Consumer Expectations Soar On Rising Stock Market

Consumer Expectations - Confidence Rises

The stock market is usually thought of as a reflection of the future economy. However, through the reflexivity theory, the stock market can cause changes to the economy.

Volatility paired with the trade war and the government shutdown to take down consumer confidence and other soft data reports. Noteworthy due to weak December retail sales report and the deceleration in Redbook same-store sales in January and February.

The consumer didn’t just say their outlook changed. There was a decline in spending growth. Declines in the expectation readings in the small business and consumer confidence reports were only temporary.

The February Conference Board consumer confidence report improved significantly from January. The January report was revised higher from 120.2 to 121.7. Even so, the February index was much higher as it was 131.4. This beat the consensus for 125 and the high end of the expected range which was 127.5.

Last time this report increased by about 10 points was in mid-2015 when there was volatility in the stock market.

Consumer Expectations - Stock Market Boosts Confidence

This leads us to the point that consumer confidence is severely impacted by the stock market. The upper class is impacted the most because it owns the most stocks. It also spends the most money, making it very important. Since 2009, the S&P 500 and consumer confidence have a 97.7% correlation and an r-squared of 95.4%.

The fact that a declining stock market hurts consumer confidence which causes more declines and a rising market helps consumer spending. It pushes stocks higher, supports vicious moves. That explains why stocks fell so quickly in Q4 and rose so quickly in the past 2 months.

The recession in 2001 was impacted by the tech bubble burst as without the lofty valuations these tech startups couldn’t invest in capex and hire new workers. That was one of the 2 recessions since 1950 that wasn’t catalyzed by a decline in real residential investment growth.

This situation is different from 2001 because the housing market has been weak. Because home building hasn’t grown much this cycle. Lending standards remained high, real housing prices haven’t exploded. And housing debt isn’t that high. The housing market probably can’t catalyze a recession by itself.

But with a crashing stock market in early 2019, Q1 GDP growth could have been negative. Q1 GDP growth is already probably going to be below 2% even with a rising market.

Consumer Expectations Soar

As I mentioned, declines in small business optimism and consumer confidence were temporary because they were driven by weakness in expectations.

Small businesses and consumers aren’t experts on the economy. So I don’t take temporary declines in expectations seriously. Expectations were transparently weakened by the government shutdown, bear market, and trade war. In February, the expectations index was up 14 points to 103.4. The current conditions index was up 3.3 points to 173.5.

One popular indicator that was screaming a recession was coming was the differential between current conditions and expectations. It didn’t work in this case because the decline in expectations was temporary.

When you see a chart that makes it seem obvious a recession is coming, question every aspect of it. I have seen hundreds of charts calling for a recession in the past 10 years. Obviously, all of them were wrong as this is about to be the longest expansion since the 1800s.

Consumer Expectations - Plans To Purchase Fall

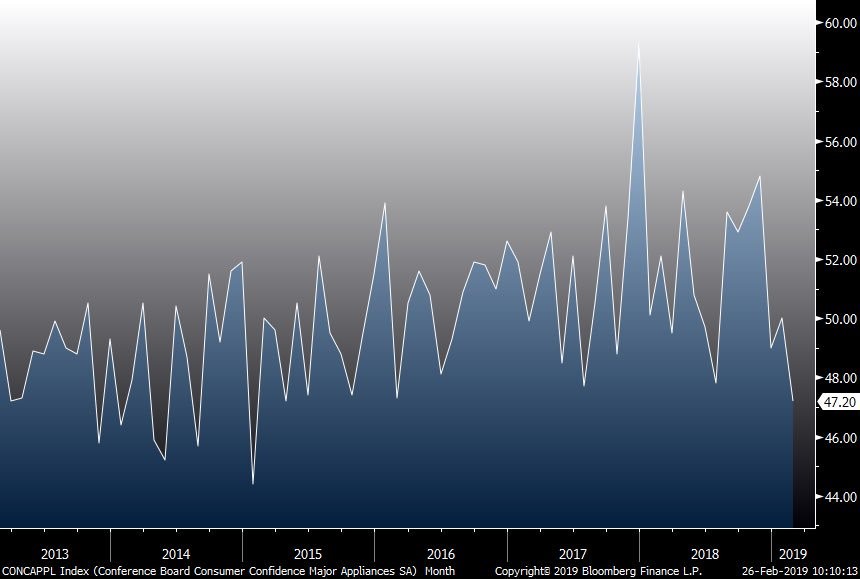

Plans to buy major appliances fell, as you can see from the chart below. They are the lowest since January 2015. The chart below is choppy which implies a tick lower isn’t a huge deal.

However, it’s still weird to see this fall when the overall index was so great. Plans to purchase a car or a truck fell to the lowest level since July. Plans to buy a home fell to the lowest level since July as well. This is inconsistent with the MBA applications data.

(Click on image to enlarge)

Consumer Expectations - Inflation & Job Market

Expected inflation in the next year was 4.3%. There is no chance inflation will be 4.3%, but this indicator is always high. In fact, that was the lowest reading since August 2003.

Inflation this cycle has been extremely low, so these expectations should have been lower than previous cycles. Either way, this reading supports the Fed’s plans to pause rate hikes. We will get more clarity on the Fed’s favorite inflation metric on Friday.

If inflation spikes and the Fed is forced to hike rates, it could catalyze a recession and another bear market that’s worse than the one in Q4 2018. That’s why I am laser focused on inflation.

Some investors and economists only follow the labor market readings in the consumer confidence report because the one thing consumers know is if their plans to get a job are fruitful. As I mentioned, their expectations can be wrong because they don’t follow the economy. Their expectations for inflation have been way too high for years.

Those saying jobs are hard to get fell 0.8% to 11.8%. Those saying jobs are plentiful fell slightly.

As you can see from the chart below, the difference between those saying jobs are plentiful and those saying jobs are hard to get increased to 34%. That is way above the peak last cycle, but below the peak in the early 2000s. This is slightly more optimistic than what the prime age labor participation rate shows.

(Click on image to enlarge)

Consumer Expectations - Conclusion

Consumer confidence improved at the sharpest rate since mid-2015 because the stock market rallied, the trade war cooled down, and the government shutdown ended.

This means consumer spending should improve in the coming months. The December retail sales report was likely a temporary blip. We need to see stronger hard data reports to support the improvement in the soft data. That would help improve GDP growth. It seems like GDP growth will bottom in the first quarter as some have estimates below 1%.