than the current situation index, it’s a signal the business cycle is turning.

However, no single sentiment index is going to drive my thinking on the economy. It’s possible consumers saw the big crash in stocks and assumed economic weakness was coming. It’s pretty rare for stocks to fall 20% on nothing, so they have the right idea.

However, most of the economic data I’ve read indicates this is a slowdown. Some manufacturing surveys show negative growth.

Consumer Sentiment - Labor market reports show the economy is still humming along.

The difference between the present situation and expectations exploded because the present situation index only fell from 169.9 to 169.6. It looks like the economy is falling off a cliff when you look at the difference between the two stats now. But that doesn’t mean the steadiness in the present situation index is bad.

To me, it means people were concerned about the stock market volatility, government shutdown, and trade war, but nothing changed in the past month in their own life. If an agreement on border security is made, we can put 2 of the 3 issues that are upsetting consumers behind us.

Consumer Sentiment - Sub-Components Look Strong

Specifically, those saying jobs are hard to get increased from 12.2% to 12.9%. It’s not good to see this increase, but it’s still low which signals the labor market report this Friday will be strong. Those saying jobs are plentiful increased 1.1% to 46.6%. It shows the changes to the labor market weren’t large.

The status quo is great considering how strong the December BLS report was.

It’s interesting to see the buying plans for autos and houses because the University of Michigan survey showed the buying conditions are the worst in years.

6-month buying plans for autos ticked up slightly. There was a large downtick for plans to buy major appliances. However, there was a sharp 1.9% uptick to 7.8% in plans to buy homes. This is in tune with the MBA mortgage applications index.

The housing market likely got stronger in January because interest rates fell. And also because home price growth has slowed for the past few months. Home prices don't need a major decline to make them more affordable. Especially when the labor market is nearly at full employment and real wage growth is accelerating.

Finally, there was a small downtick in the year ahead inflation estimates to 4.4%. This is a low estimate for this index. Low estimates for inflation make sense because gas prices are low, food inflation has been low, and shelter inflation has moderated.

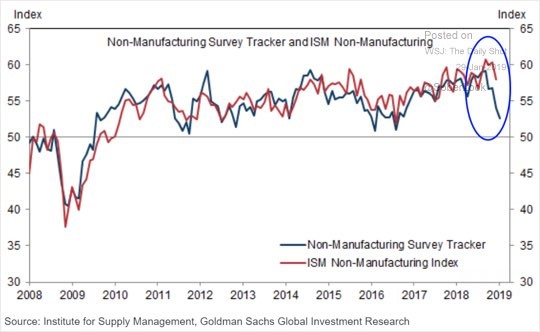

Consumer Sentiment - Is A Weak ISM Non-Manufacturing PMI Coming?

There are tracking estimates for all economic reports. This means investors have an idea of where the economy is. But they don’t know for sure until the government reports come out.

Economic data still moves markets, so I still follow it and use it. The ISM PMI is a private report, so it never stopped coming out during the government shutdown. There is also a private tracker for this report to help investors play it.

As you can see from the chart below, Goldman Sachs’ non-manufacturing tracker shows the PMI will be about 52.

That would be a major decline from the 57.6 reading in December. I am expecting that reading for the manufacturing PMI. However, the flash Markit reading differs from the regional Fed reports. Markit showed services was weak and manufacturing was strong.

We will see where the non-manufacturing PMI lands on February 5th. Obviously, it would be worse to see them both plummet to the low 50s than one falling. The bulls would rather see manufacturing weakness as it can be explained away by blaming the global economic slowdown.

A 52 non-manufacturing PMI would take down estimates for Q1 GDP growth.

(Click on image to enlarge)

Consumer Sentiment - Conclusion

This article included a lot of negative data. Consumer confidence fell, and weekly Redbook same store sales growth decelerated. Also, the Goldman Sachs tracker for the January non-manufacturing PMI implies growth slowed sharply.

The good news is, plans to buy a house increased despite the weakness in consumer sentiment. If the housing sector rebounds, it will be a major boon for the Q1 GDP report. I’m curious to see when the Q4 GDP report will come out.